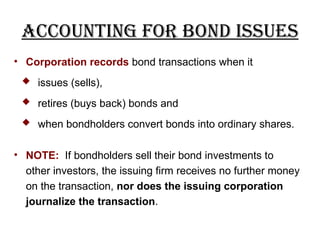

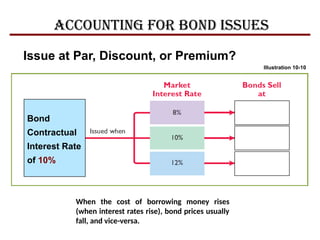

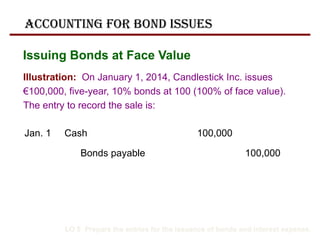

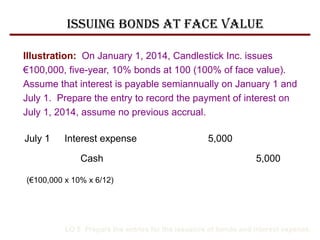

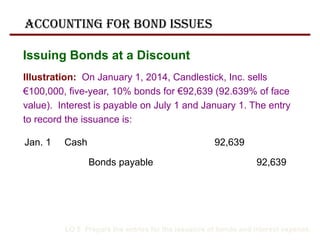

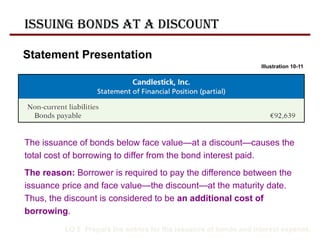

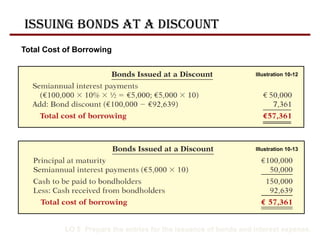

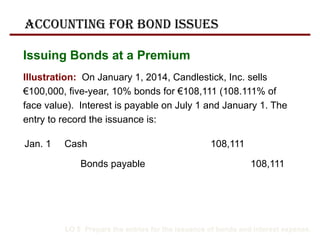

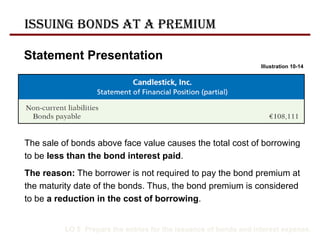

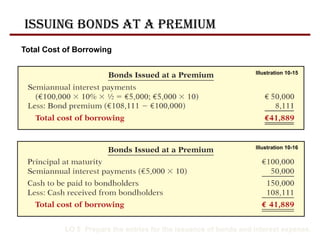

The document discusses project financing, categorizing funding sources into debt and equity. It outlines various types of debt financing, including borrowing, corporate bonds, trade debt, and customer deposits, detailing processes and accounting entries related to bond issuance and payments. Additionally, it covers equity financing through the sale of shares, highlighting the tax implications of each financing method.