The document provides information about Comfort chair company which manufacturers recliners. In February:

- The company started production of 73,000 chairs.

- It completed 78,000 chairs and transferred them to finishing.

- It ended the month with 10,000 chairs in inventory.

- Beginning inventory was 15,000 chairs.

- It uses FIFO process costing and adds conversion costs uniformly throughout production.

- Beginning work in process was 30% complete for conversion costs.

- Ending work in process was 80% complete for conversion costs.

The document then provides this information to answer 31 multiple choice questions about costs, equivalent units, and units started/completed for Comfort chair company

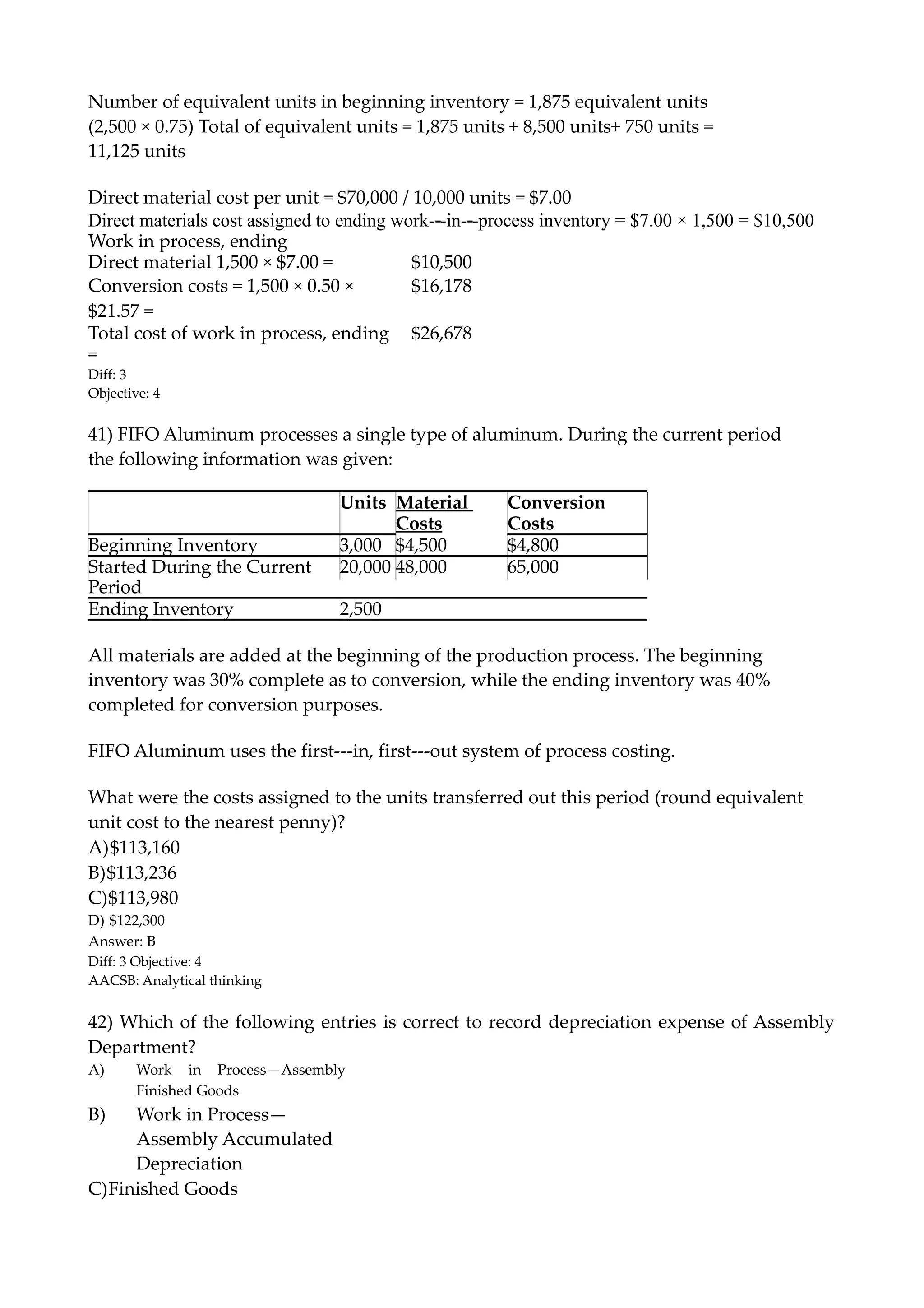

![Number of equivalent units in beginning inventory = 10,500 (15,000 × 0.7)

Total equivalent units for conversion costs = 10,500 + 63,000 + 8,000 = 81,500 units

Direct material cost per unit = $168,000 / 73,000 = $2.30

Direct materials cost assigned to ending work-‐-in-‐-process inventory = $2.30 × 10,000 =

$23,000

Work in process, beginning inventory $24,000 +

$35,000 =

$

59,000.0

Costs added to beginning inventory = 15,000 ×

0.7 × $3.411

35,815.5

Total from beginning inventory

Started and completed

Direct materials = $2.30 × 63,000 = 144,986.

