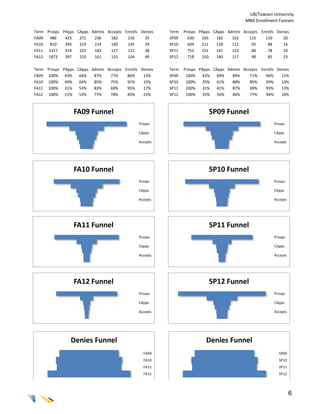

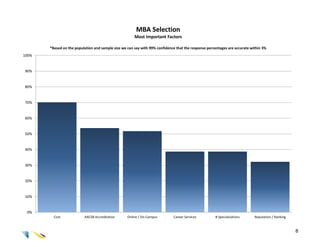

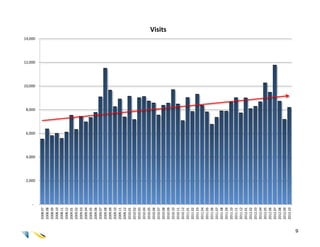

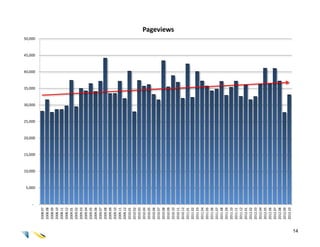

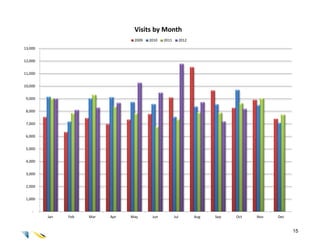

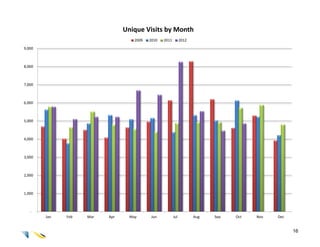

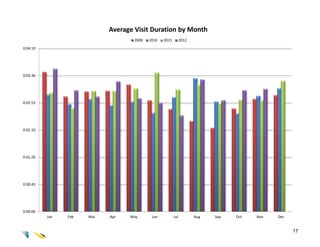

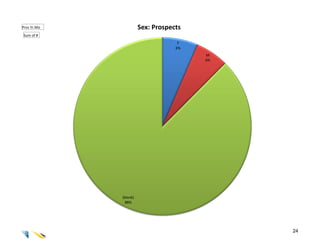

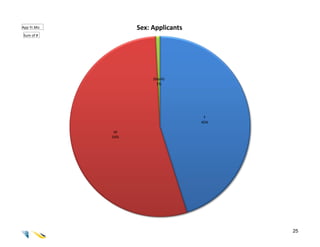

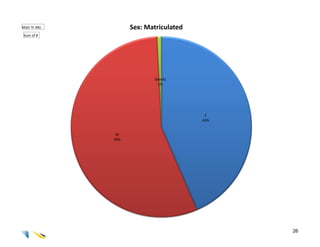

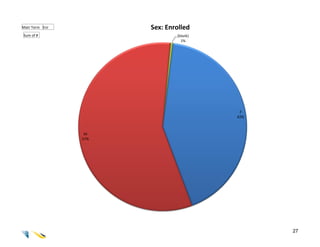

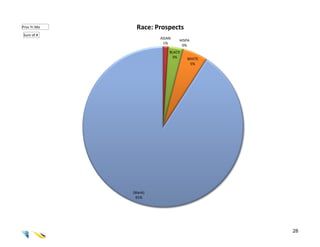

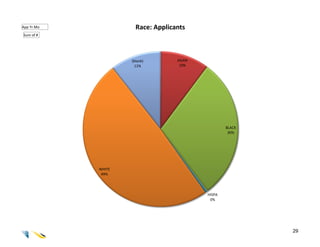

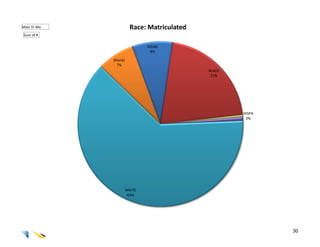

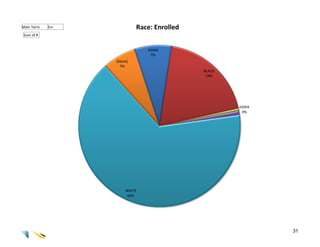

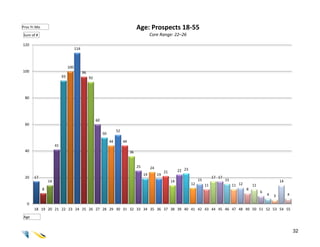

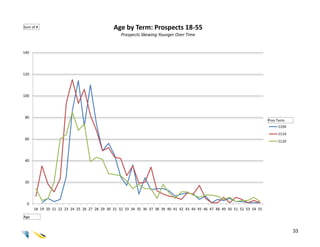

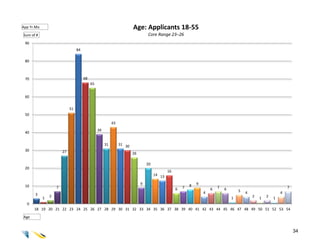

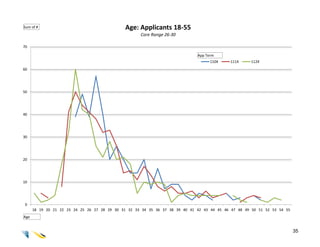

