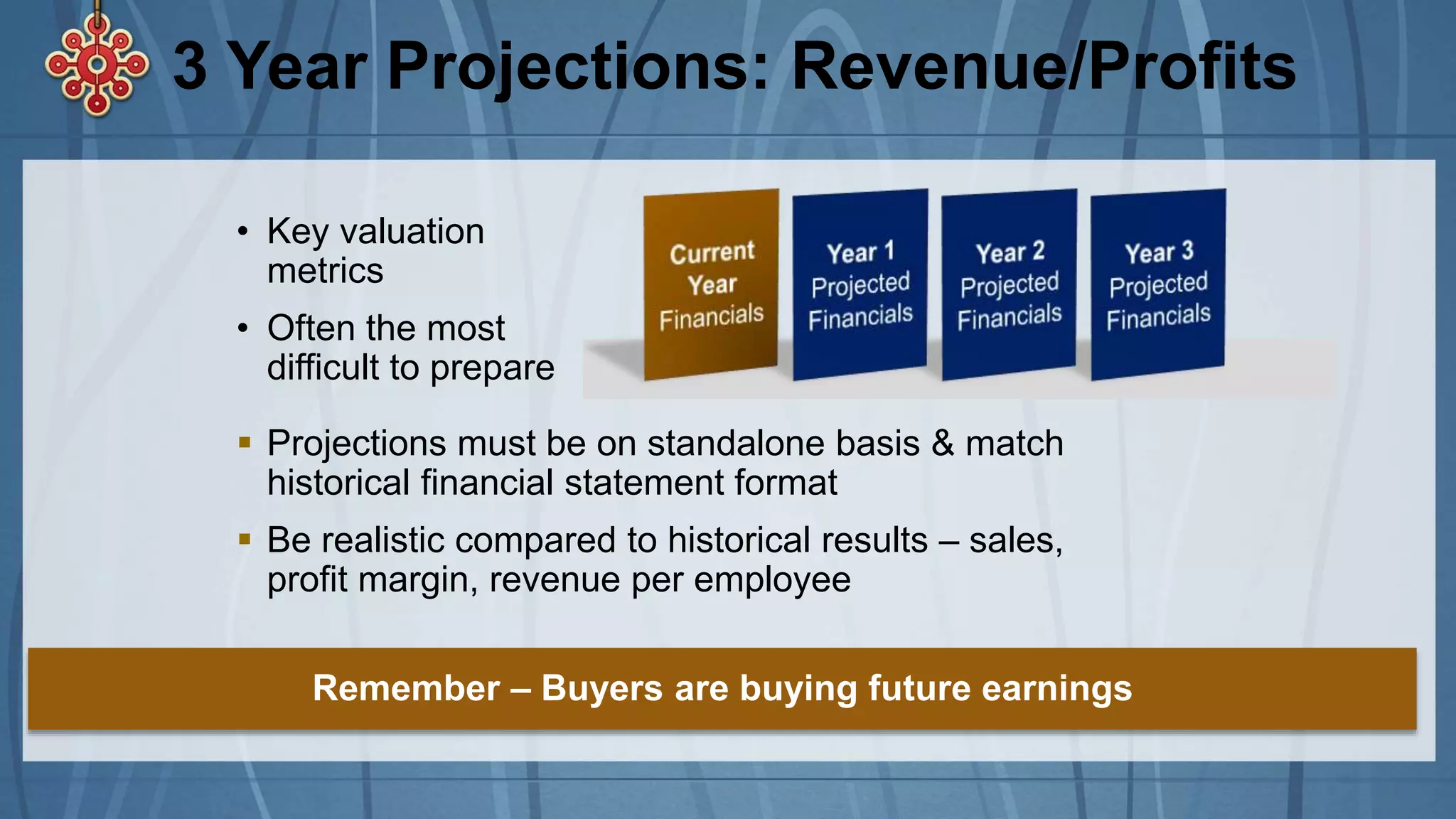

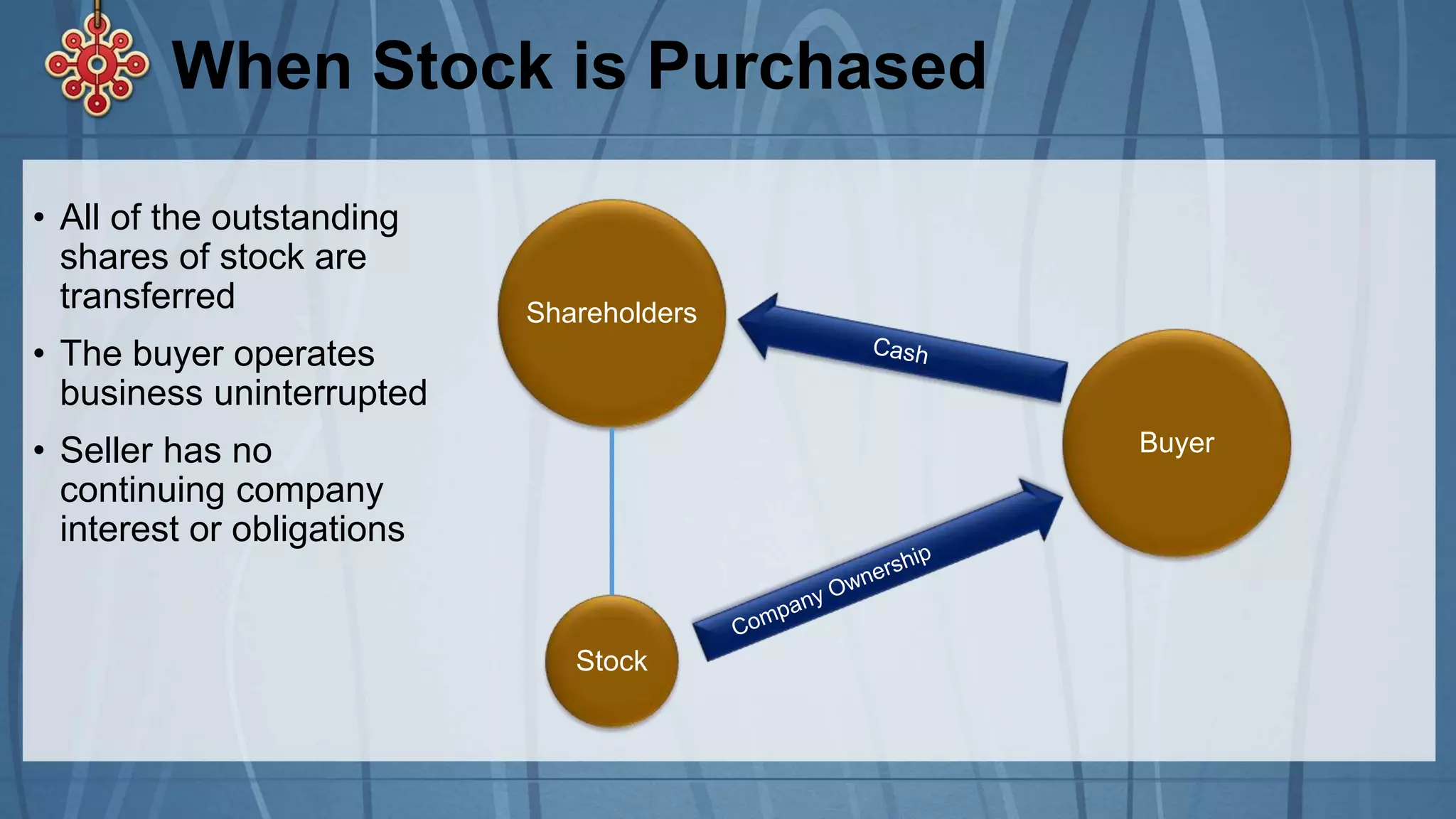

Daniel Bernstein, Vice President of Corum Group, outlines the importance of preparation in the M&A process, emphasizing due diligence, record keeping, and understanding the buyer’s checklist. He details various aspects that companies need to prepare, such as financial data, corporate structure, and employee relations, to optimize outcomes and valuations during a sale. The document provides insights into both asset and stock transactions in M&A, highlighting necessary documentation and strategic planning for successful negotiations.