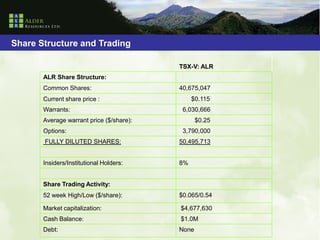

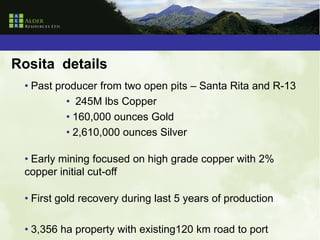

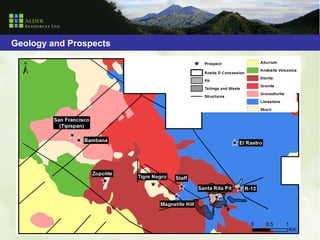

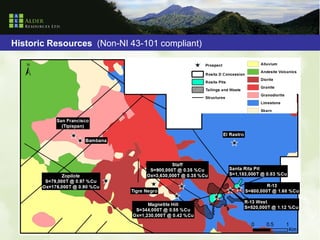

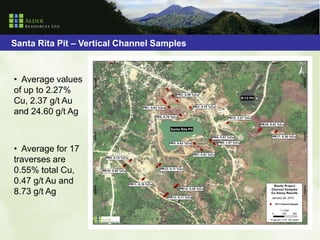

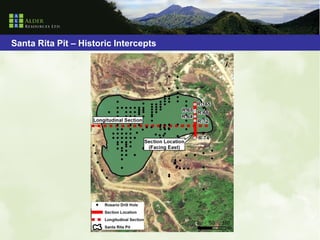

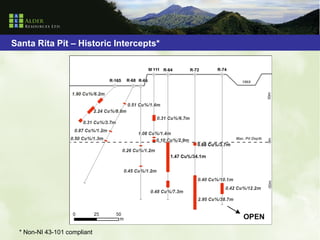

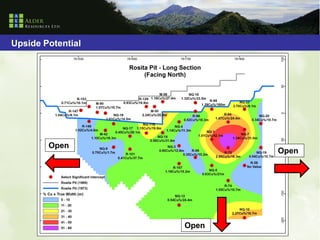

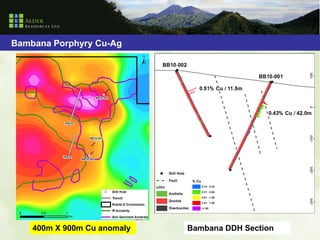

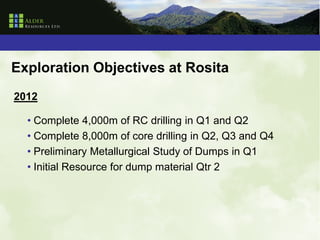

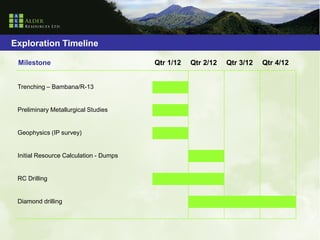

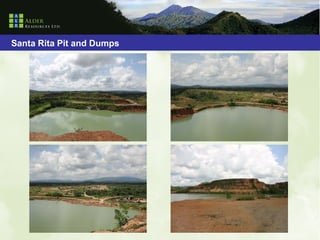

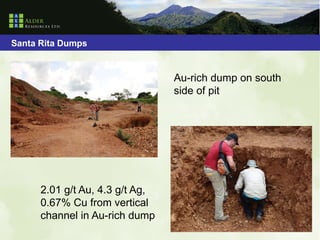

TSX-V: ALR explores for copper and gold in Nicaragua, focusing on its Rosita project which hosts the past-producing Santa Rita and R-13 copper mines. Highlights of the Rosita project include a large land package with existing infrastructure, numerous high-priority targets identified through soil and geophysical surveys, and plans for an aggressive exploration program in 2012 including trenching, drilling, and metallurgical studies. The company aims to outline initial resources from mine dumps and advance exploration of porphyry and skarn targets to add value from this underexplored historic mining district.