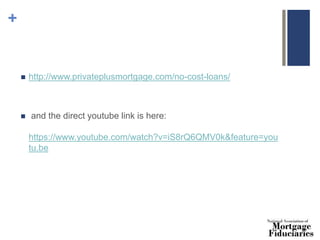

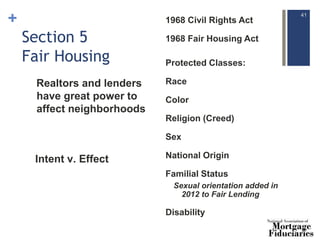

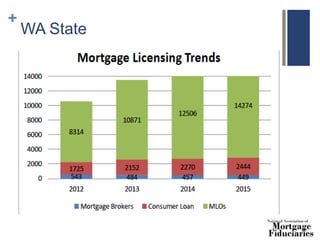

This document provides an agenda and materials for an 8 hour continuing education course for loan originators. The course covers federal lending laws including TILA, RESPA, HMDA, appraisal rules, and the TRID rule. It also discusses non-traditional lending, ethics, consumer protection, fair lending, and mortgage fraud. Presentation materials include case studies, questions for discussion, and a quiz. A separate 1 hour section focuses on Washington state-specific requirements and includes a DFI rulemaking update, security best practices, and a case study on a DFI enforcement action.