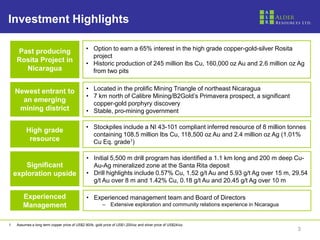

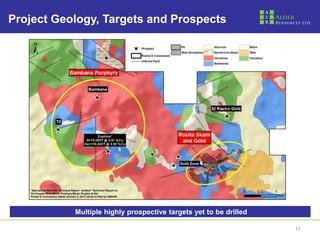

The document discusses Alder Resources Ltd.'s Rosita copper-gold-silver project in Nicaragua. Key points include:

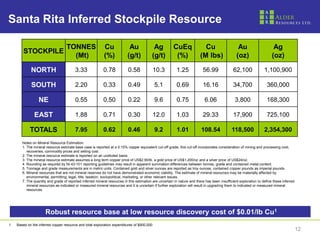

- Rosita has a NI 43-101 compliant inferred stockpile resource of 8 million tonnes containing 108.5 million lbs of copper, 118,500 ounces of gold, and 2.4 million ounces of silver.

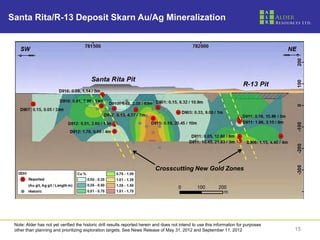

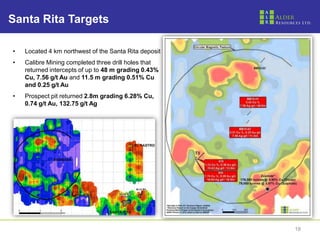

- Initial drilling identified a 1.1 km long by 200 m deep copper-gold-silver mineralized zone below the historic Santa Rita open pit. Drill highlights include intercepts of up to 29.54 g/t gold over 8 meters.

- The project is in a prolific mining district in Nicaragua that has produced over 305 million lbs of