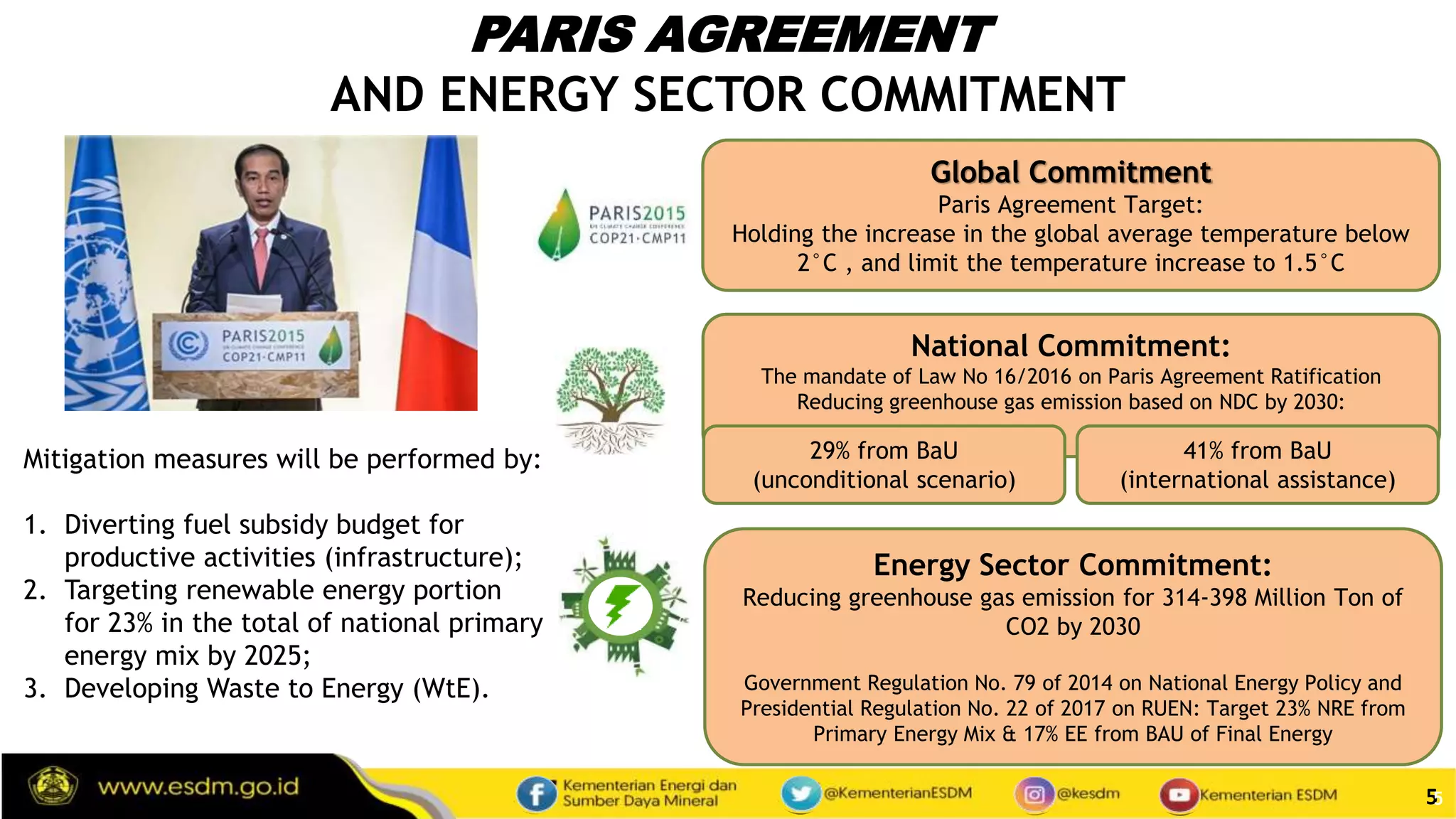

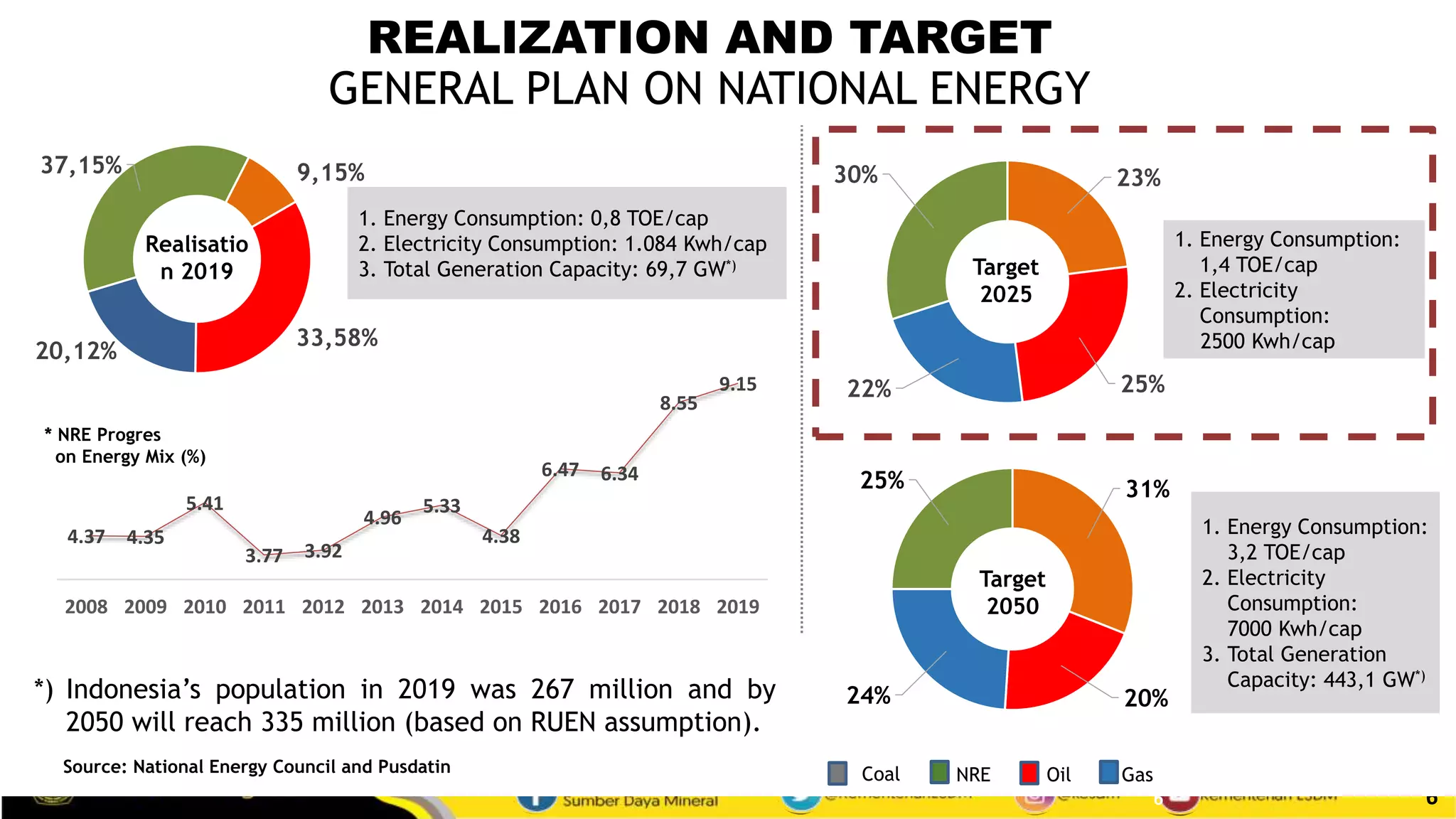

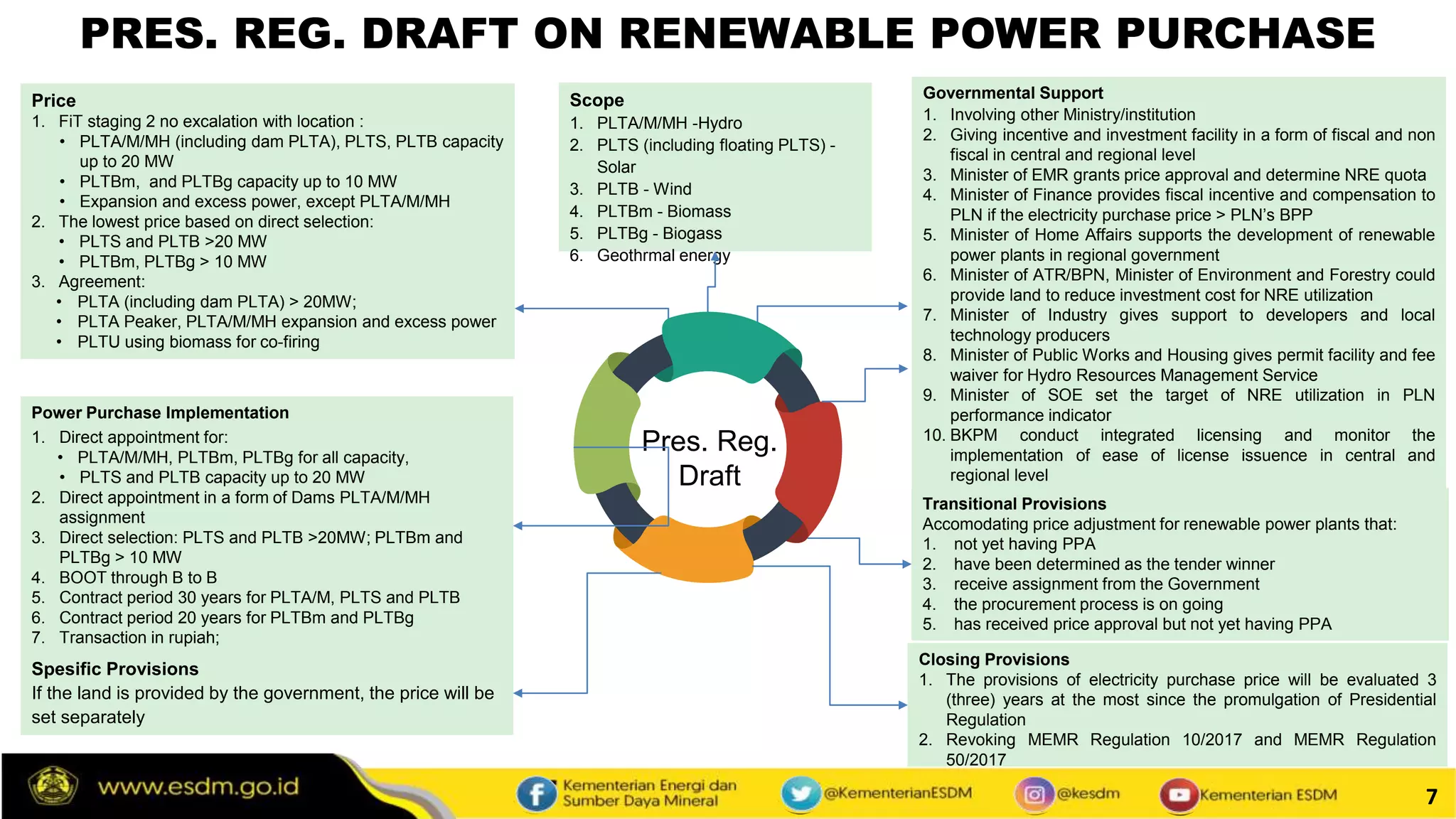

