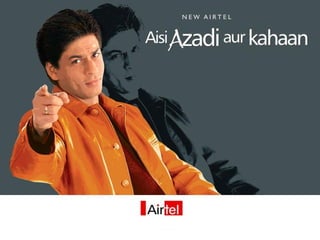

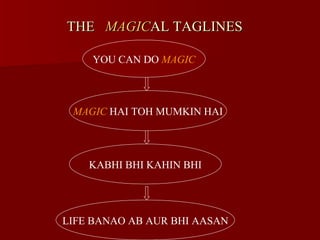

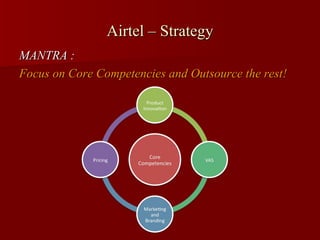

Airtel launched its prepaid cellular service called Magic in January 1999 in India to target infrequent mobile users. Magic was made easily accessible by making SIM cards available in various stores. This led to rapid growth in Airtel's subscriber base. To sustain its position as market leader, Airtel revamped Magic by rebranding it as Airtel Magic, introducing regional roaming and other value-added services. It also implemented aggressive celebrity endorsement campaigns. These strategic changes helped Airtel transform the Indian cellular market and achieve a subscriber base of over 65 million by 2008, making it the largest cellular provider in India.