The document provides an introduction to spread trading, including the basic concepts, advantages, and how it works. It then provides examples of different types of traders, including:

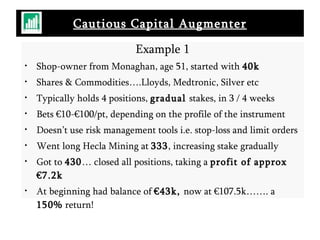

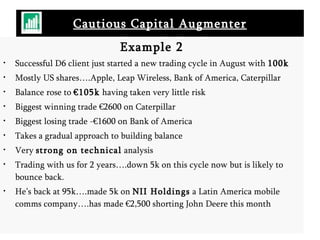

1) A cautious capital augmenter who takes a gradual approach, focusing on technical analysis over various time frames.

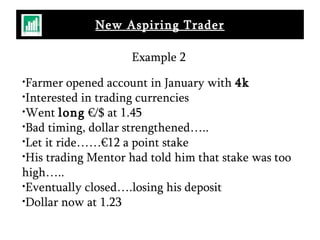

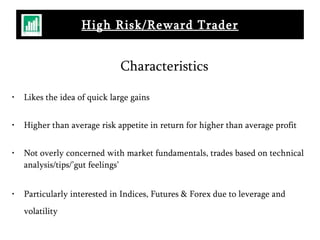

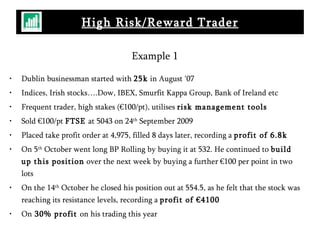

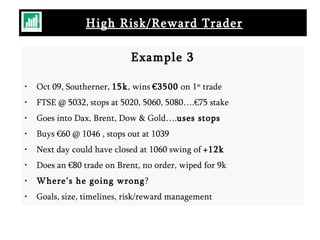

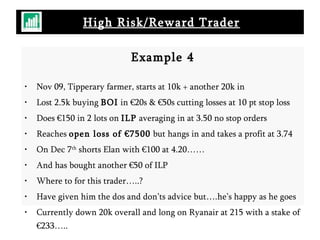

2) A high risk/reward trader who seeks quick gains and uses leverage, with varying success due to a lack of risk management.

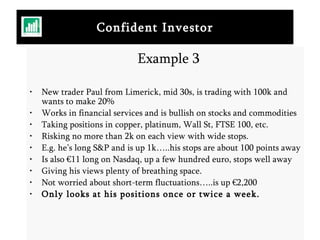

3) A confident investor who educates themselves, has a clear trading plan, and aims for consistent returns over time.