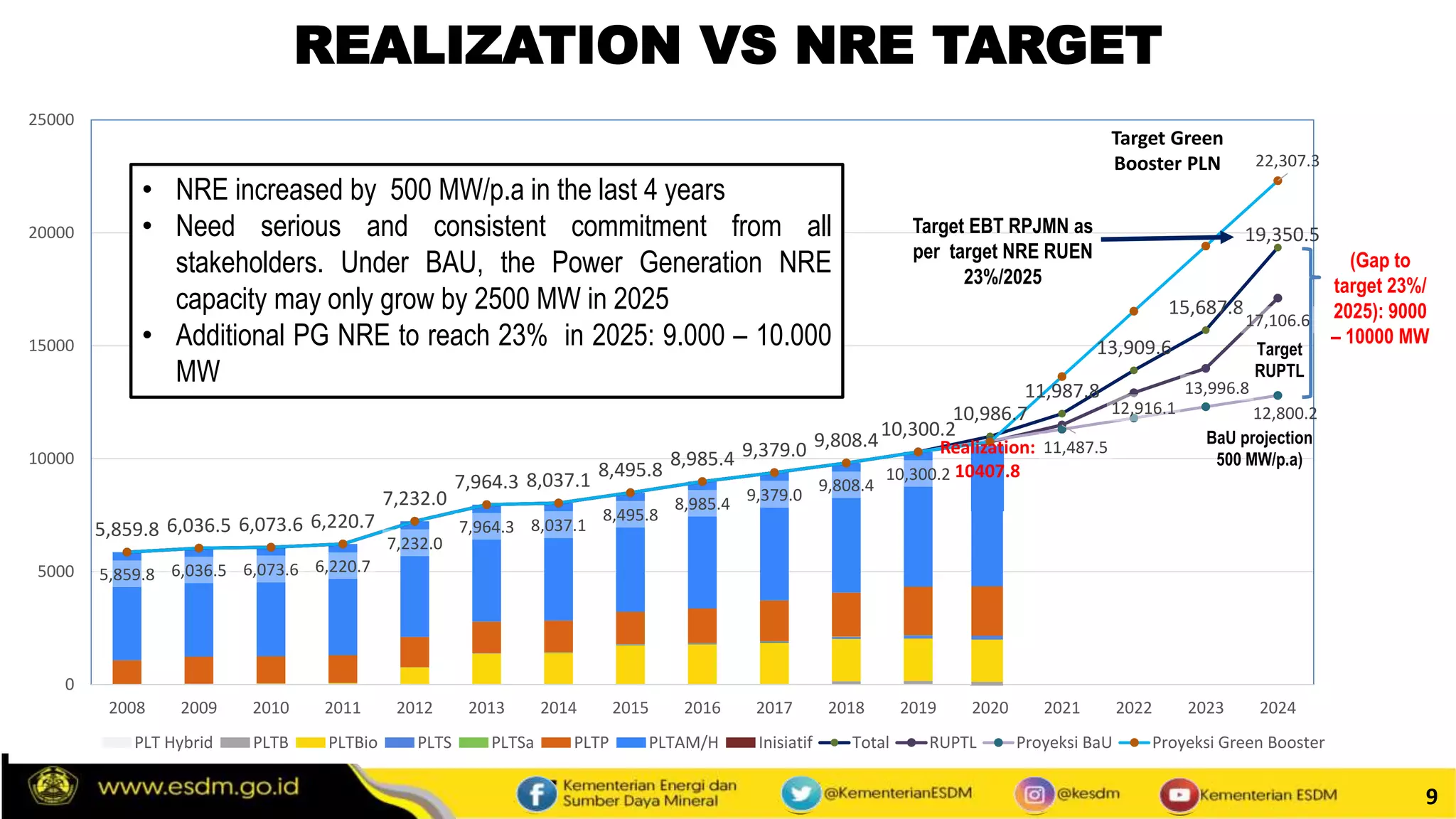

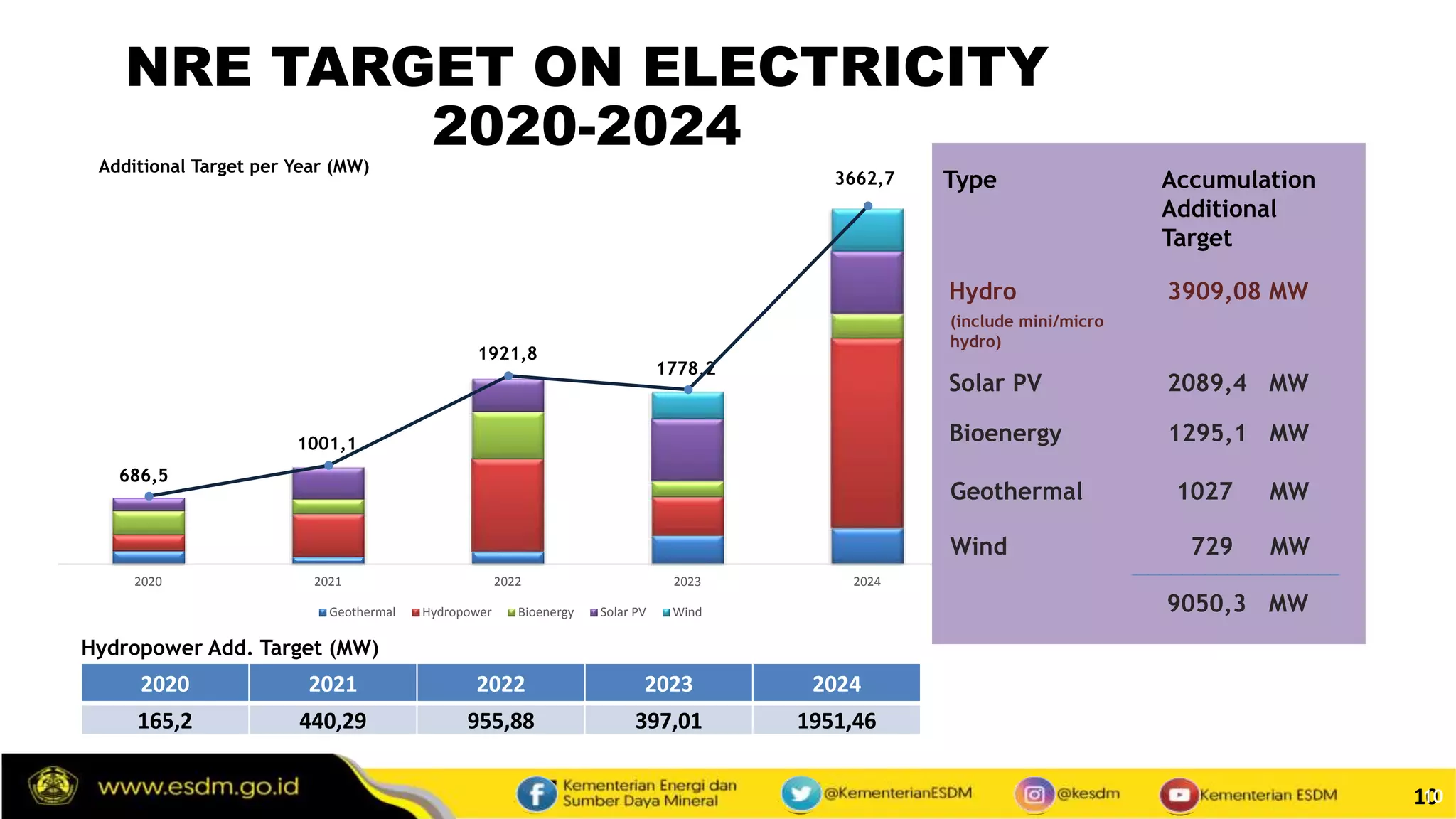

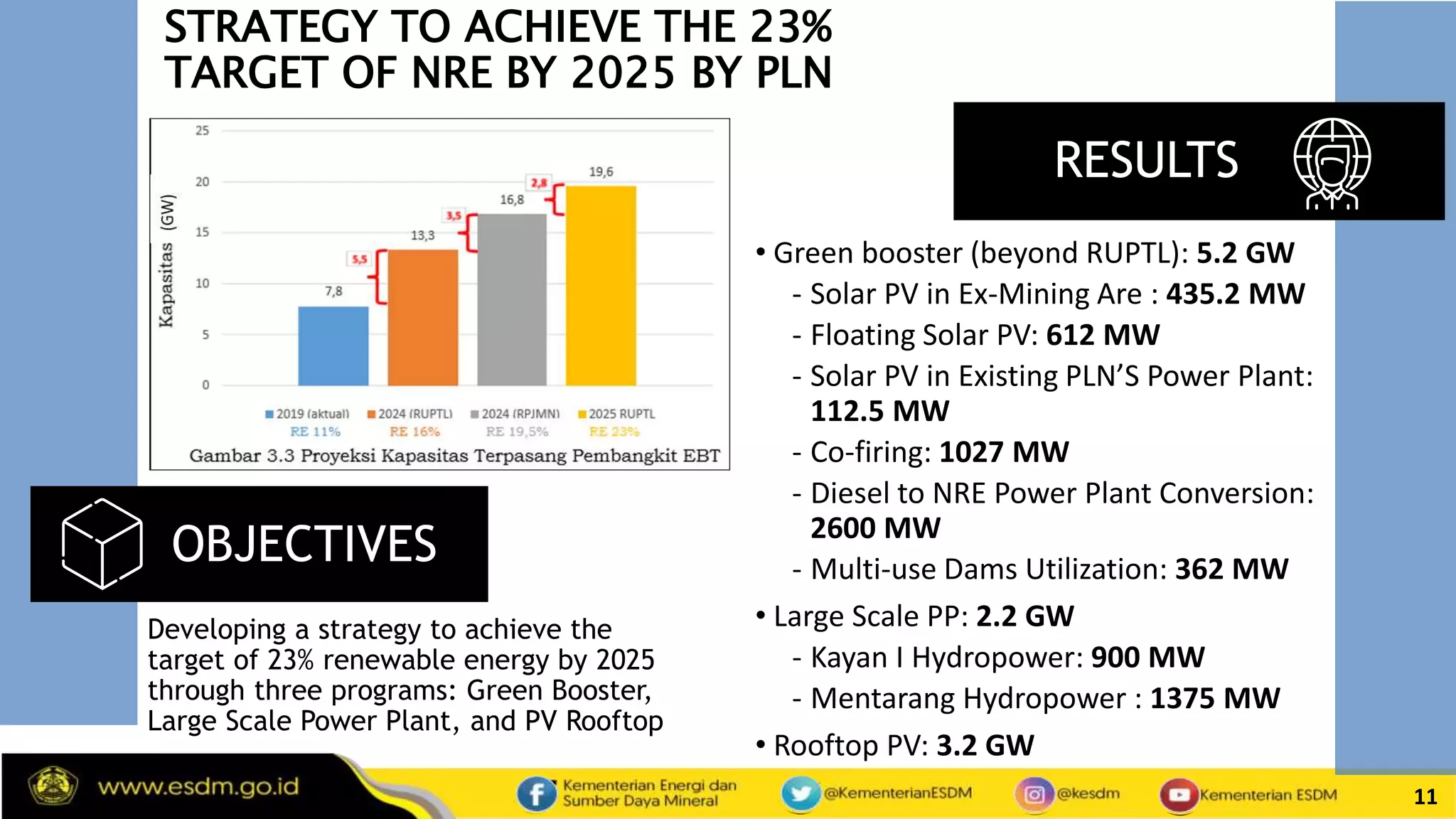