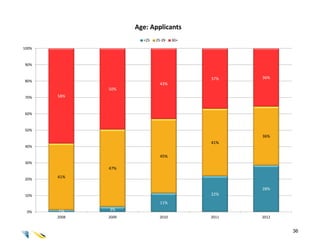

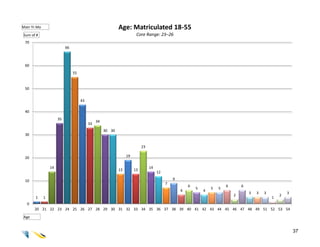

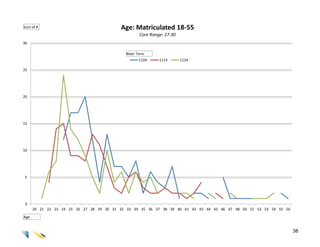

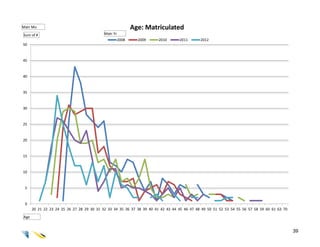

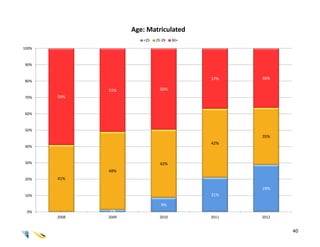

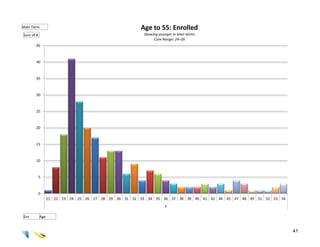

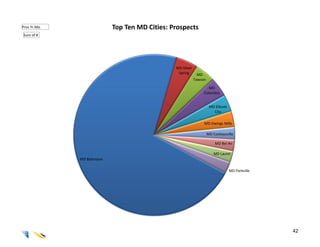

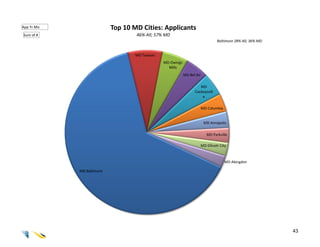

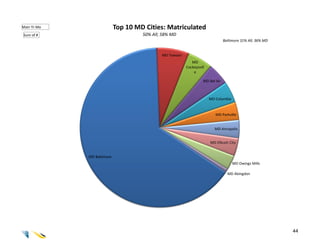

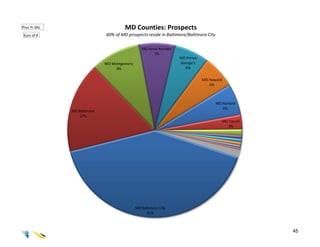

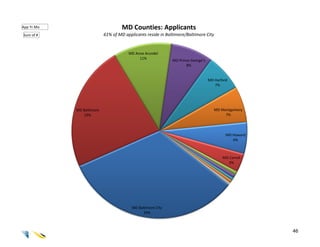

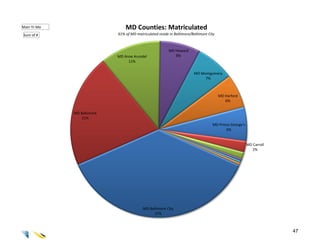

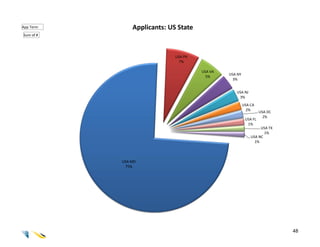

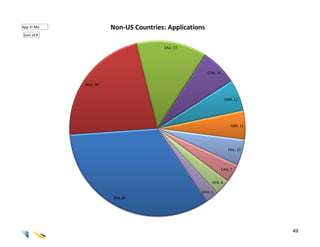

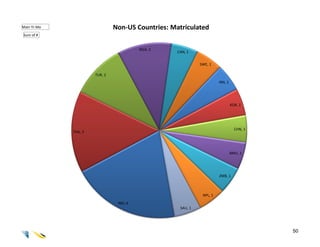

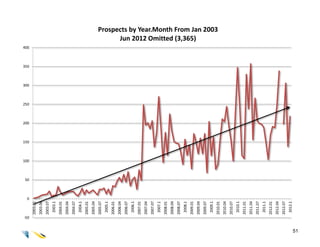

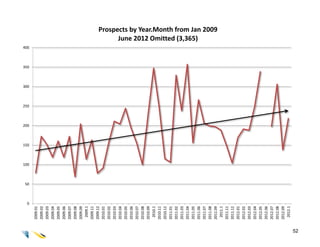

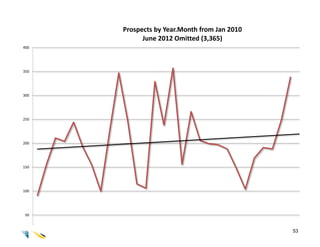

