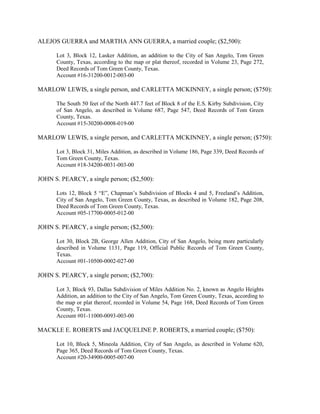

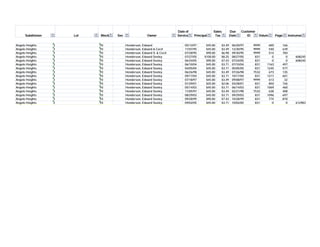

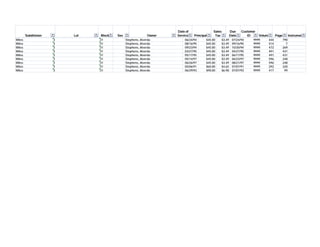

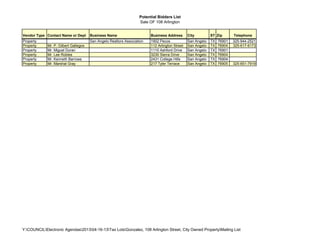

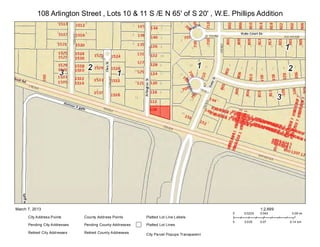

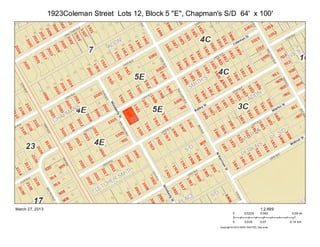

The document is a notice for a public meeting of the City Council of San Angelo, Texas to take place on April 16, 2013. The agenda includes opening procedures like calling the meeting to order, pledges, and proclamations. It then lists 11 consent agenda items for consideration, including awarding bids, authorizing property sales, approving leases, and adopting bylaws. The agenda concludes with a resolution to approve funding from the Texas Events Trust Fund for an equestrian competition in the amount of $13,136 with a state match.

