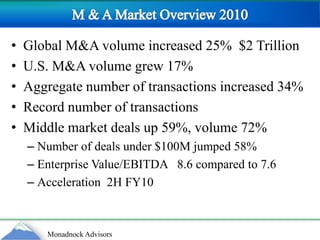

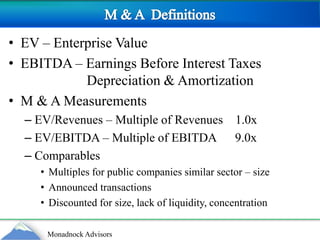

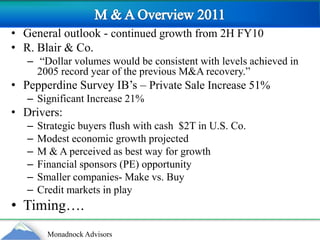

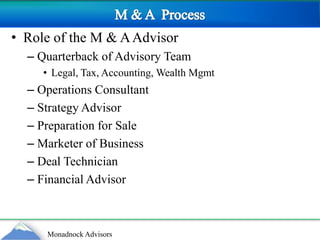

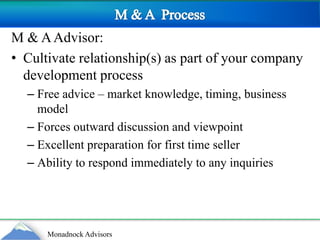

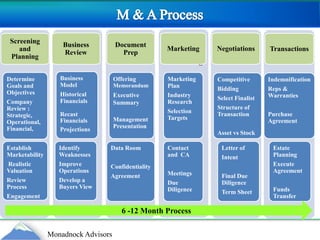

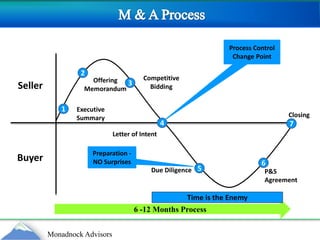

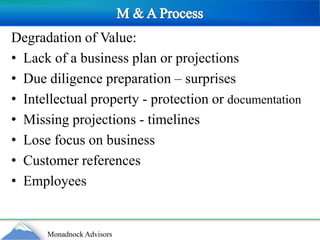

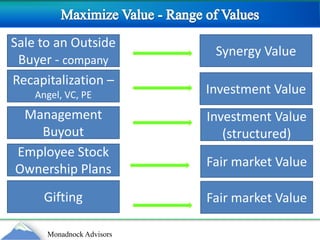

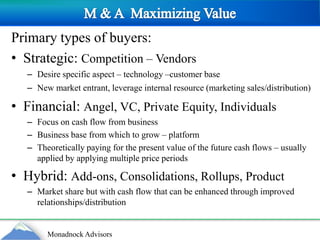

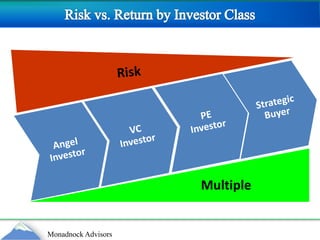

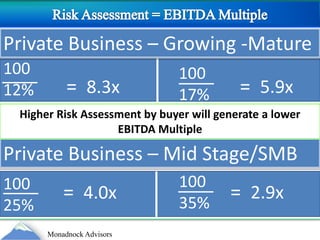

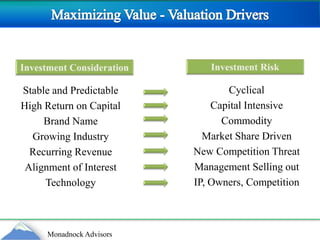

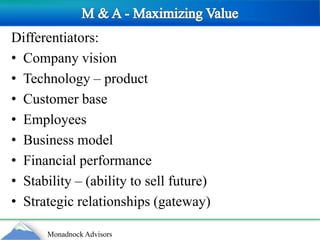

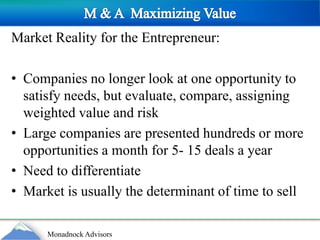

The document provides an overview of mergers and acquisitions (M&A) market trends and the M&A process. It notes that global M&A volume increased 25% to $2 trillion in 2010, with US M&A volume growing 17% and middle market deals up 59%. The top drivers of M&A activity in 2010 and 2011 included equity market gains, favorable credit markets, and cash reserves driving corporate and financial sponsorship deals. The document outlines the typical M&A process, from initial preparation and marketing to negotiations, due diligence, and closing. It emphasizes maximizing deal value through differentiation, stable financial performance, strategic relationships, and market realities for entrepreneurs.