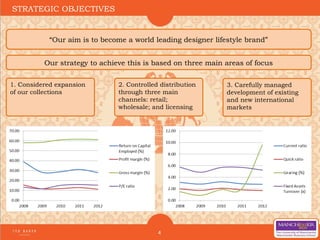

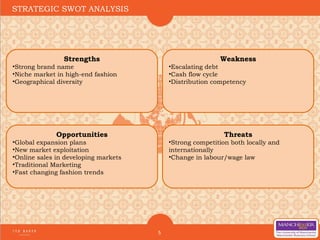

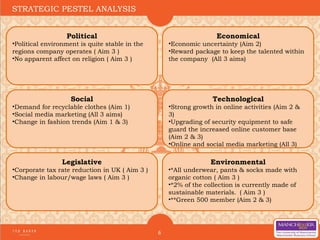

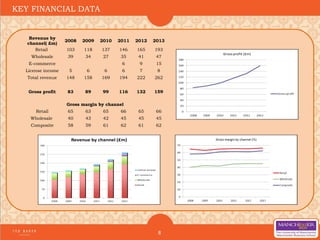

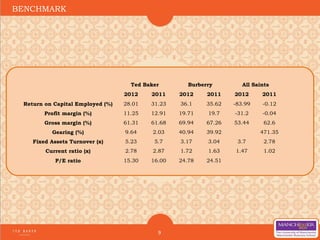

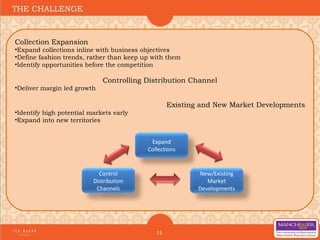

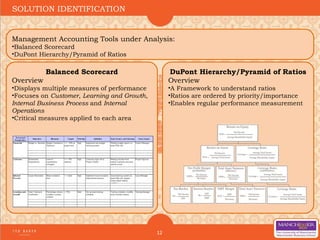

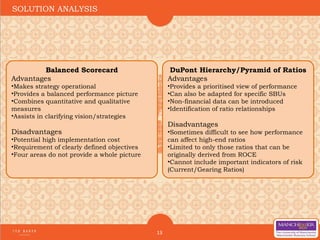

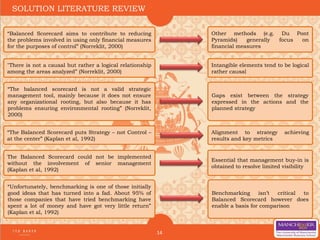

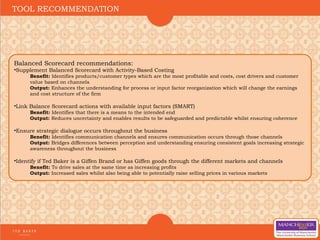

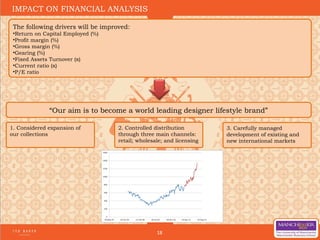

The document provides an overview of Ted Baker's strategic objectives, which are to expand their collections, control distribution through retail, wholesale and licensing channels, and carefully manage existing and new international markets. It analyzes Ted Baker's strategy using PESTEL, SWOT and financial analyses. Two management accounting tools - the balanced scorecard and DuPont analysis - are identified as potential solutions. The balanced scorecard is recommended to supplement financial measures and ensure strategic alignment. Metrics are proposed to measure objectives across customers, learning & growth, internal processes and finance. The recommendation aims to improve Ted Baker's return on capital employed, profit margin, and other financial ratios to achieve their strategic goals.