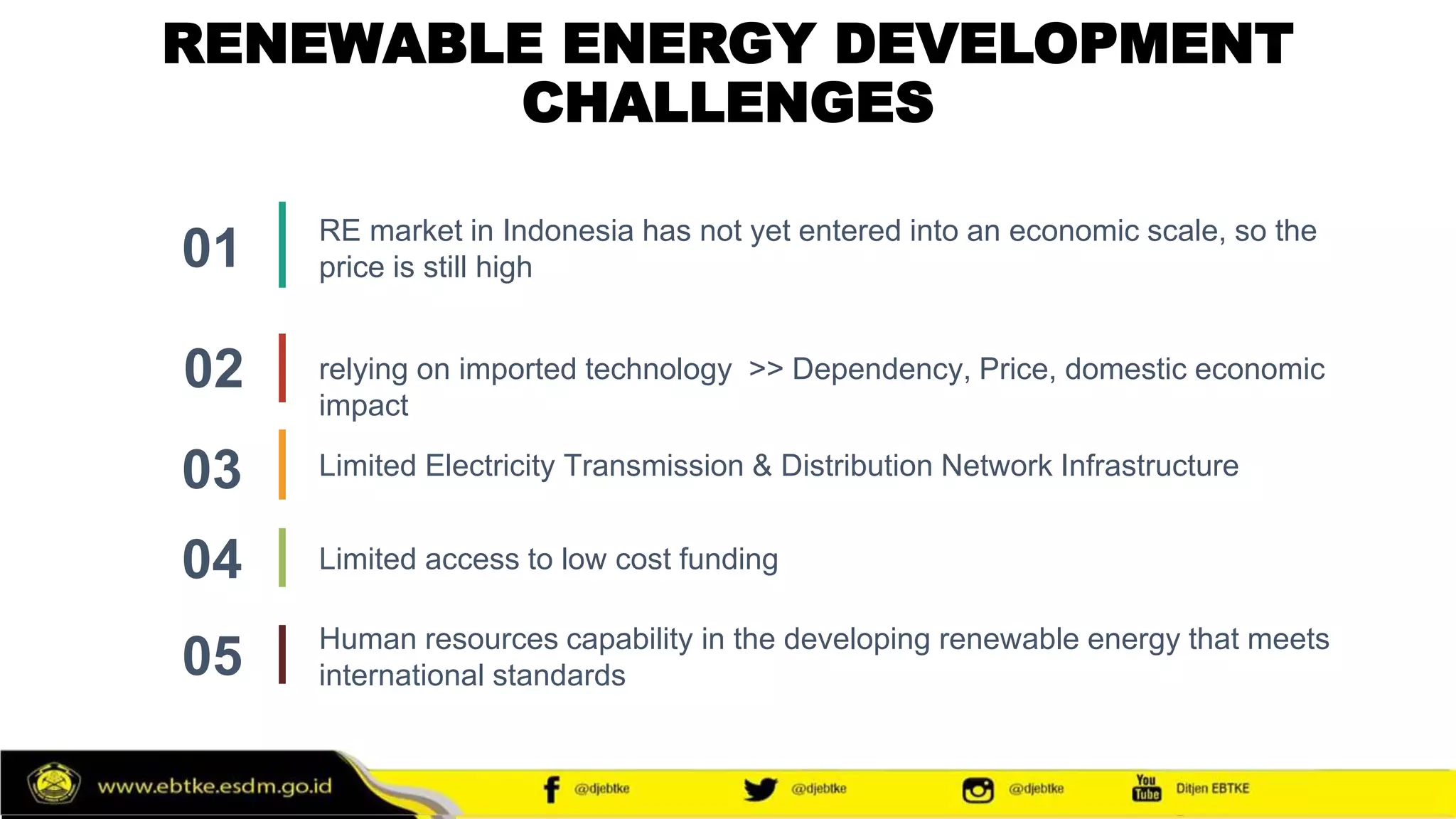

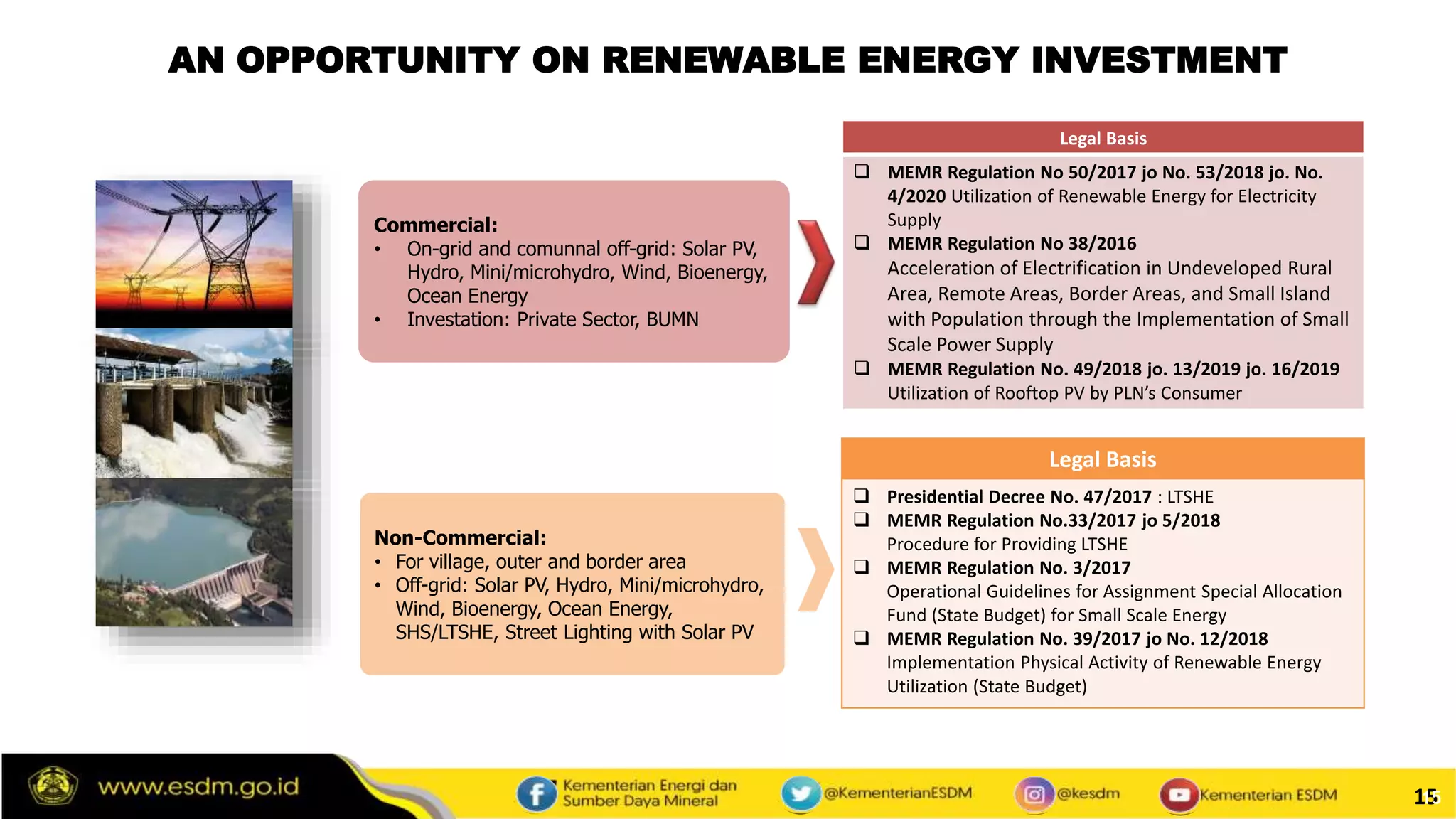

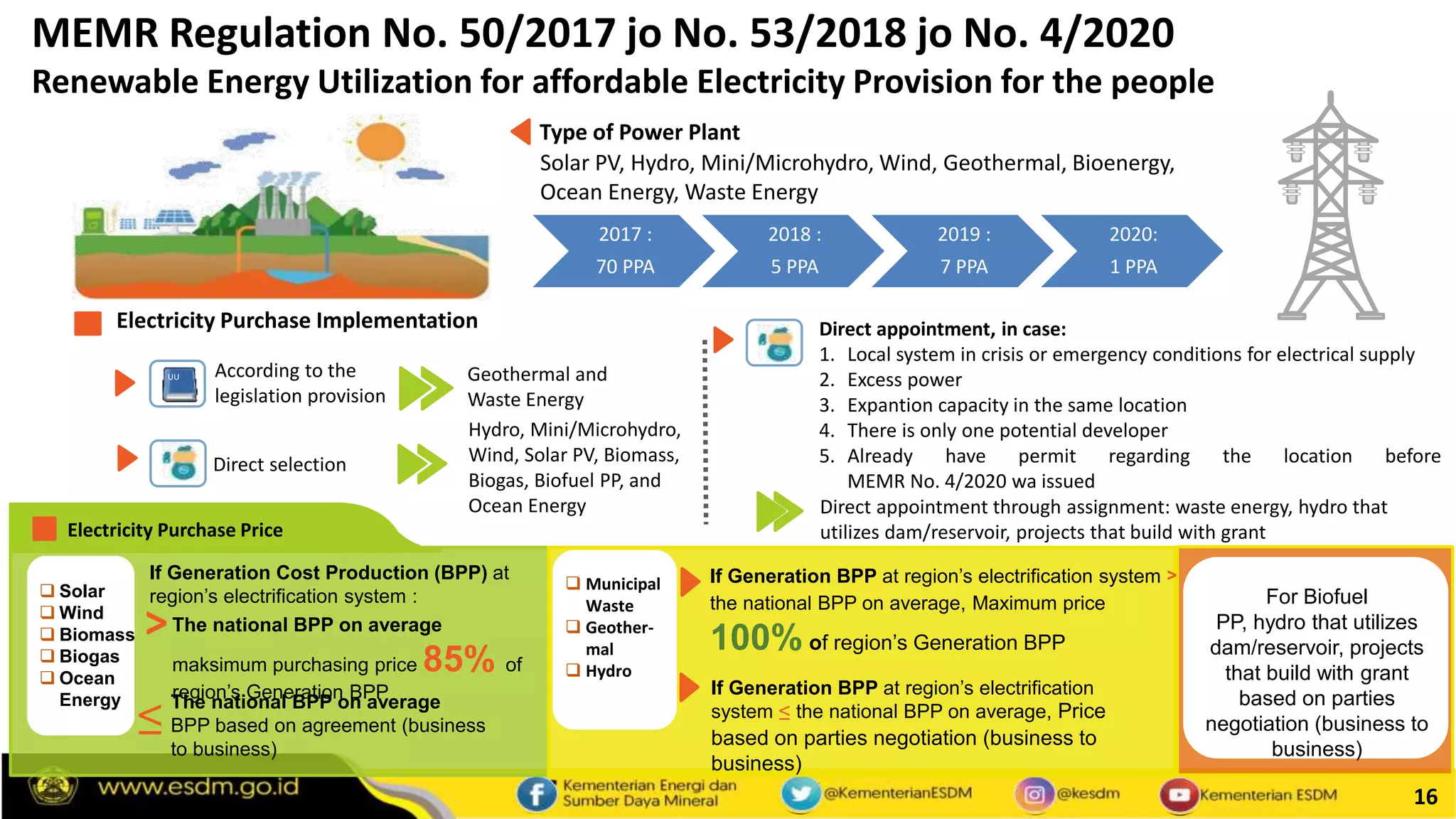

