This document provides an agenda and summary of recent and upcoming changes to International Financial Reporting Standards (IFRS). Key points include:

- Revisions to IAS 23 on capitalization of borrowing costs and IAS 1 on financial statement presentation requirements.

- A new standard, IFRS 3 on business combinations, will be effective in July 2009.

- New and revised interpretations include IFRIC 13 on customer loyalty programs and IFRIC 14 on defined benefit assets.

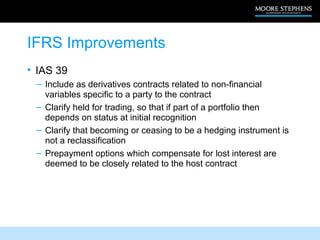

- Proposed improvements to various IFRS standards to clarify guidance and make minor amendments.

- Upcoming changes include a new standard for insurance contracts and expanded disclosure requirements in IFRS 7 on financial instruments.