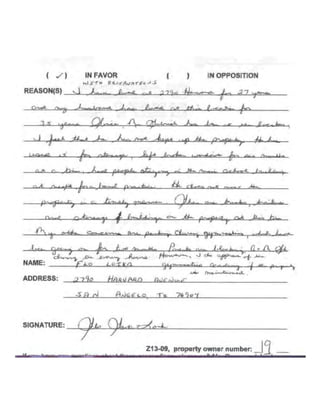

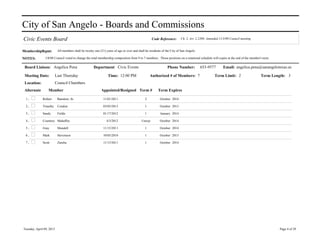

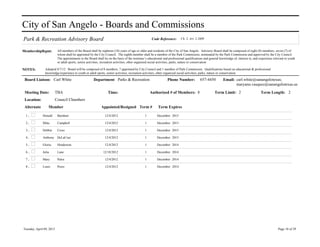

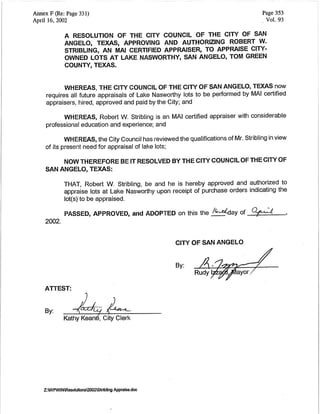

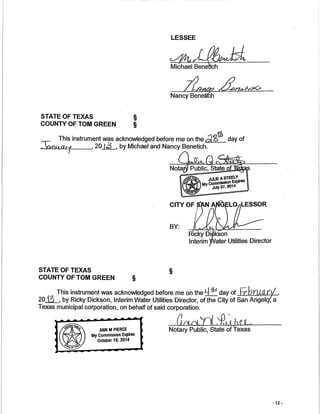

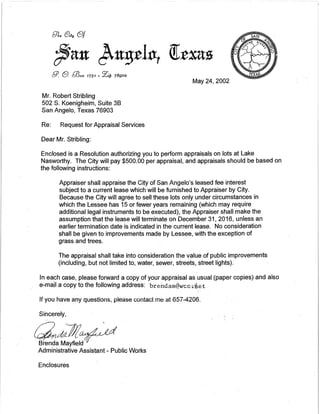

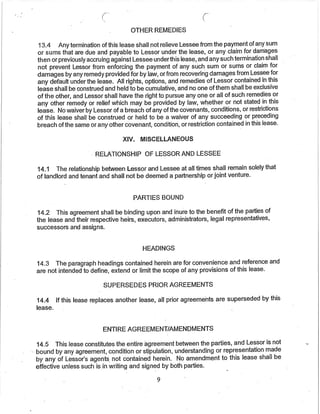

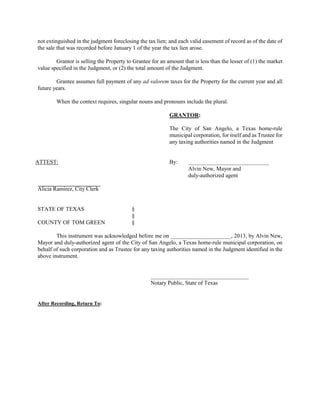

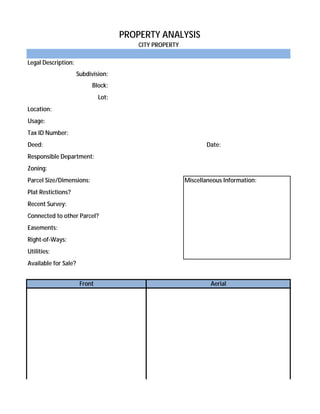

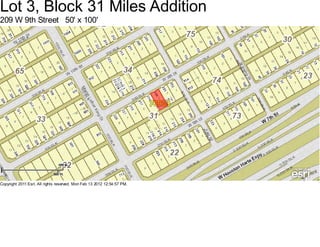

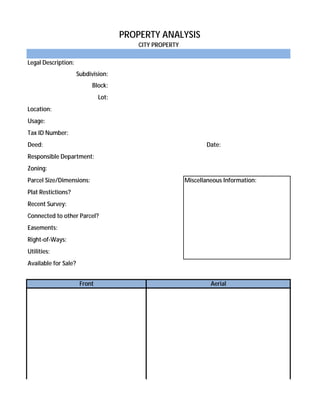

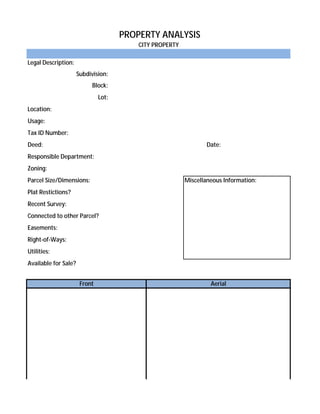

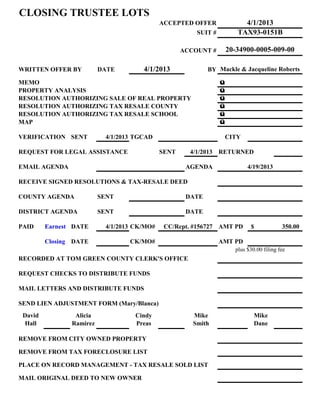

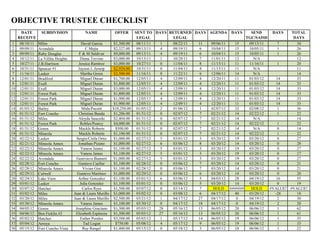

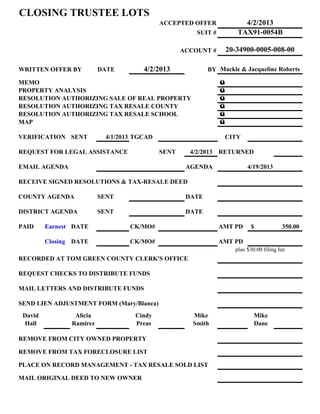

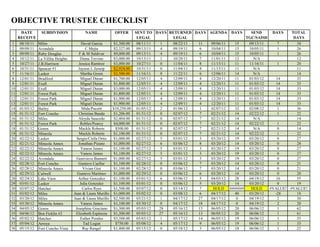

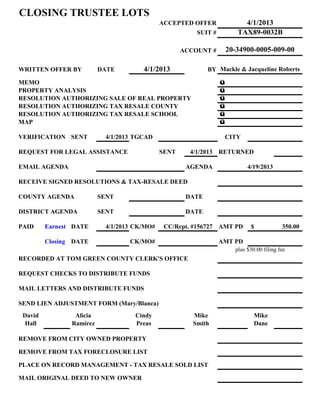

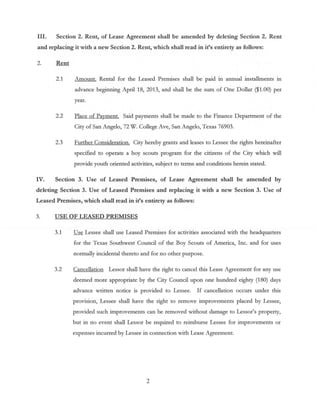

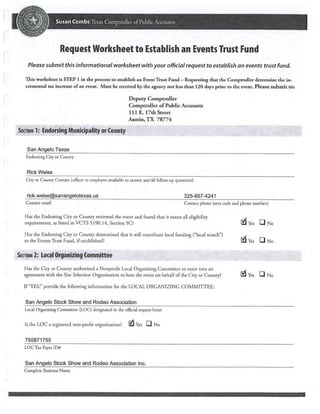

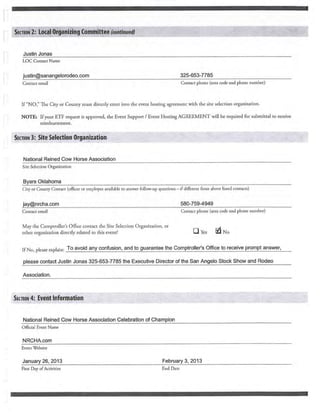

![violation of which shall entitle the other party, at its option, to terminate this

contract.

14. This contract constitutes the entire agreement between the parties hereto, and

Lessor is not bound by any agreement, condition, stipulation, understanding or

representation made by any of the Lessor's agents not contained herein.

15. All notices concerning this lease shall be in writing and delivered to the parties at

the addresses below:

LESSEE: Allan Temperton, President

MK-Allan Enterprises, Inc.

764 Royal Oaks Loop

Fredericksburg, Texas 78624

LESSOR: City of San Angelo

Water Utilities Department

72 W. College

San Angelo, Texas 76903

[Signature Page to Follow]

5](https://image.slidesharecdn.com/agendapacket-130412164632-phpapp02/85/Agenda-packet-578-320.jpg)