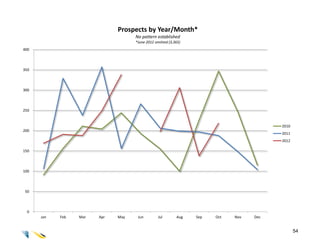

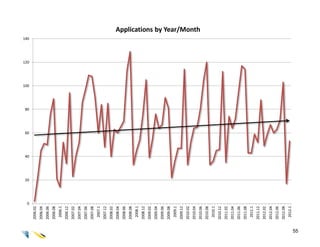

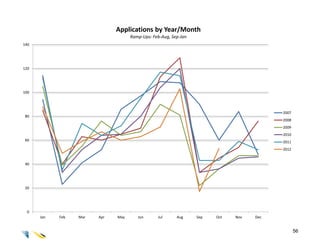

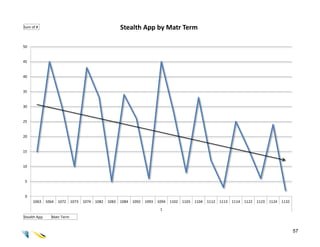

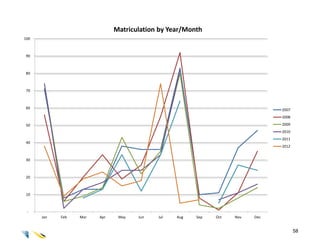

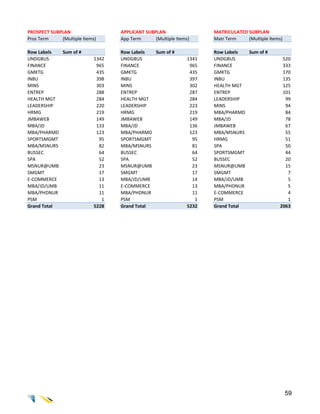

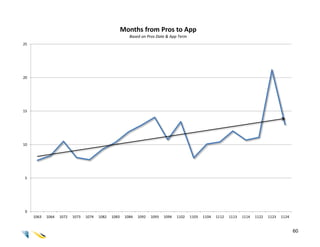

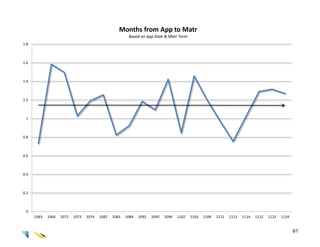

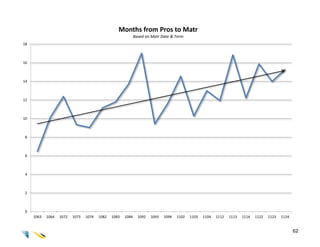

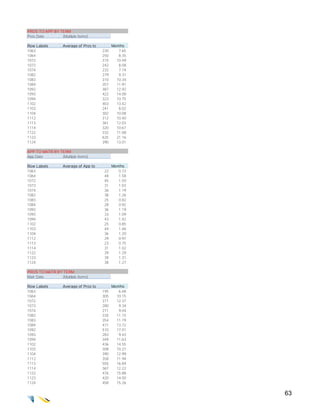

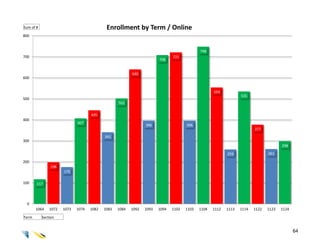

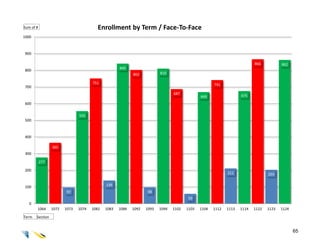

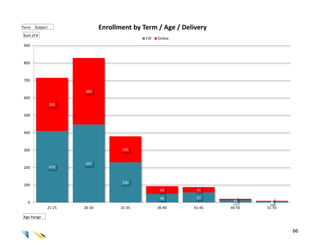

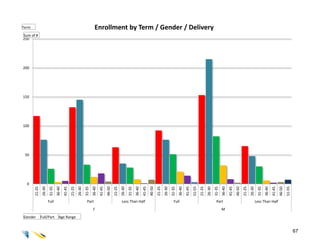

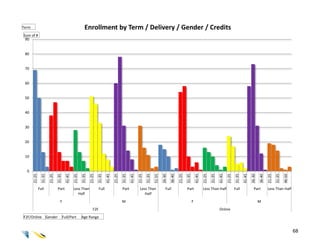

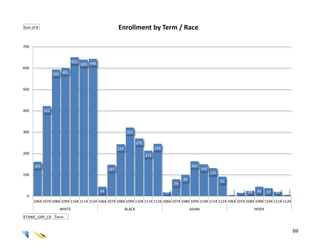

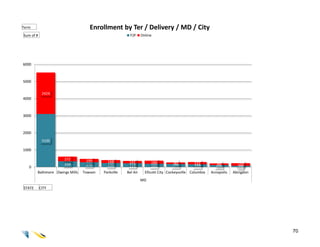

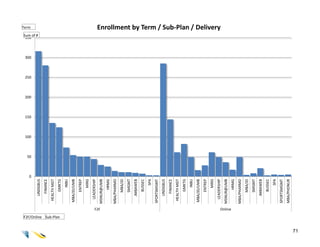

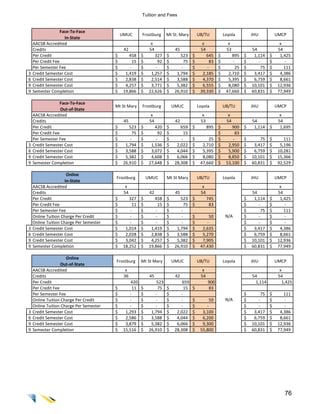