3

Conversion costs =

[$278,000 / (10,500 + 8,000 + 65,000)] × 63,000 = 214,895.

0

Total costs of units completed and transferred out = 454,694.

8

Diff: 3

Objective: 4

AACSB:

Application of

knowledge

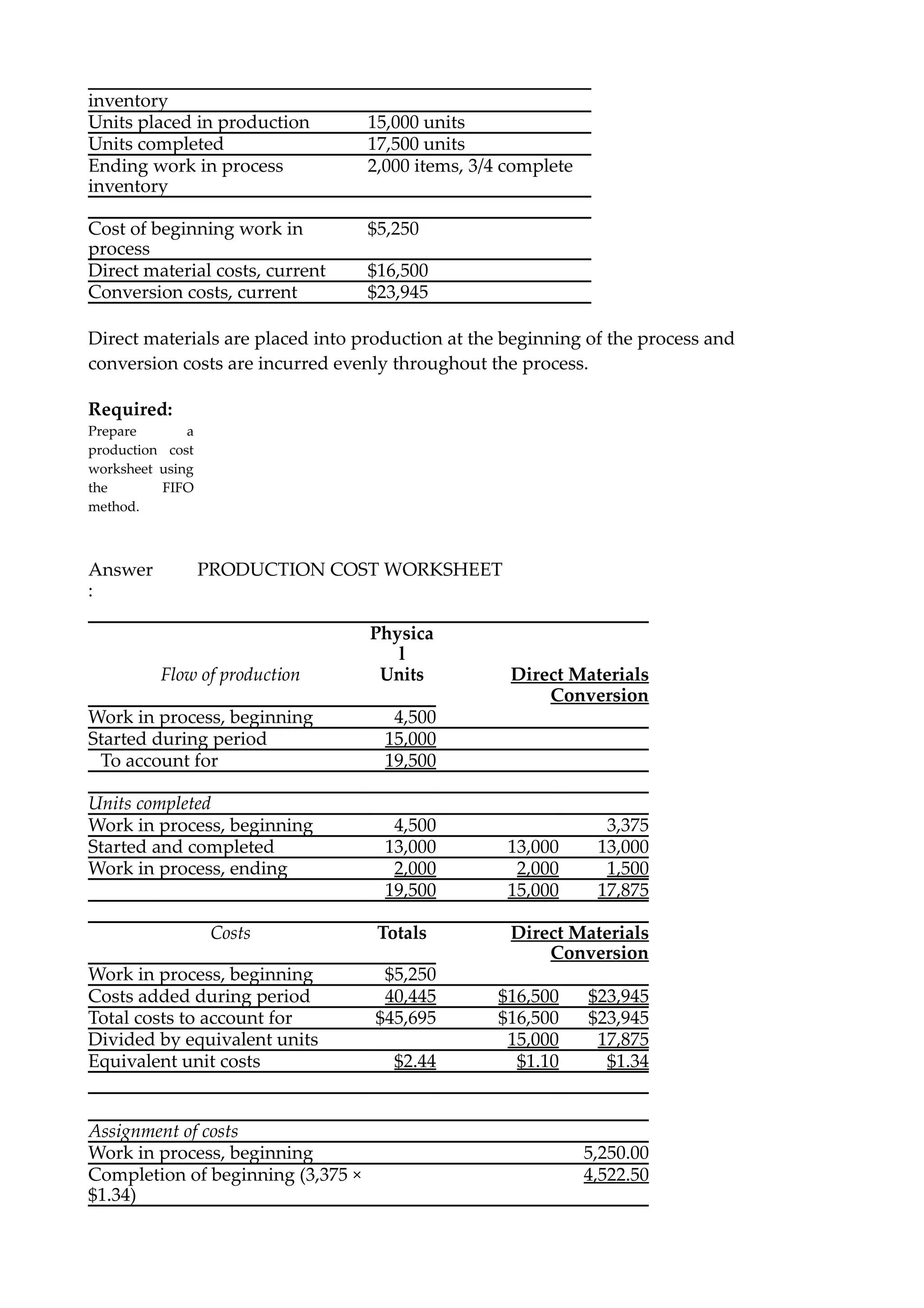

Answer the following questions using the information below:

Jane Industries manufactures plastic toys. During October, Jane'ʹs Fabrication Department

started work on 10,000 models. During the month, the company completed 11,000 models,

and transferred them to the Distribution Department. The company ended the month with

1,500 models in ending inventory. There were 2,500 models in beginning inventory. All

direct materials costs are added at the beginning of the production cycle and conversion

costs are added uniformly throughout the production process. The FIFO method of

process costing is being followed. Beginning work in process was 25% complete as to

conversion costs, while ending work in process was 50% complete as to conversion costs.

Beginning inventory:

Direct materials

costs

$19,200

Conversion costs $10,800

Manufacturing costs added during the accounting period:

Direct materials

costs

$70,000

Conversion costs $240,000

32) How many of the units that were started and completed

during October? A) 13,500](https://image.slidesharecdn.com/costch17quis-170105132502/75/Cost-ch17-quis-4-2048.jpg)