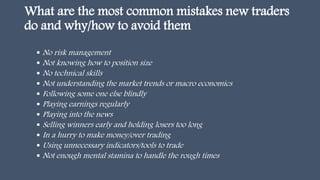

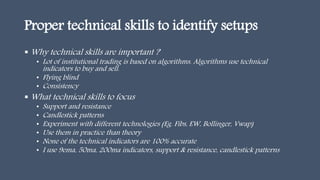

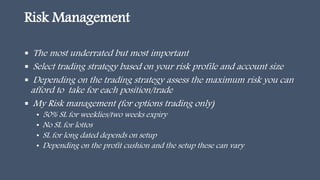

This seminar covers how to approach trading as a skill, common mistakes made by new traders and how to avoid them, the skills needed to be profitable like risk management and technical analysis, how to achieve these skills through practice and learning, how to trade small accounts through options with rules like position sizing, and that the ultimate goal is consistency while protecting capital. The presenter has 5 years experience as a profitable swing trader and will take live questions at the end.