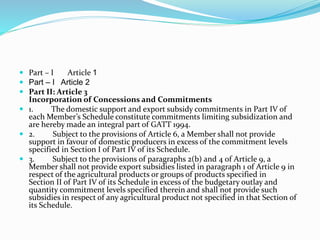

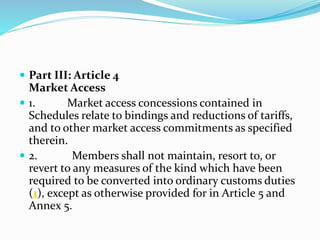

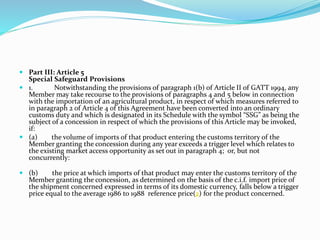

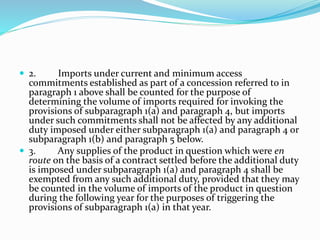

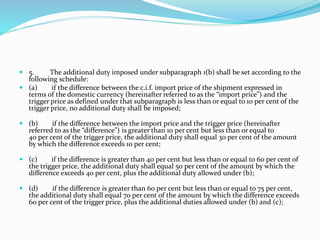

The document discusses the key aspects of the Agreement on Agriculture from the World Trade Organization (WTO). It outlines the main parts of the agreement, including commitments on market access, domestic support, and export subsidies. It also describes provisions for special safeguards to protect domestic agriculture from import surges and support for developing countries. Specific commitments are required to be made through national schedules on tariff reductions and limits on trade-distorting domestic subsidies and export subsidies.