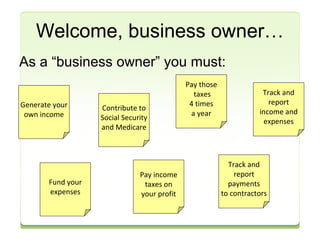

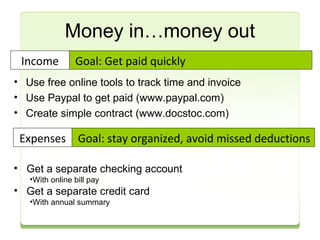

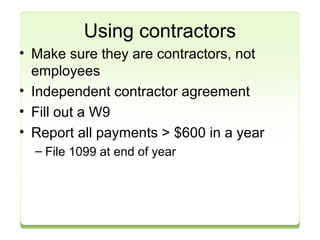

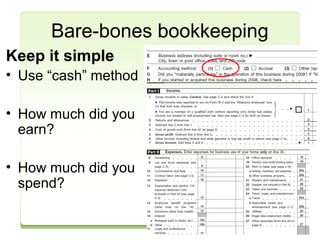

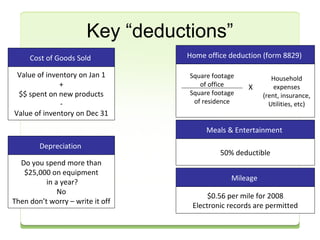

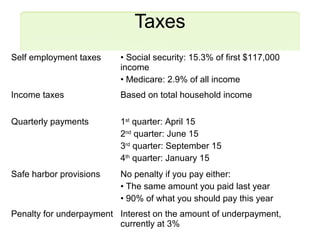

This document provides an overview of managing finances, bookkeeping basics, and tax tips for small business owners. It discusses the responsibilities of business owners, including generating income, funding expenses, tracking income and expenses, and paying taxes. It offers tips for getting paid, paying others, using contractors, keeping simple bookkeeping records, deducting expenses, paying quarterly estimated taxes, and penalties for underpayment. The document aims to help small business owners stay organized with their finances and taxes.