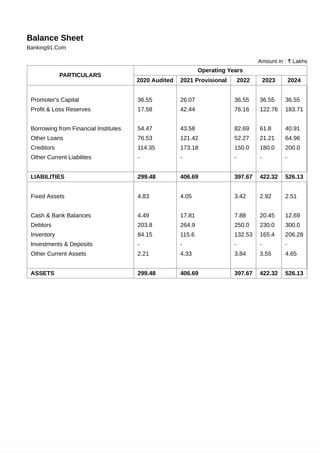

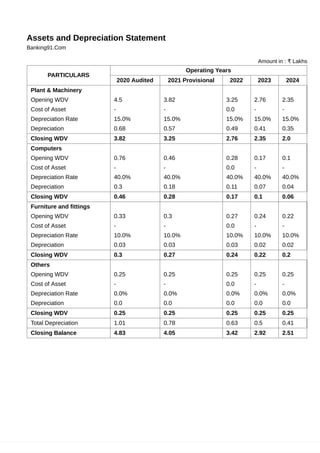

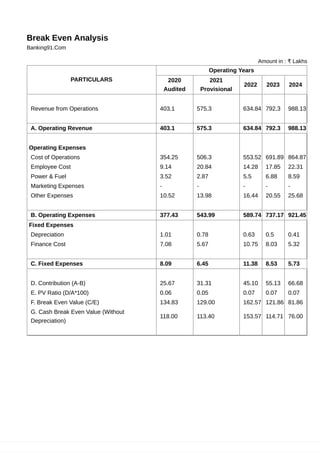

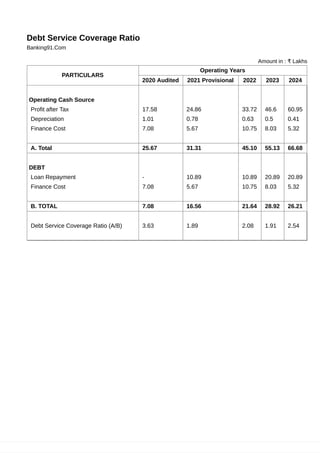

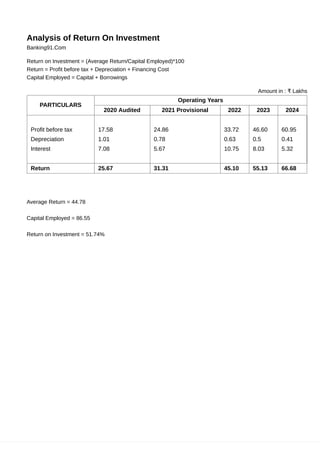

The Credit Monitoring Arrangement (CMA) report for Banking91 outlines its financial viability and projections for operations over multiple years, including profit and loss statements, balance sheets, and cash-flow statements. Key highlights include projected revenue growth from ₹403.1 lakhs in 2020 to ₹988.13 lakhs in 2024, with corresponding net profits increasing from ₹17.58 lakhs to ₹60.95 lakhs. The report also assesses debt service coverage and return on investment, indicating a solid financial outlook for the business.