Sandfire Resources has begun mining at its new DeGrussa copper-gold mine in Western Australia, opening a new chapter of growth for the company. Key points:

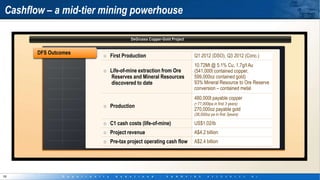

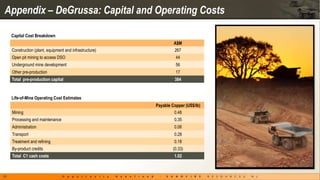

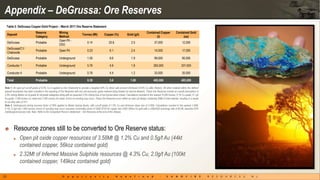

- Mining commenced in February 2012 with the first shipment of development ore. Underground mining will begin in Q3 2012.

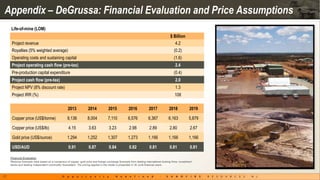

- DeGrussa is expected to produce on average 77,000 tonnes of payable copper and 36,000 ounces of gold annually for the first three years.

- The mine has a projected life of over 7 years and is fully funded. Production will establish Sandfire as a mid-tier mining company and generate significant cash flow.

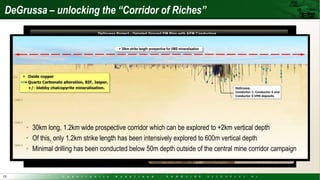

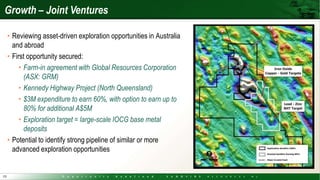

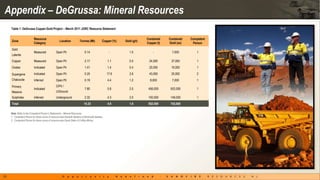

- Exploration potential remains along a 30km prospective corridor, providing