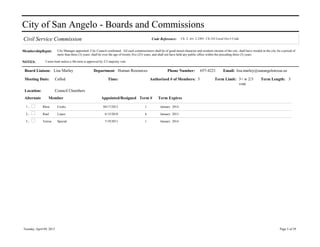

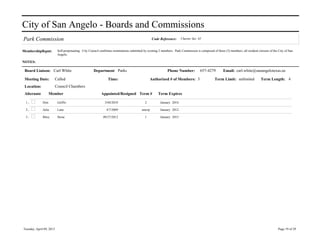

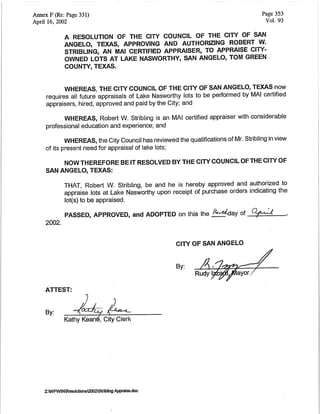

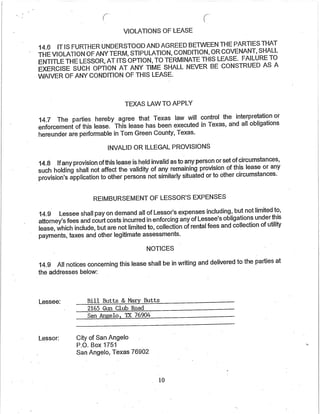

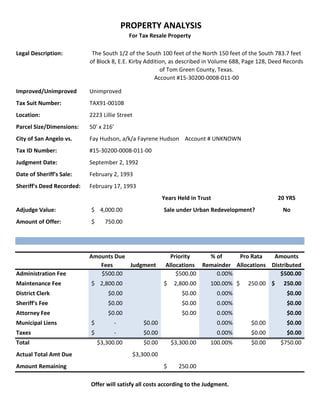

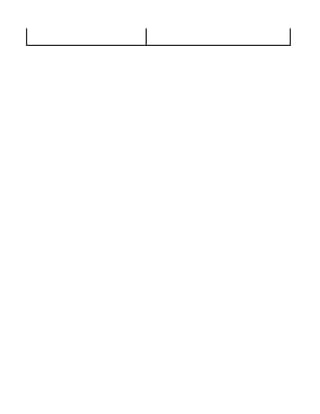

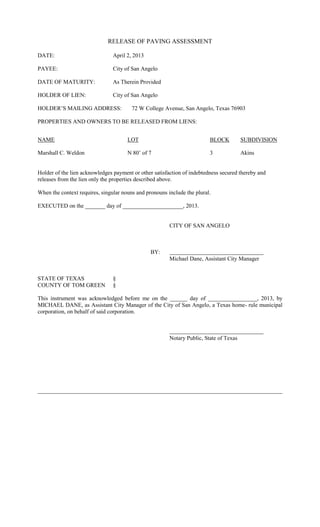

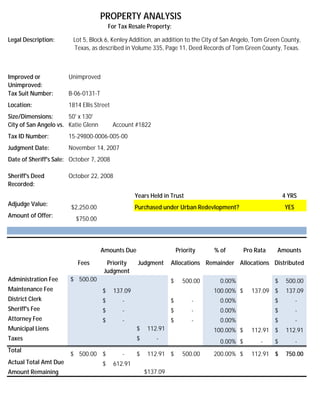

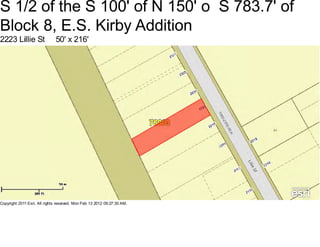

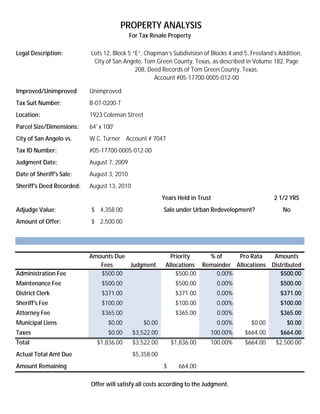

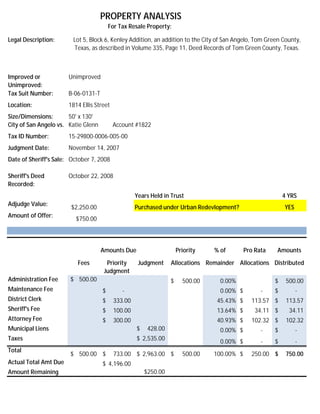

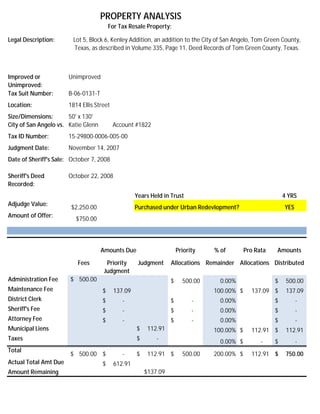

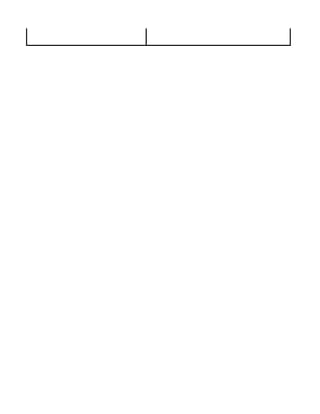

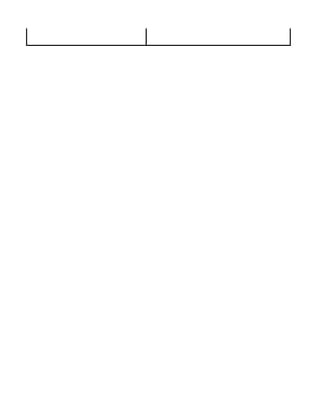

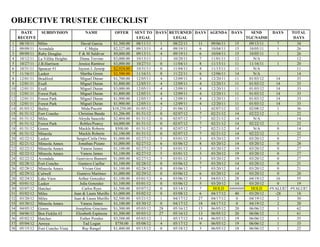

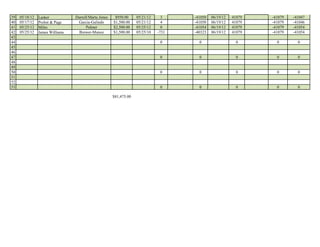

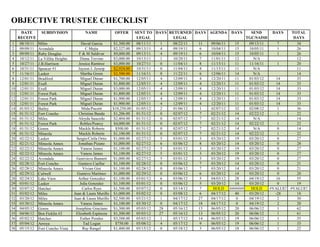

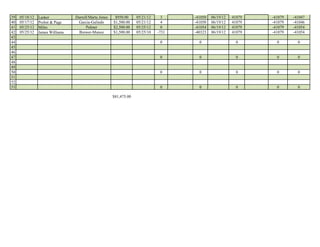

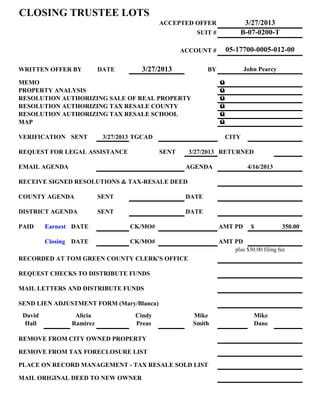

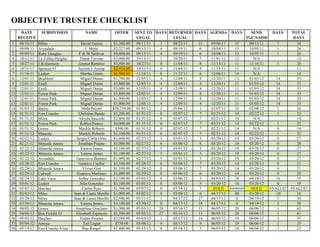

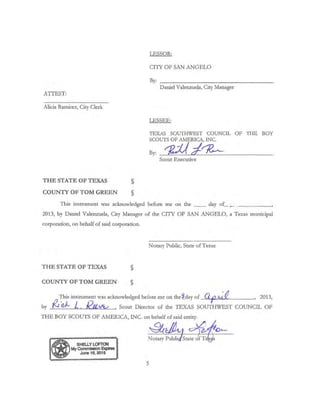

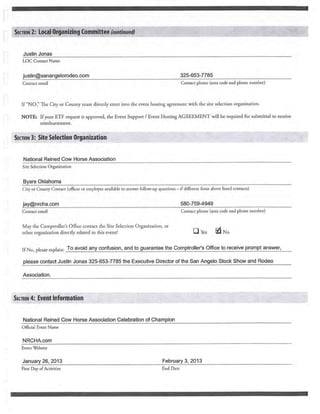

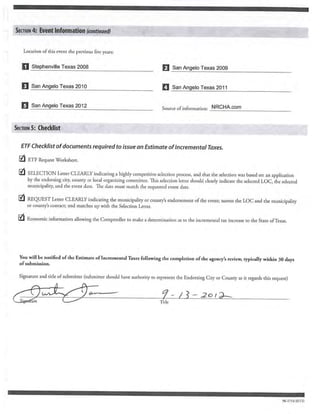

![Section 4. Terms of Office. Of the members first appointed by the City Council, four (4)

appointments shall be for a term of three (3)-years each and three (3) appointments shall be for a

term of two (2)-years each. The first appointment selected by the Parks Commission and

approved by the City Council shall be for a term of two (2)-years each. Thereafter, appointments

shall be for a term of two (2)-years each, except vacancies for unexpired terms which shall be

filled by appointment of the City Council for the remainder of the unexpired term. Board

members shall serve without compensation at the pleasure of the City Council, subject to

termination at any time without cause.

Section 5. Vacancies. Any vacancy occurring on the Parks & Recreation Advisory Board shall

be filled by the appointment of the City Council under such procedures as it prescribes and such

appointment shall be for the unexpired term of the member whose position is vacated; provided

however, that a person serving such unexpired term shall nevertheless be eligible to serve two

full consecutive terms after the completion of the unexpired term as appointed hereunder.

ARTICLE III

MEETINGS

