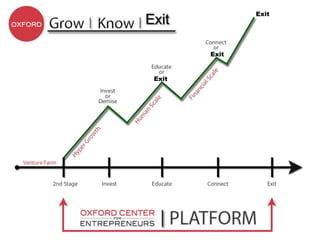

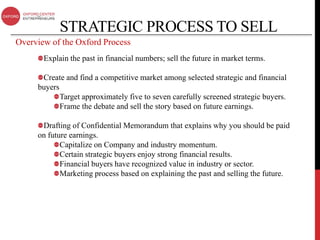

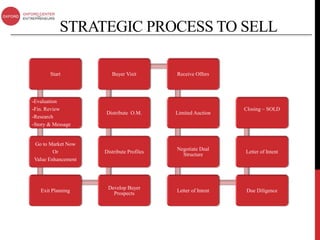

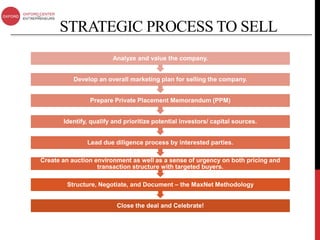

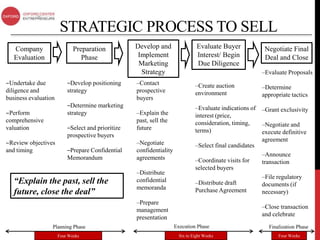

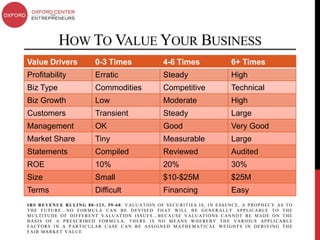

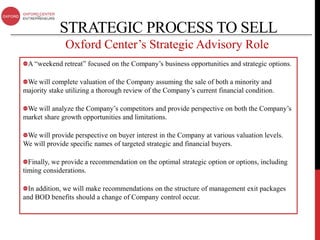

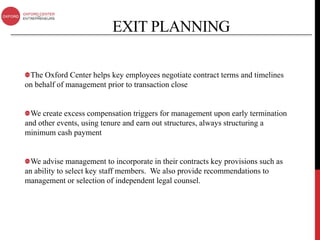

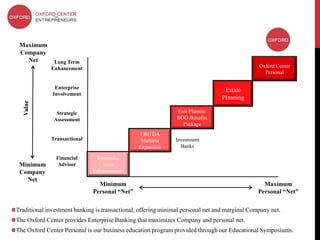

The document outlines a strategic process for selling a company, beginning with evaluating the company and developing a marketing plan, identifying potential buyers, conducting due diligence, and negotiating a final deal to close the transaction while maximizing value for the company and its owners. It also discusses how to value different types of businesses based on factors like profitability, growth, customers, and management, and the role of an advisory firm in assisting with exit planning.