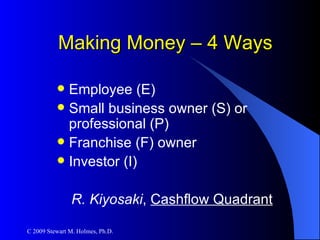

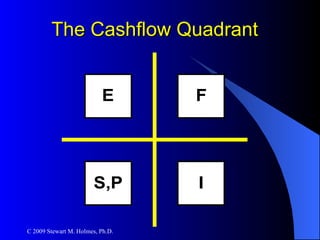

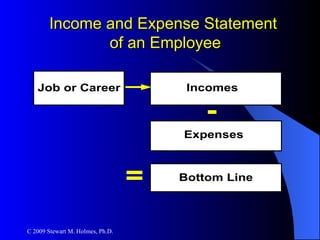

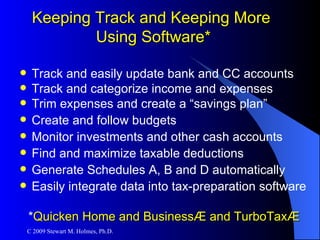

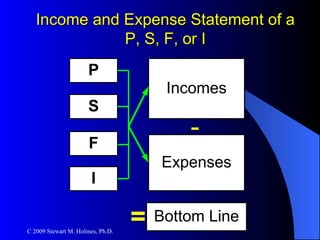

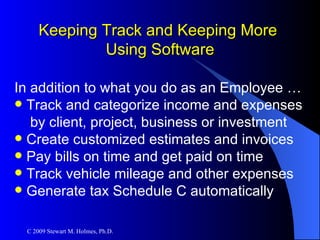

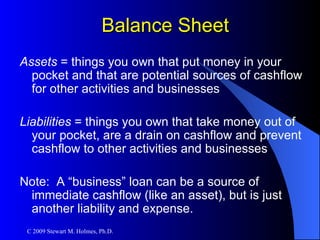

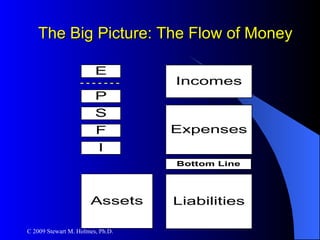

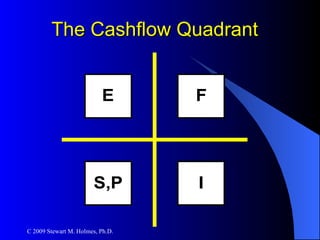

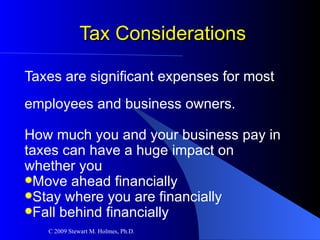

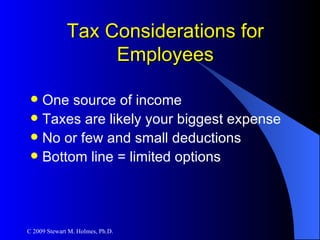

The document discusses ways to move ahead financially by making more money and keeping more of what you earn. It outlines four main ways to make money: as an employee, small business owner, franchise owner, or investor. It also discusses the importance of tracking income and expenses, generating tax documents, and considering taxes which can be a large expense. The document recommends assembling a team of financial, legal, insurance and tax professionals to help maximize income, deductions, and reducing taxes owed to best ensure moving ahead financially.