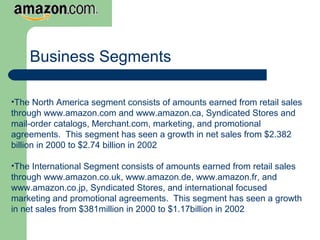

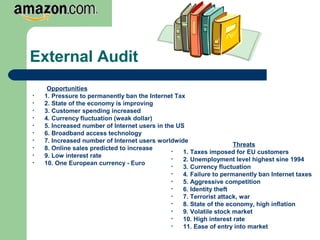

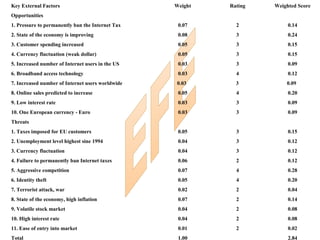

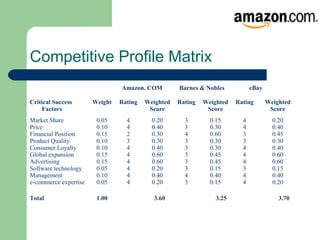

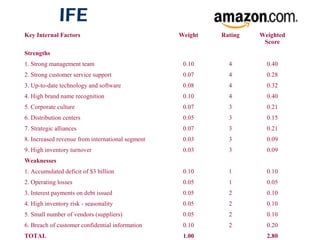

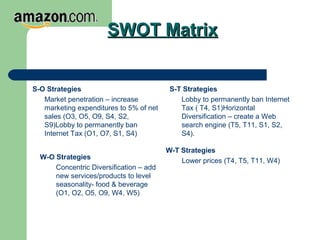

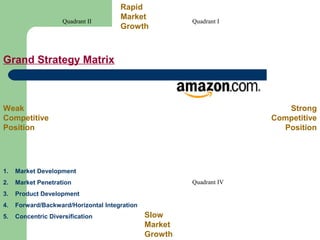

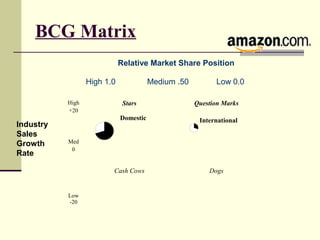

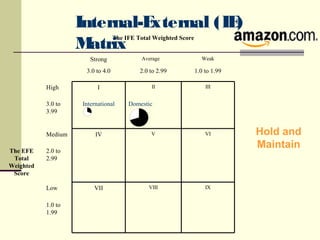

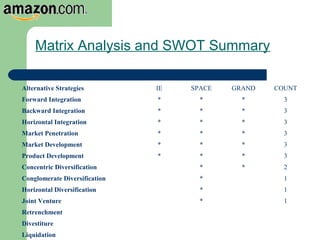

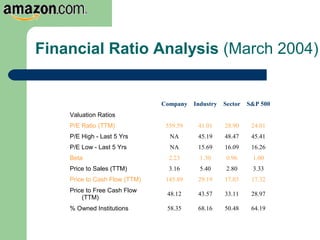

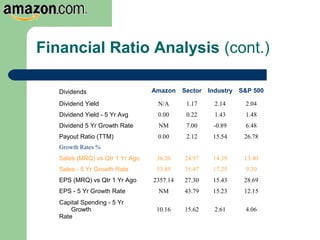

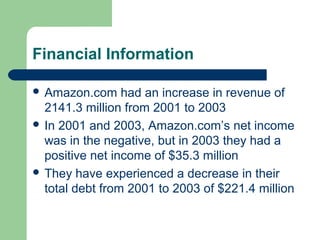

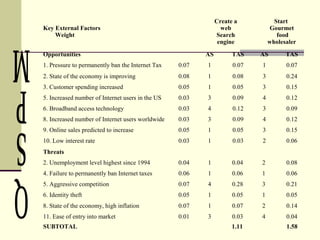

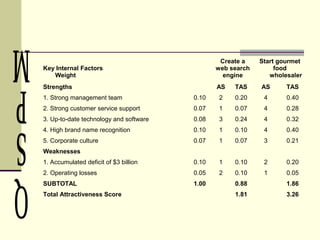

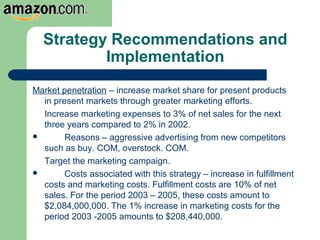

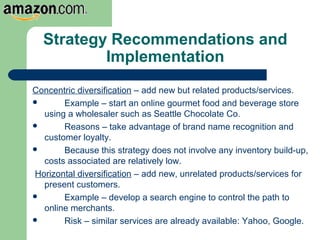

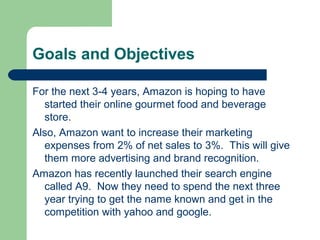

This document provides an outline and overview of Amazon.com, Inc. It begins with a brief history of the company from its founding in 1994. It then discusses Amazon's current business segments and operations. The document performs both an external and internal analysis of Amazon, identifying opportunities, threats, strengths and weaknesses. It also includes industry financial ratios and proposes various strategic recommendations and matrices to analyze Amazon's position and potential strategies.