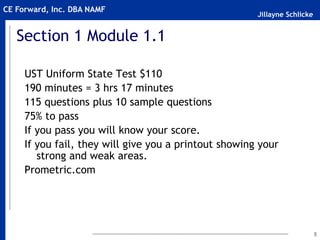

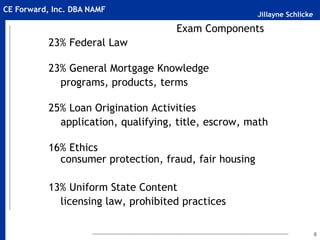

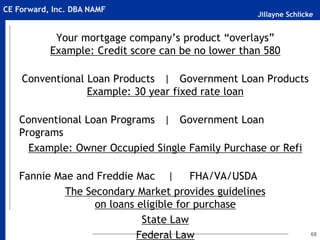

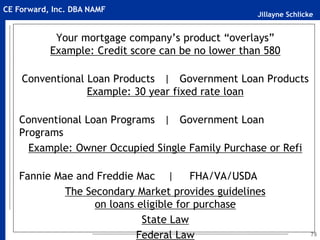

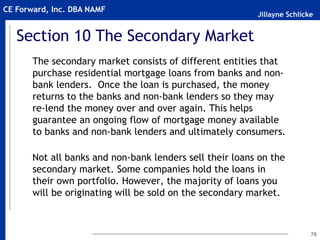

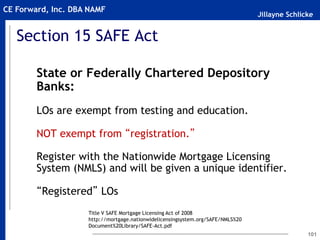

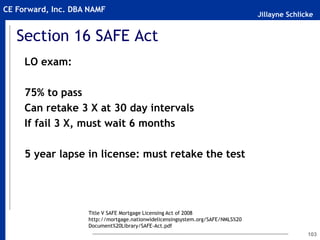

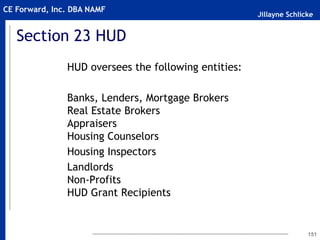

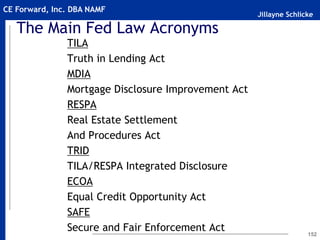

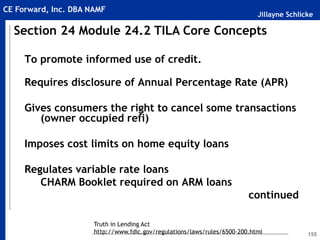

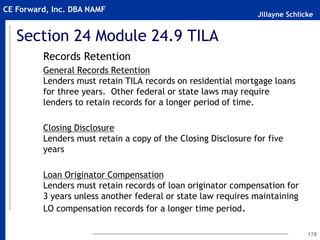

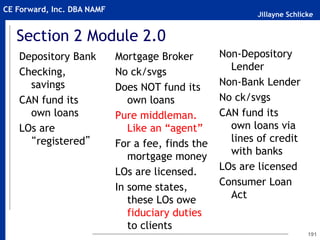

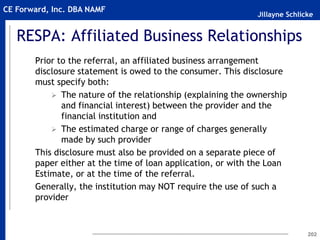

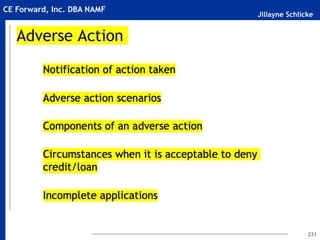

The document outlines an agenda for a 20-hour mortgage lending training course, including sections on licensing exams, the mortgage origination process, underwriting, credit, title insurance, escrow, appraisals, and insurance. The course will cover federal and state laws, various mortgage products and terms, the roles of people involved in originating and funding loans, and how to qualify borrowers and analyze applications. The trainer will use presentations, case studies, and group discussions to prepare attendees to obtain their mortgage loan originator license.