Section 1. Meetings. The Board shall adopt a schedule providing for at least one regular

meeting per calendar month and may make provision for such other special meetings as it deems

appropriate. An agenda of the Parks & Recreation Advisory Board shall be posted in a public

area and filed with the City of San Angelo City Clerk’s office at least 72 hours in advance of the

called meeting. Meetings of the Board shall be held pursuant to public notice and shall be open

to the public in compliance with the Texas Open Meetings Act.

Section 2. Committees. The Board may create ad hoc or standing committees of less than a

quorum of the Board members, which may include residents of the City who are not Board

members, as needed or deemed desirable to address specific matters within the purview of the

Board. Committees shall report to the Board and shall have the authority to gather information,

make reports and prepare recommendations for consideration by the Board.

Section 3. Attendance. In the event any member is absent from four (4) regularly scheduled

meetings during the course of any year, a Board member shall be deemed to have resigned,

unless such absence from the meeting is “excused” (i.e., family emergency, work-related

commitments, medical necessity or vacation outside the City of San Angelo).

Section 4. Quorum and Vote. All members of the Board shall have voting rights. A quorum

shall consist of a simple majority [five (5)] of the duly appointed members of the Board. The

affirmative vote of a majority of the members present at a properly called meeting with a quorum

present shall be the act of the Board.

Section 5. Staff Liaison. The Parks and Recreation Director shall be designated as the Parks &

Recreation Advisory Board’s staff liaison and shall cause copies of the Parks & Recreation

Advisory Board’s agenda, minutes and notices to be filed with the City of San Angelo City

Clerk. Said liaison may designate other City staff to facilitate matters of the Parks & Recreation

Advisory Board as he/she deems necessary.](https://image.slidesharecdn.com/agendapacket-130412164632-phpapp02/85/Agenda-packet-639-320.jpg)

