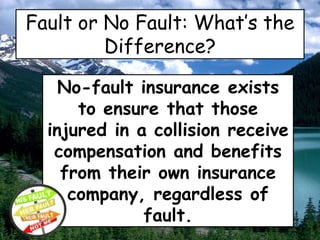

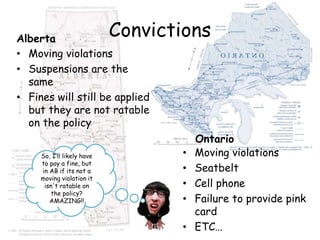

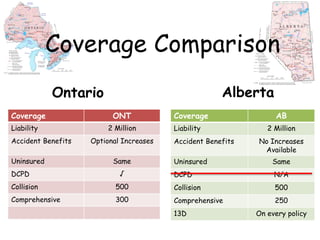

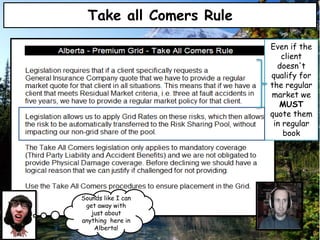

Myrna has moved from Ontario to Alberta and is confused about the differences in her auto insurance policies between the two provinces. The document provides information to help explain the key differences, including:

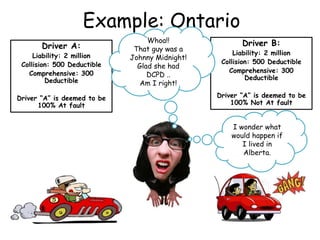

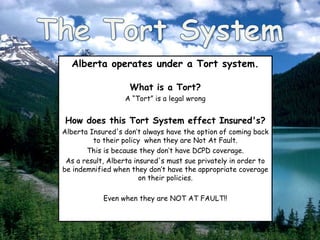

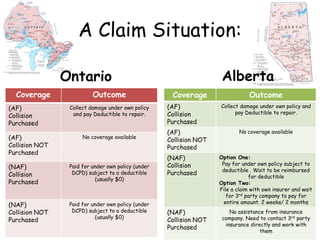

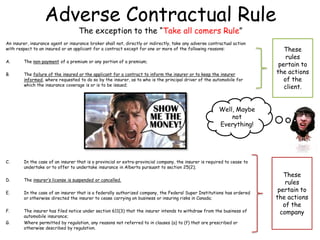

- Alberta operates under a tort system rather than no-fault like Ontario, meaning insured parties may need to sue privately to be compensated if not at fault in an accident.

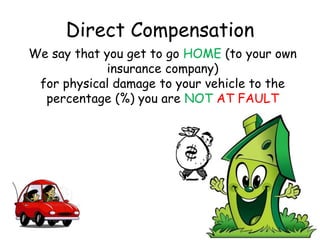

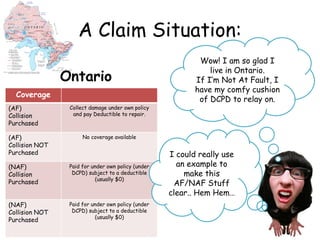

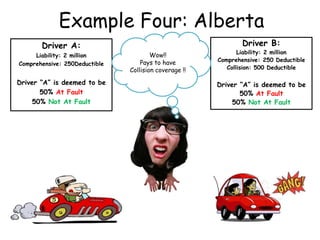

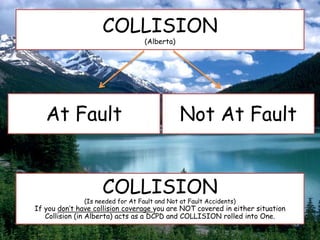

- In Alberta, collision coverage is important for both at-fault and not-at-fault accidents, unlike in Ontario where drivers can rely on DCPD coverage if not at fault.

