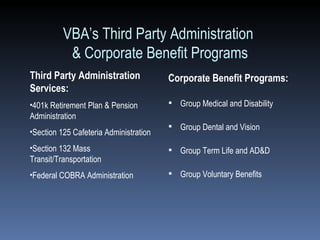

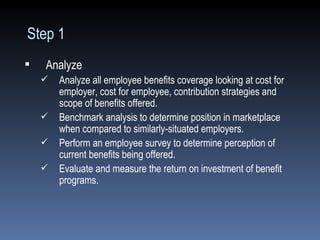

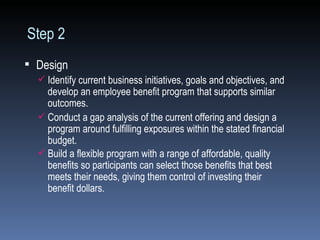

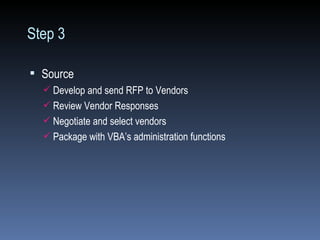

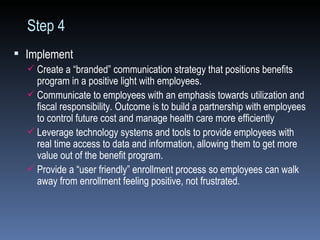

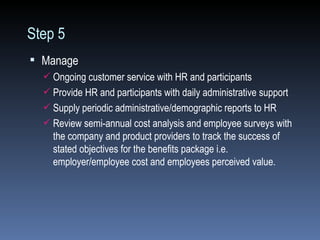

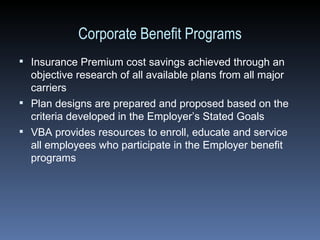

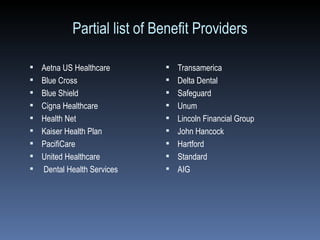

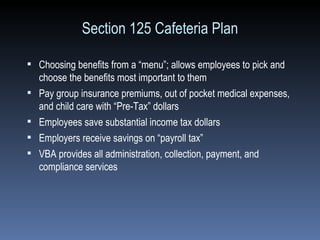

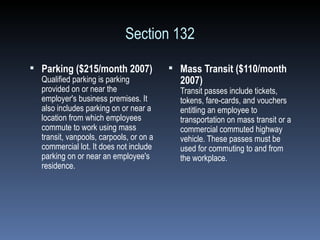

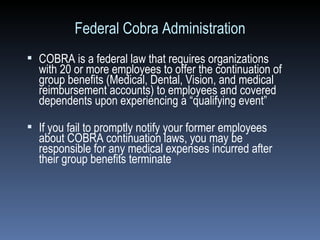

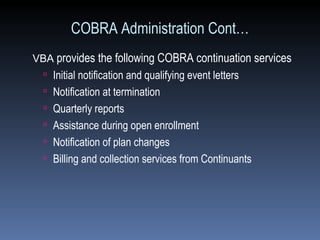

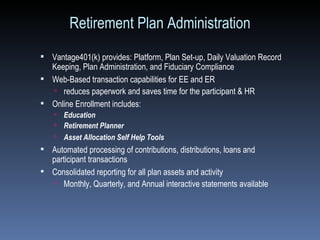

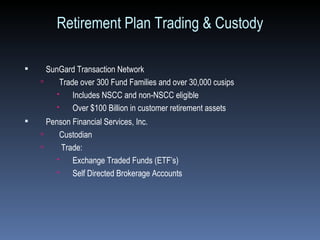

Vantage Benefits Administrators (VBA) is an independent benefits administration and insurance agency that has over 35 years of experience administering corporate benefit programs. VBA analyzes clients' existing benefits, designs customized benefit plans within budgets, sources and implements benefit providers, and manages ongoing administration. VBA's services include group medical, dental, life, and disability insurance; cafeteria plans; commuter benefits; retirement plans; and COBRA administration. VBA works as a partner with clients and their advisers to control costs and maximize value for employees.