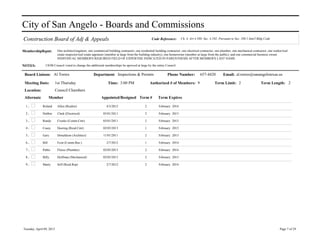

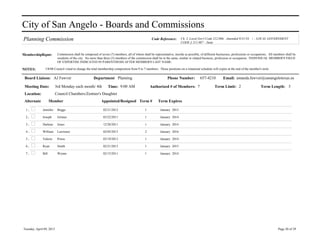

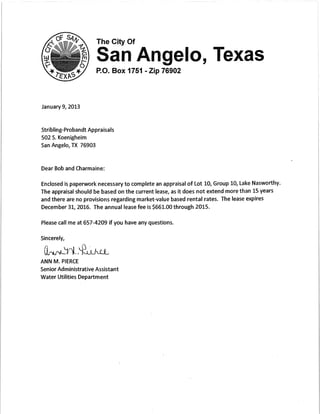

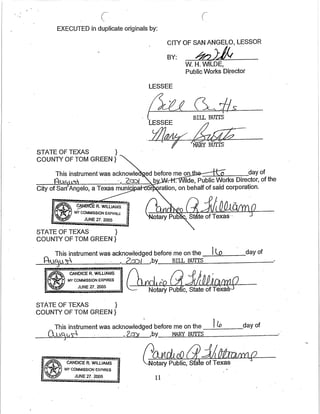

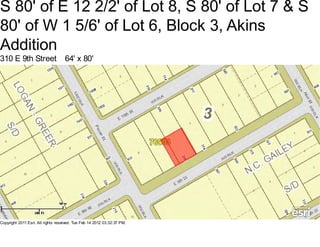

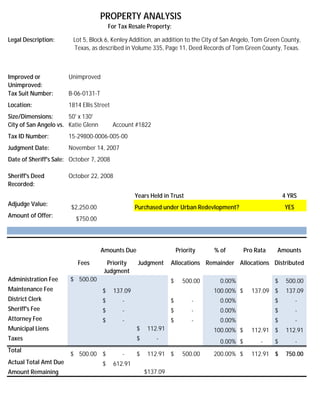

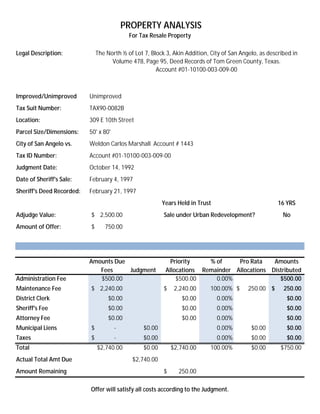

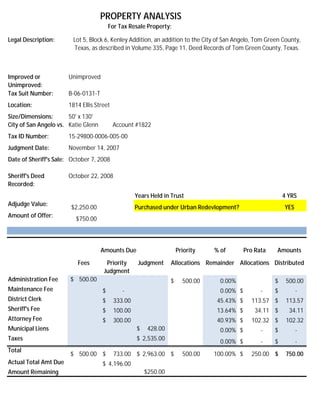

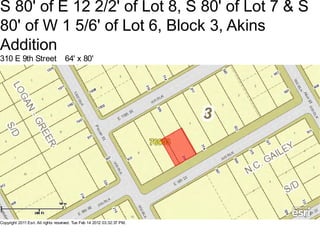

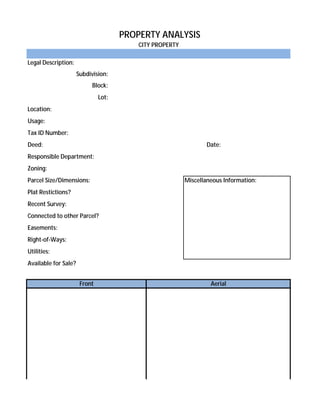

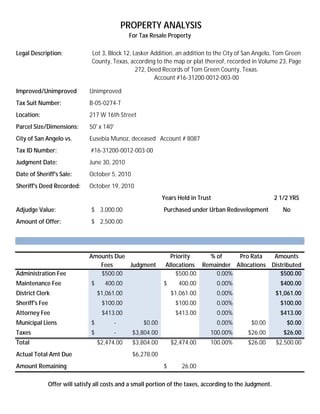

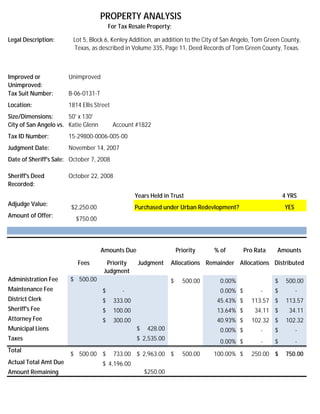

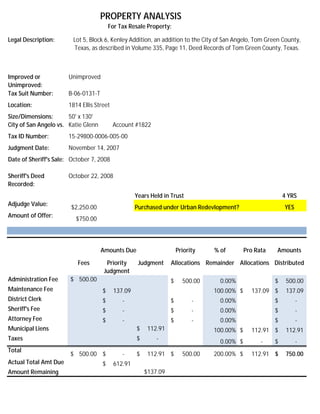

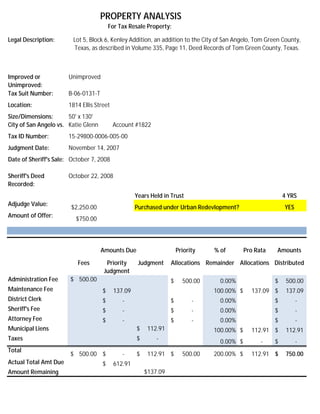

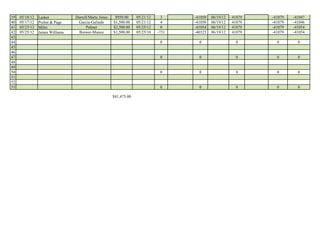

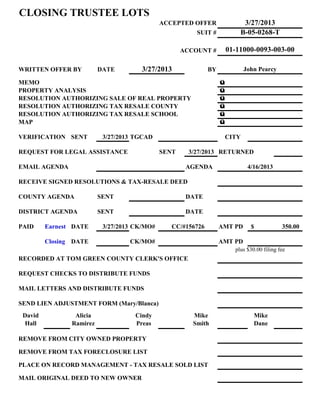

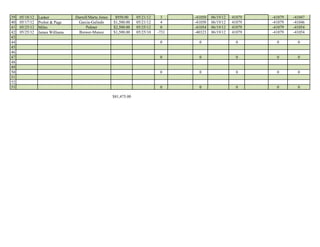

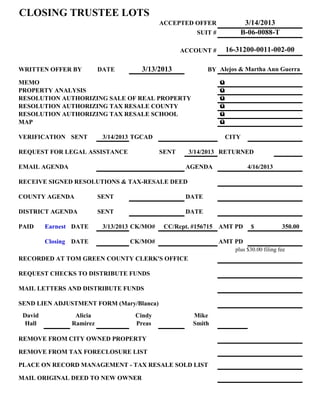

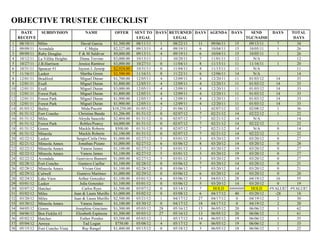

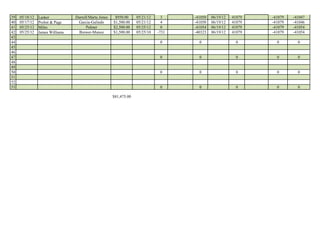

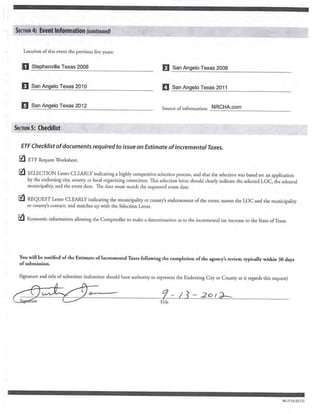

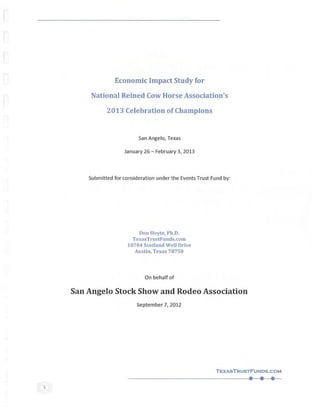

![ARTICLE IV

OFFICERS

Section 1. Designation and Election of Officers. At a regular meeting, generally in February,

