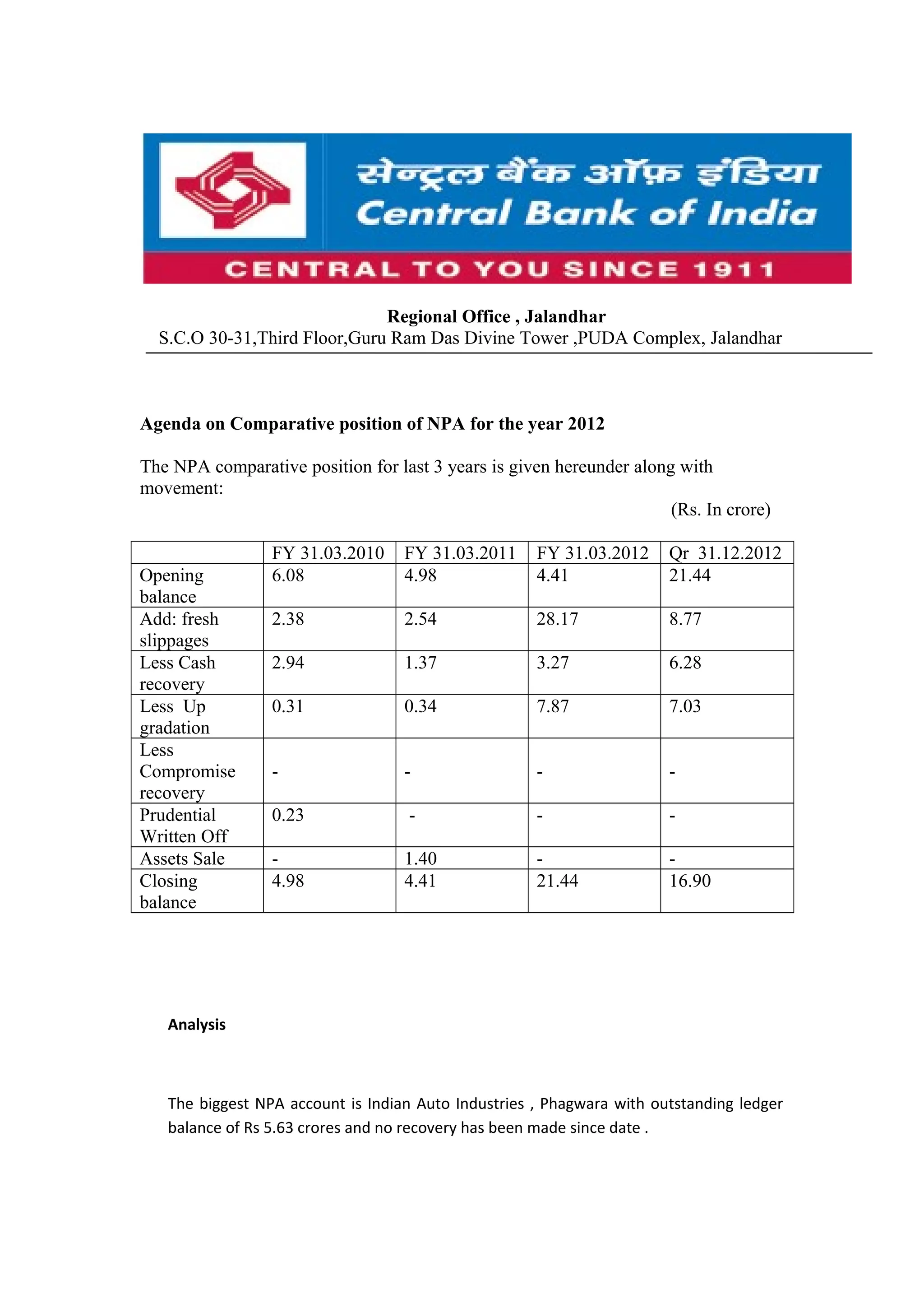

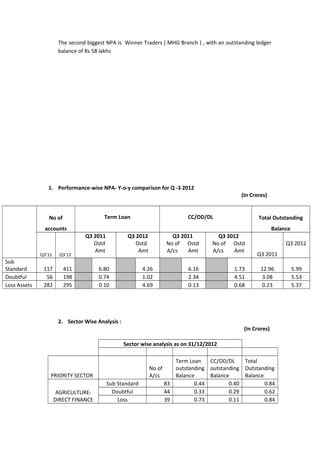

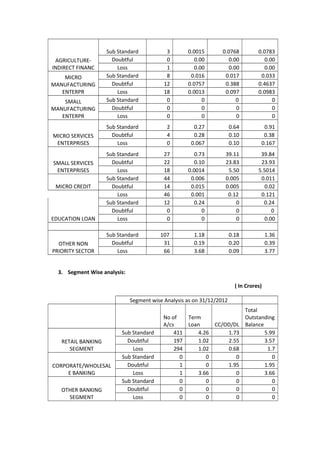

The document provides an analysis of NPA (non-performing assets) for a regional office of a bank for the years 2010-2012 and the third quarter of 2012. It summarizes NPA levels, fresh slippages, recoveries, upgrades, and write-offs. The two largest NPA accounts are identified. Sector-wise, segment-wise, and status under SARFAESI Act analyses are also presented. An action plan for further recovery and reducing NPA levels is outlined.