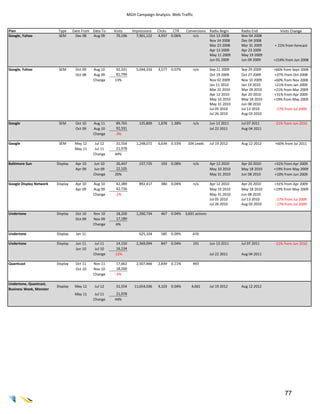

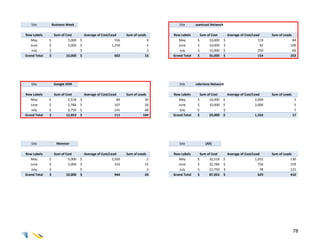

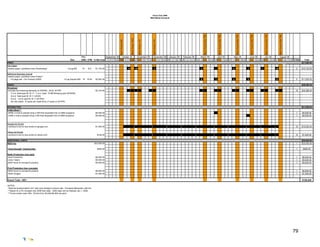

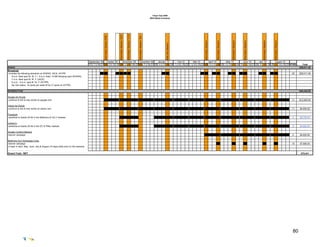

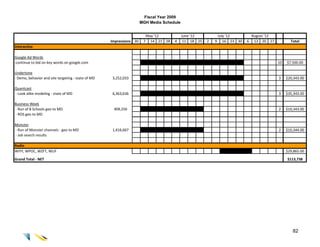

This document provides an overview and data summary for a joint MBA program between University of Baltimore and Towson University. It outlines issues with the program's branding, creative materials, media strategy, and web presence. It then provides extensive data on applicant demographics, enrollment trends, and conversion rates. The document requests proposals for a new program name/brand, multi-year marketing campaign, annual media strategy, and redesigned website. Accompanying the summary is detailed enrollment and application data to inform strategic recommendations.