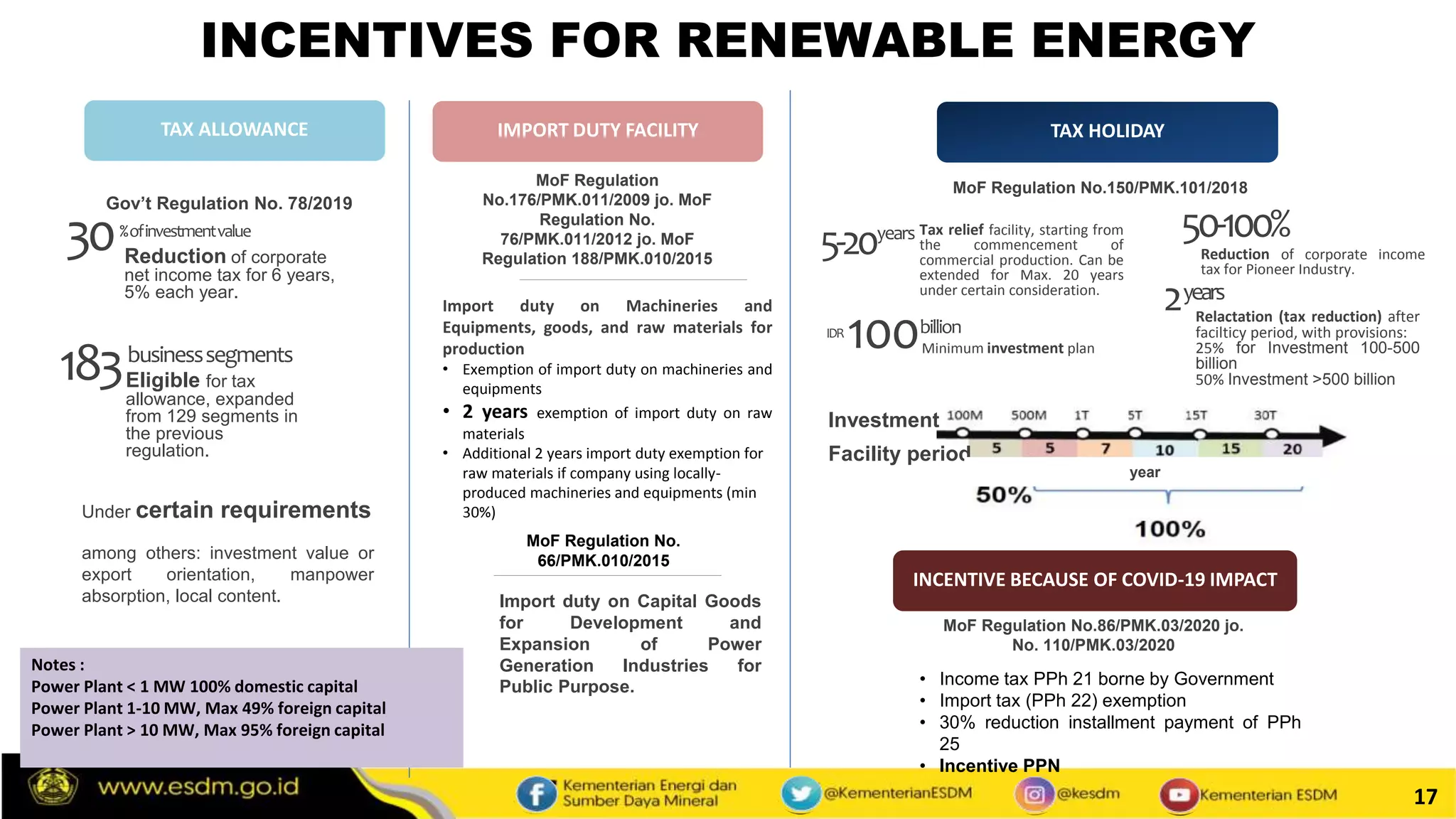

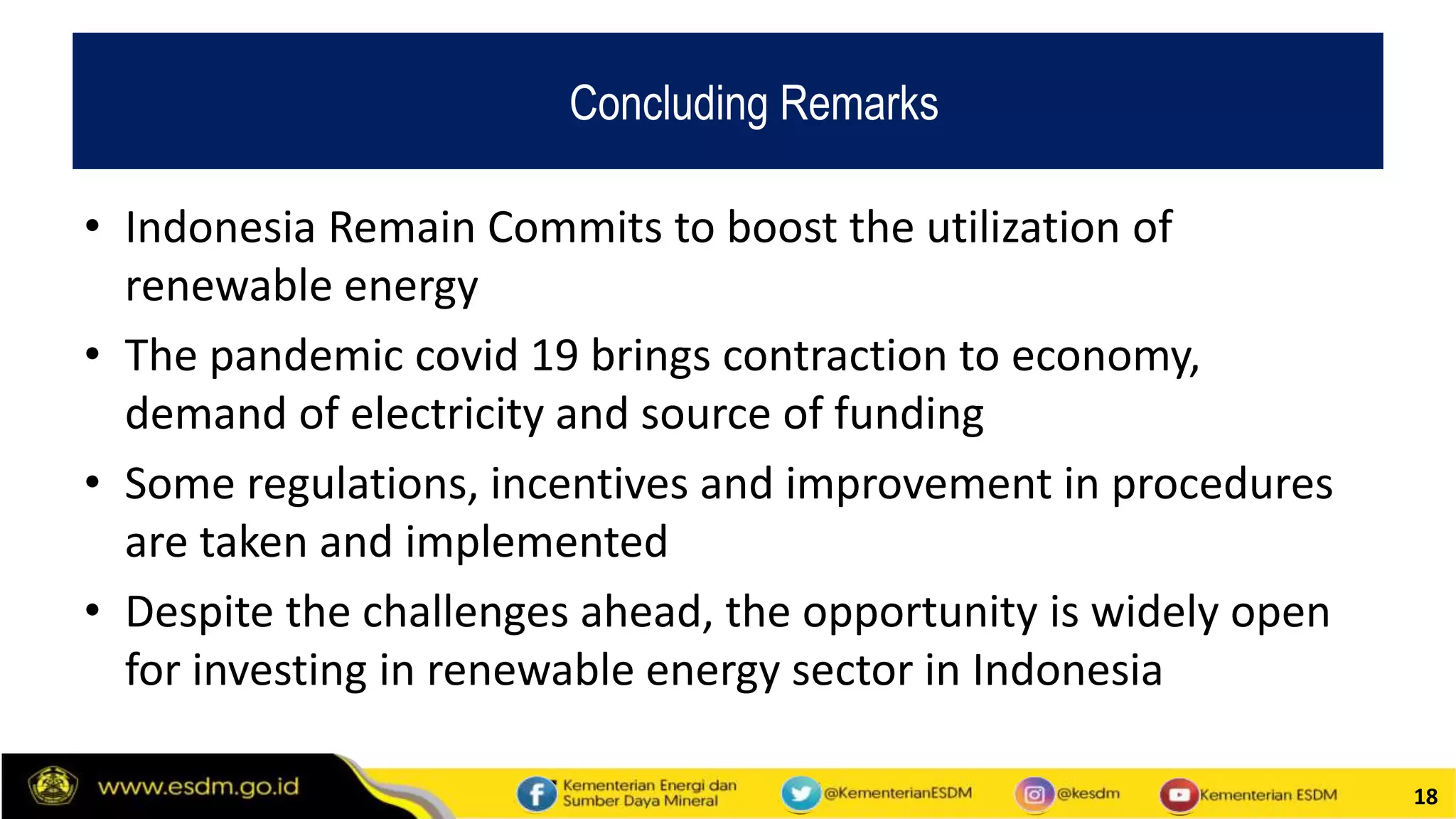

The document discusses Indonesia's commitment to accelerating renewable energy utilization, outlining policy updates, targets, and strategies to meet a 23% share of renewable energy in the national energy mix by 2025. It highlights challenges posed by the COVID-19 pandemic on electricity demand and investment while emphasizing new regulations and incentives to encourage renewable energy investment. The document also details specific energy generation targets and programs, such as the Green Booster initiative, to achieve these goals.