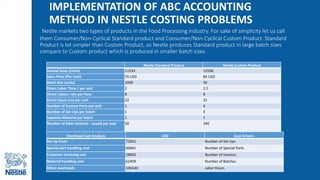

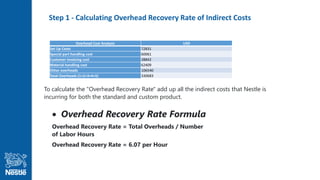

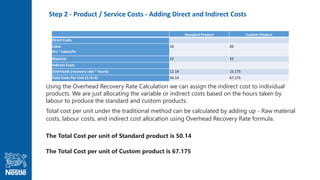

- Nestle follows traditional costing that assigns overheads directly to products

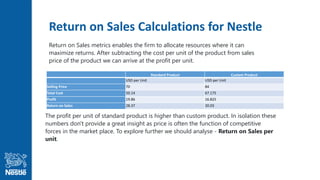

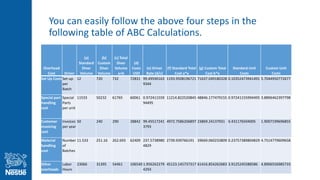

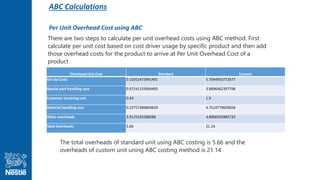

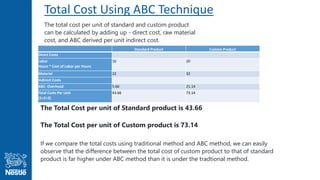

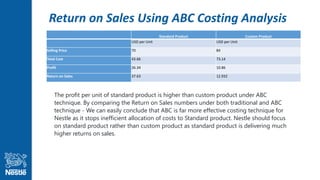

- Activity-based costing (ABC) was used to calculate the cost of Nestle's UC Range series 4 end cover product and found it was overcost under the traditional method

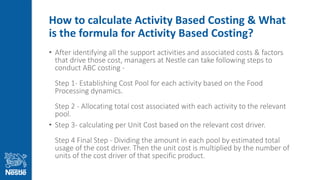

- ABC understands true profitability and helps identify areas to reduce costs or increase efficiencies, so Nestle should adopt ABC