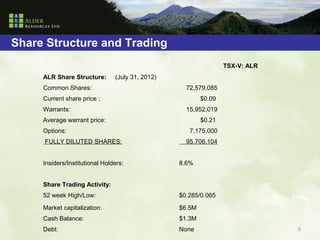

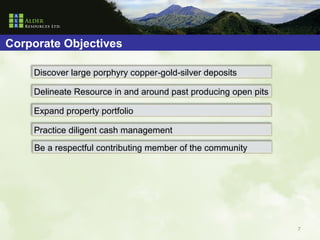

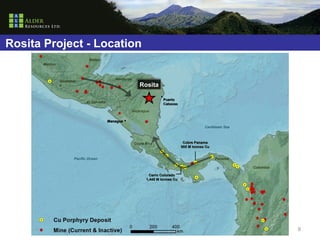

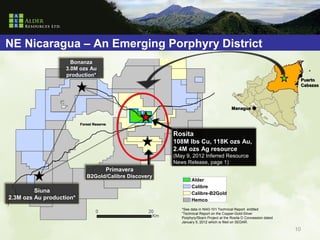

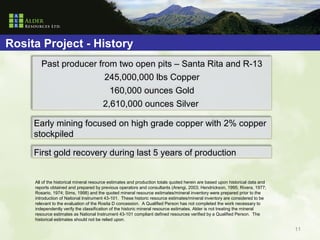

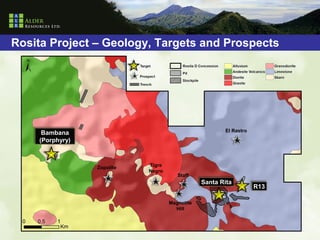

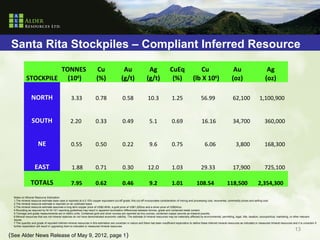

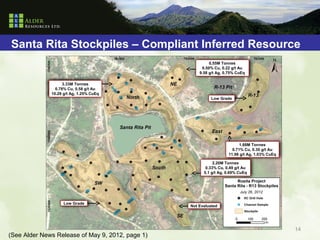

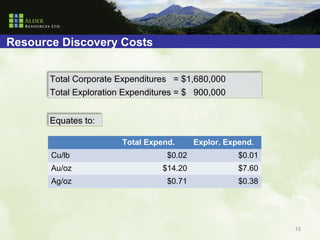

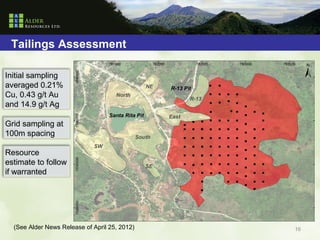

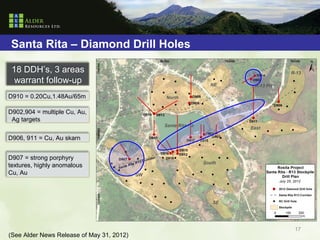

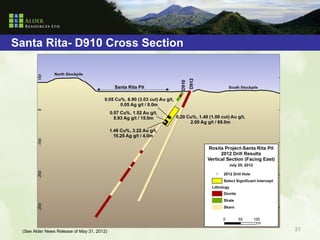

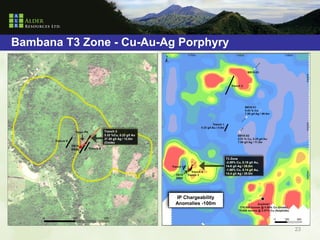

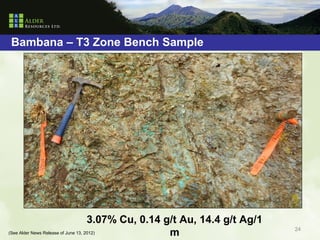

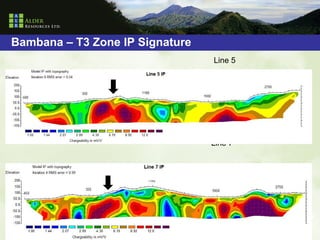

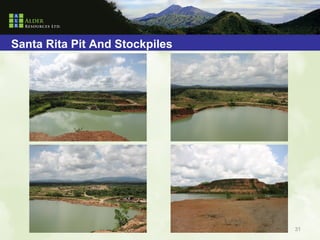

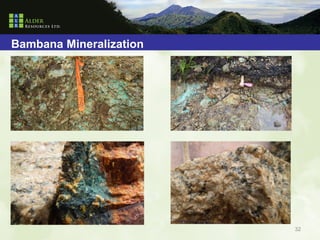

Alder Resources holds a 65% interest in the 33 km2 Rosita copper-gold-silver property in northeast Nicaragua. Rosita is located in an emerging porphyry district and was a past producer. Alder's experienced management team recently outlined an initial inferred resource at Rosita of 108 million pounds of copper, 118 thousand ounces of gold, and 2.4 million ounces of silver. Alder's objectives are to discover large porphyry deposits at Rosita, expand resources around past open pits, expand its land portfolio, and practice diligent cash management.