each year, the members shall elect a Chair and Co-Chair. The method for nomination and

election shall be determined by a vote of the majority of those members in attendance at such

meeting. The Chair shall appoint committees for any purpose deemed necessary by the Board in

order to execute more effectively its duties and responsibilities.

Section 2. Terms. The officers shall serve a term of one year and thereafter until their

successors are elected. Any member chosen as an officer shall be eligible for reelection not to

exceed two consecutive terms; but having served two consecutive terms in an office, such person

shall not be eligible for reelection to the same office until the expiration of one year after the

completion of such second consecutive term.

Section 3. Duties and Authority of Officers.

a. Chair: Shall preside at all meetings of the Parks & Recreation Advisory Board, have

responsibility for the accomplishment of all directions of the City Council and be primarily

responsible for the accomplishment of the purpose and discharge of the duties and

responsibilities imposed on the Board by the City Council. The Chair shall appoint members of

all committees and shall appoint such committees as deemed necessary and appropriate to carry

on the business of the Parks & Recreation Advisory Board and shall designate the Chair of such

committees.

b. Co-Chair: Shall, in the absence of or disability of the Chair, perform the duties and

exercise the powers of the Chair and shall perform such other duties as the Parks & Recreation

Advisory Board may prescribe.

ARTICLE V

AMENDMENTS

The Board shall adopt and may amend from time to time its bylaws, establishing rules for its

regulation, effective upon approval of the City Council. Said bylaws and amendments thereto as

approved by the City Council shall be filed with the City Clerk. The Board may adopt rules or

regulations in conformity with its bylaws relating to the administration of its business.

ADOPTED AND APPROVED by the Parks & Recreation Advisory Board on this ____ day of

_______, ______.

[SIGNATURE PAGE TO FOLLOW]](https://image.slidesharecdn.com/agendapacket-130412164632-phpapp02/85/Agenda-packet-640-320.jpg)

