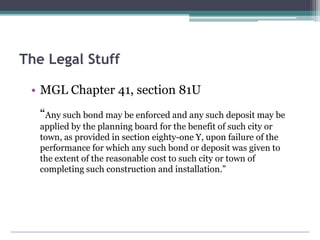

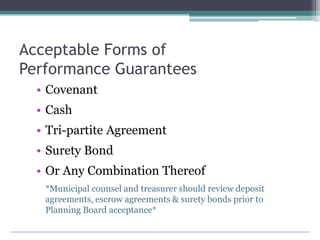

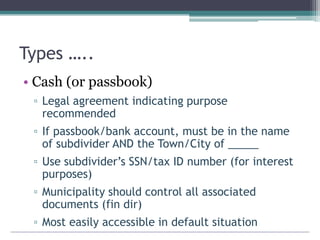

The document discusses performance guarantees for developers in municipal planning, outlining various types such as cash, surety bonds, and tri-partite agreements. It also addresses challenges municipalities face when dealing with defaults, providing case studies and potential strategies to mitigate risks, including ensuring proper management and maintenance of roads and infrastructure until projects are completed. Key recommendations include requiring cash deposits alongside surety bonds and maintaining contingency factors in performance guarantees to account for unexpected costs.