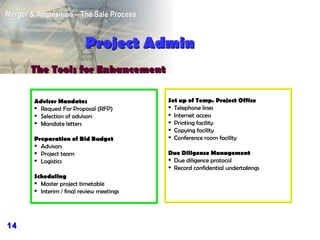

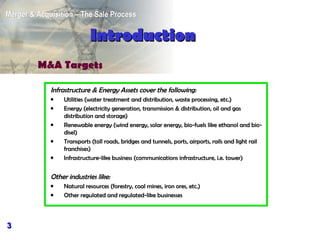

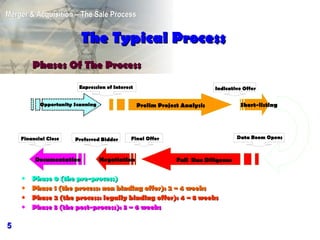

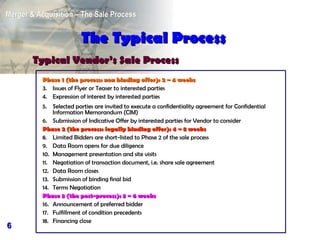

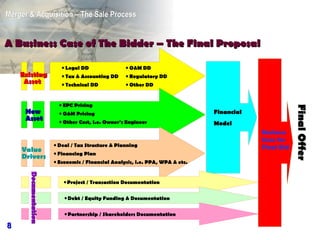

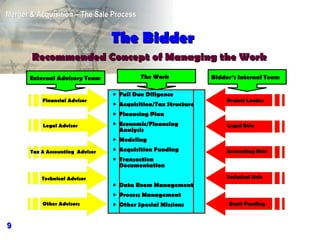

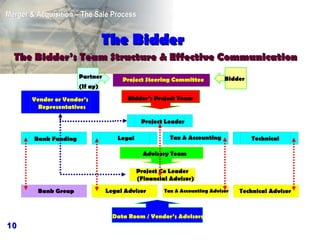

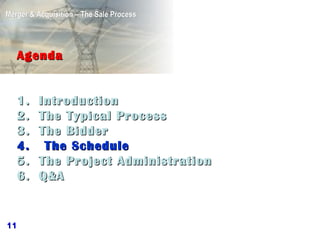

This document discusses the typical process for selling infrastructure development projects, including the sale process, typical bidders, project schedules, and project administration. The sale process generally involves multiple phases from initial documentation through final binding offers and financial close. Bidders form internal teams and engage external advisors to conduct thorough legal, financial, and technical due diligence. Project schedules outline key interim and final due diligence review meetings and milestones. Effective project administration includes selecting advisors, setting up logistics, and managing the due diligence process.

![The Schedule 1. Interim due diligence review ( within the week of [10-14] days after access to data room ) 1.1 Legal, tax, accounting and technical due diligence review meeting 1.2 Preliminary acquisition structure review meeting 1.3 Share purchase agreement preliminary comments review meeting 1.4 Preliminary financing plan review meeting (pre and post acquisition financing plan) 1.5 Assumption book and preliminary financing model review meeting 1.6 Other essential meetings as required 2. Final due diligence review ( Within the [week of 1 week] before the final offer due date ) 2.1 Legal, tax, accounting and technical due diligence review meeting 2.2 Final acquisition structure review meeting 2.3 Share purchase agreement bid version review meeting 2.4 Financing plan review meeting 2.5 Financial model review meeting 2.6 Final board presentation page turn 2.7 Other essential meetings as required Proposed Key Milestone Activities 3. Bidder’s board approval: [4-5] days before the final bid due date 4. Execution of MOU before execution of final offer bid letter (if a consortium) 5. Execution of final offer bid letter: at least [1] day before the final offer due date](https://image.slidesharecdn.com/TheAcquisitionTheSaleProcessModifiedNovember2008-122933586263-phpapp02/85/A-Recommended-Process-for-M-A-12-320.jpg)