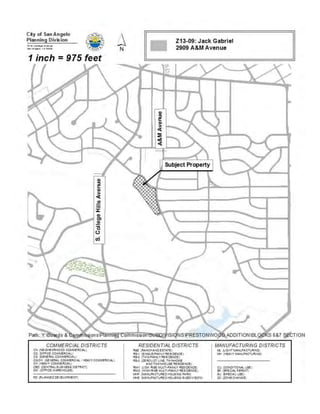

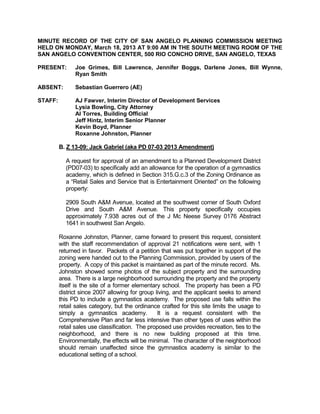

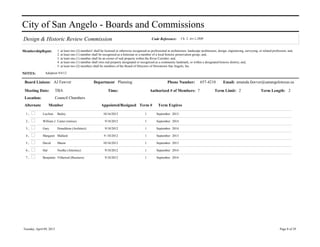

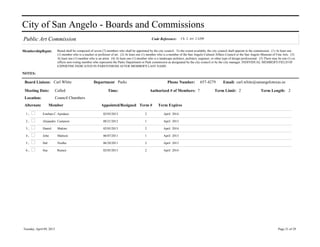

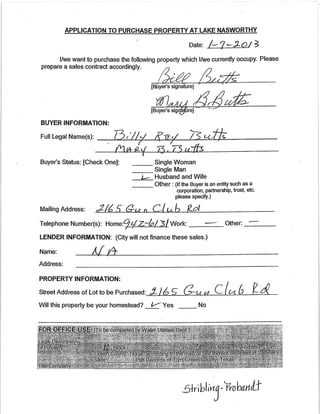

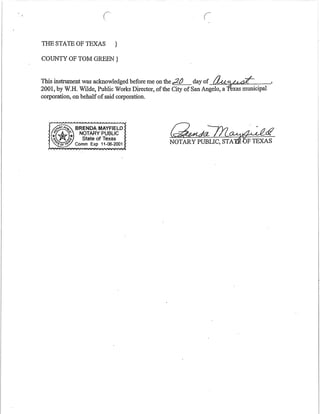

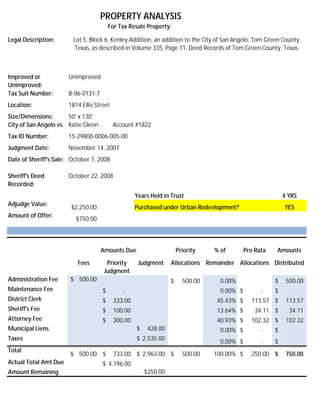

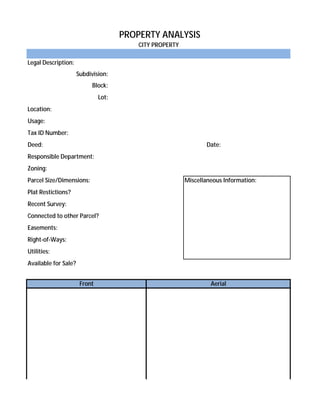

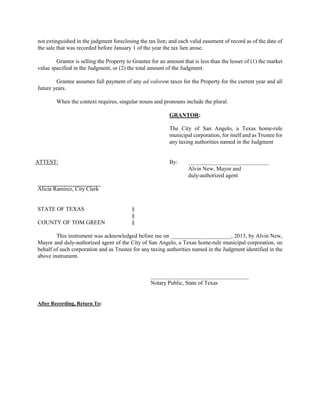

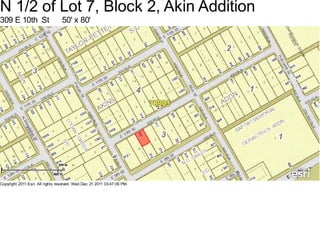

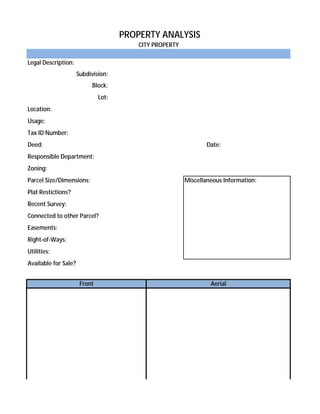

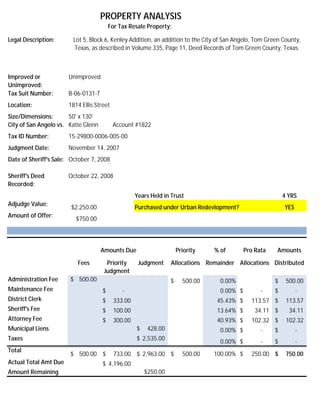

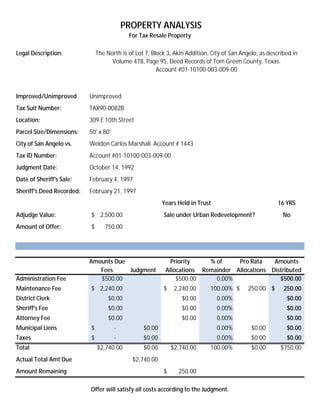

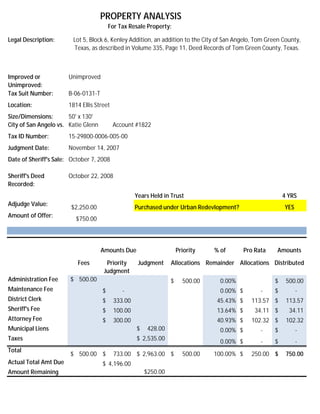

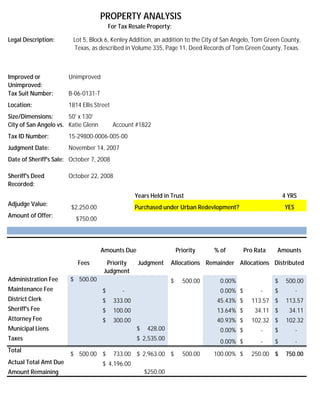

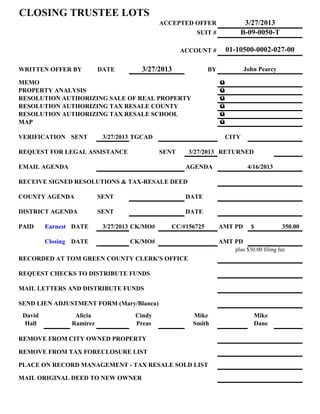

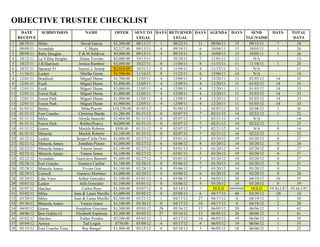

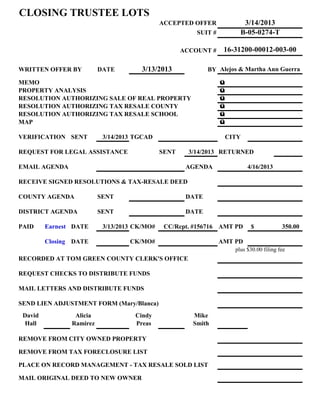

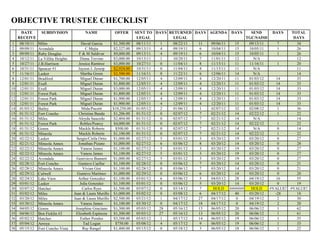

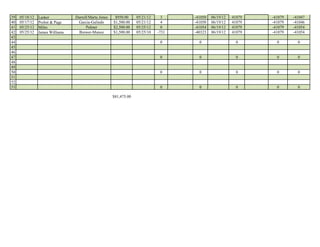

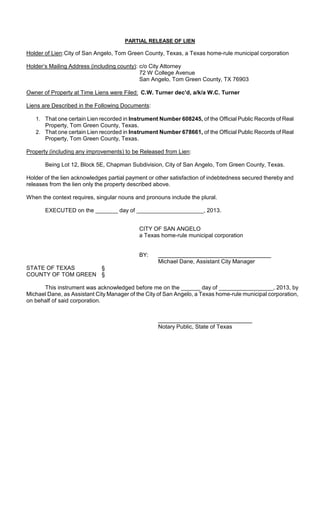

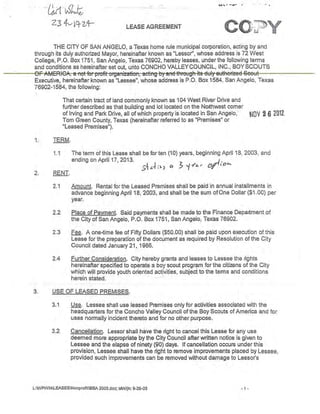

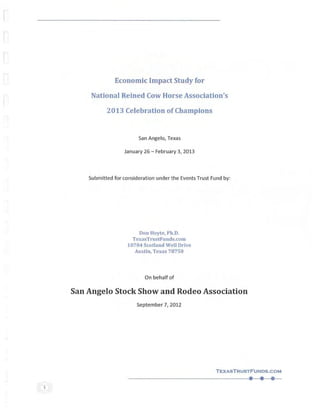

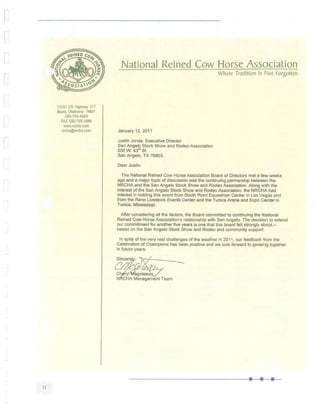

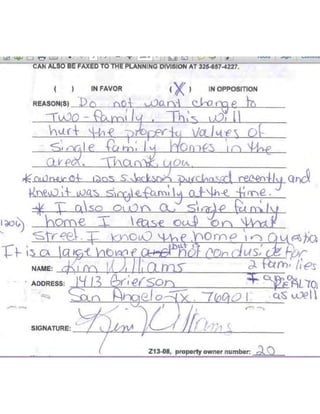

![MINUTE RECORD OF THE CITY OF SAN ANGELO PLANNING COMMISSION MEETING

HELD ON MONDAY, March 18, 2013 AT 9:00 AM IN THE SOUTH MEETING ROOM OF THE

SAN ANGELO CONVENTION CENTER, 500 RIO CONCHO DRIVE, SAN ANGELO, TEXAS

PRESENT: Joe Grimes, Bill Lawrence, Jennifer Boggs, Darlene Jones, Bill Wynne,

Ryan Smith

ABSENT: Sebastian Guerrero (AE)

STAFF: AJ Fawver, Interim Director of Development Services

Lysia Bowling, City Attorney

Al Torres, Building Official

Jeff Hintz, Interim Senior Planner

Kevin Boyd, Planner

Roxanne Johnston, Planner

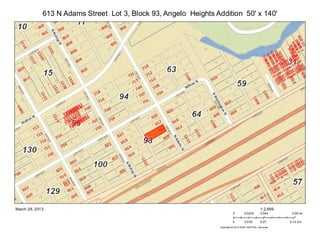

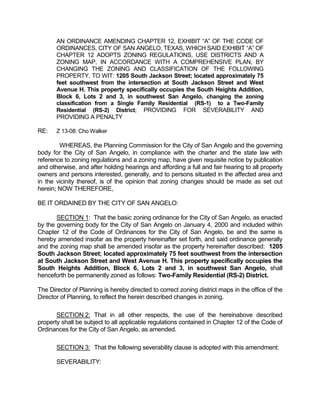

VII. Requests for Zone Change. [Planning Commission makes

recommendation; City Council has final authority for approval.]

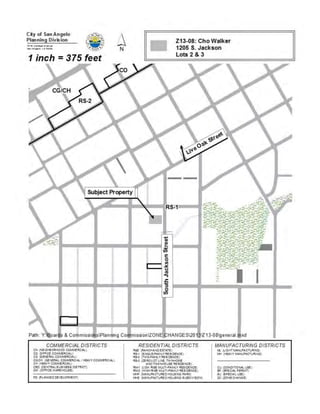

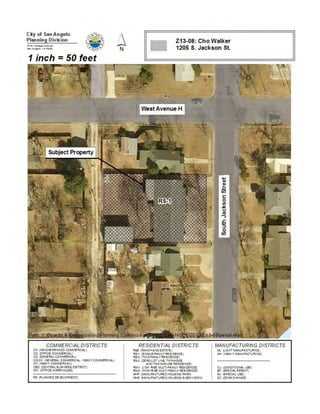

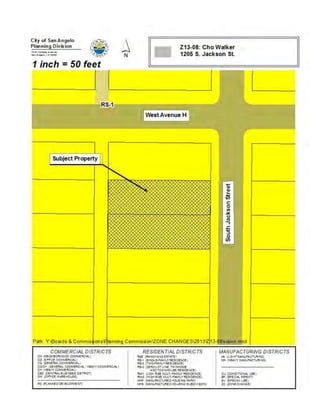

