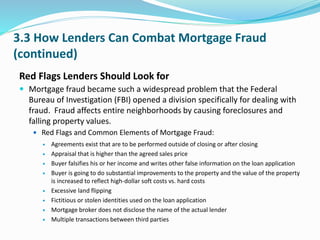

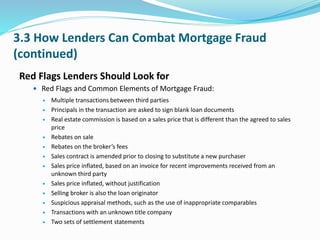

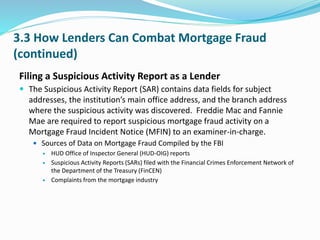

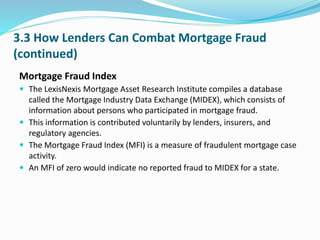

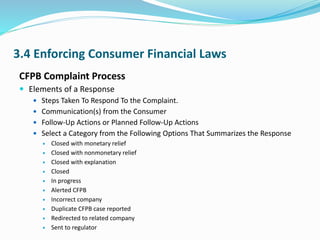

This document discusses ethics, fair lending practices, and mortgage fraud. It covers ethical lending standards, predatory lending practices like kickbacks, and how lenders can combat mortgage fraud by looking for red flags and filing suspicious activity reports. It also discusses the CFPB complaint process for consumers and the CFPB's enforcement actions against financial institutions for violations of consumer protection laws.

![3.4 Enforcing Consumer Financial Laws (continued)

CFPB Complaint Process

CFBP Office of Enforcement

The CFPB’s Office of Enforcement is authorized to employ investigatory tools

provided in Title X, Subtitle E of the Dodd-Frank Act, such as the authority to

compel documents and testimony, and to seek injunctive and monetary

remedies through civil actions or administrative proceedings.

Office of Administrative Adjudication

CFPB Civil Penalty Fund

The Civil Penalty Fund is a separate account maintained at a Federal reserve bank to collect

civil penalties obtained by the CFPB in judicial or administrative actions under the Federal

consumer financial laws. [12 CFR §§10975.100–.108].](https://image.slidesharecdn.com/module3-171103174624/85/Module-3-12-320.jpg)