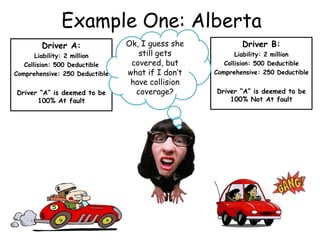

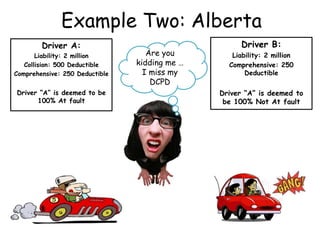

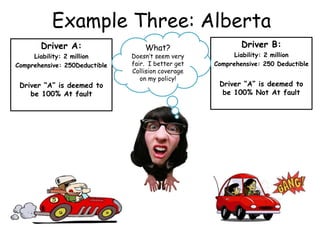

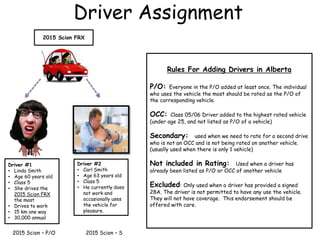

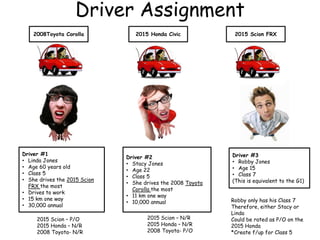

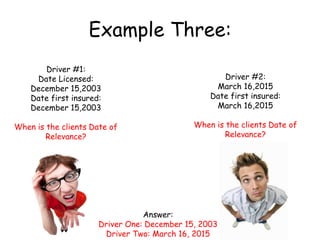

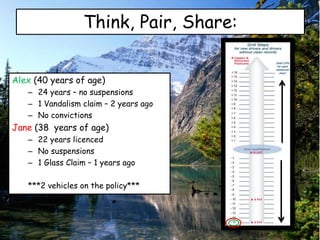

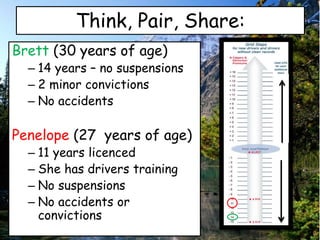

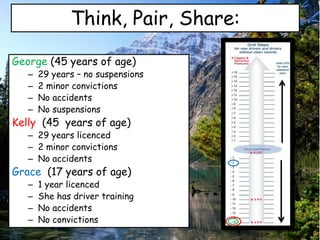

- Several examples are given to illustrate claim scenarios under the different systems and coverage options.

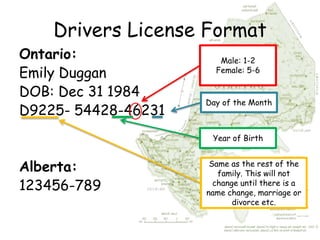

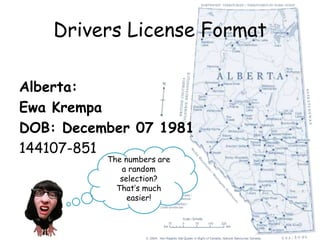

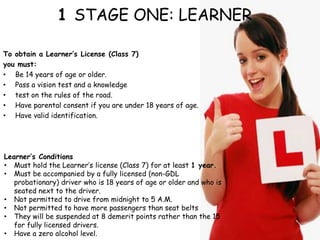

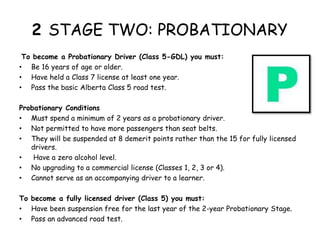

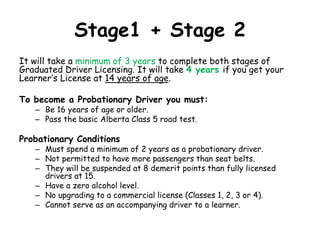

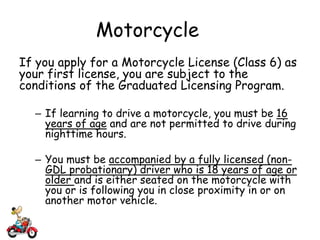

- Driver licensing programs and classes also differ, with Alberta