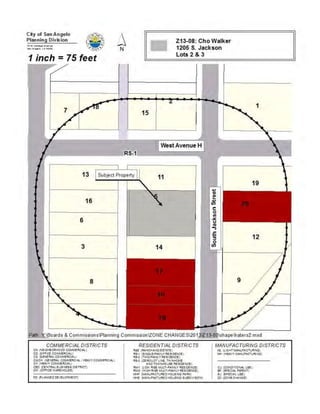

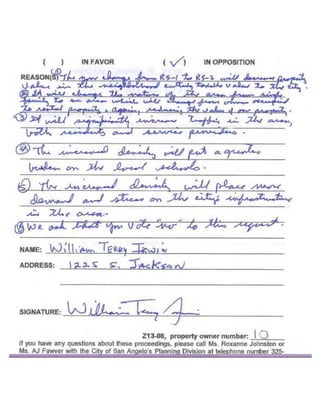

A. Z 13-08 Cho Walker

A request for approval of a zone change from Single-Family Residential (RS-

1) to Two-Family Residential (RS-2) to specifically allow for “Household

Living” as defined in Section 313.B. of the Zoning Ordinance and as allowed

in RS-2 zoning districts on the following property:

1205 South Jackson Street; located approximately 75 feet southwest from

the intersection at South Jackson Street and West Avenue H. This property

specifically occupies the South Heights Addition, Block 6, Lots 2 and 3, in

southwest San Angelo.

Roxanne Johnston, Planner, came forward to present this case, consistent with

the staff recommendation of approval. Twenty notifications were sent out, with

three returned in opposition to the request. She described briefly the concerns

that were outlined. There is predominant RS-1 zoning throughout the area, and

the subject property actually sits on two lots. The applicant would like to have a

full accessory apartment on the premises. The properties responding in

opposition to the request were shown. The Vision Plan map calls for a

"neighborhood" designation at this location. Ms. Johnston gave some other

background on the ordinance requirements for accessory apartments. Staff

explained that the zoning change was needed because a full-fledged apartment

(encompassing both a bathroom and a kitchen) would be a full second living

unit. An RS-1 zoning district only allows one living unit per lot. In this case, the

property is actually two lots, making it unique. Conceivably, if the current

buildings were removed, one residence could be constructed on each of those

lots. As such, the only thing preventing this occurring now is the limitations of

the current buildings and setbacks.](https://image.slidesharecdn.com/agendapacket-130412164632-phpapp02/85/Agenda-packet-762-320.jpg)