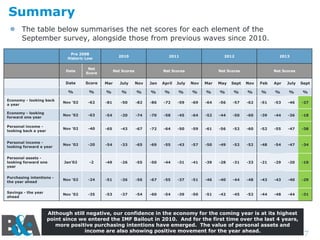

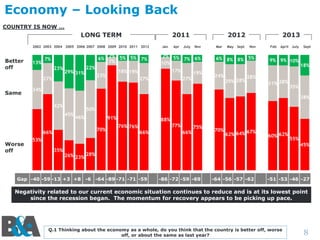

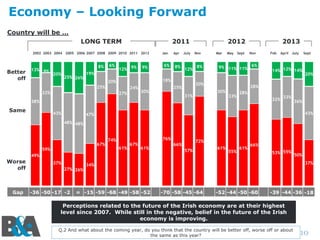

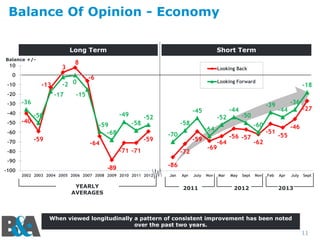

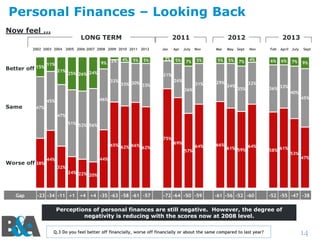

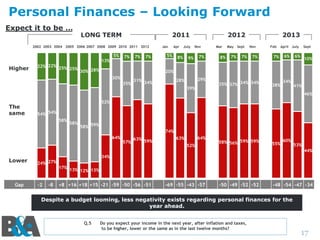

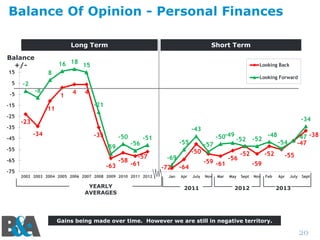

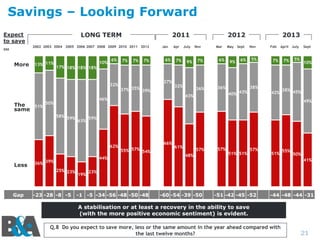

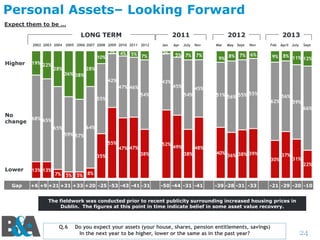

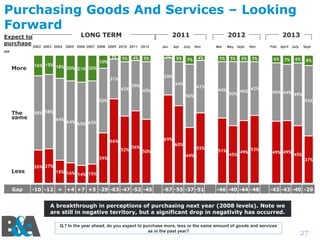

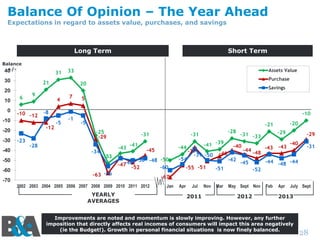

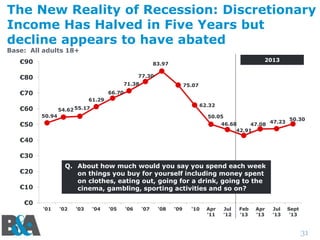

- Consumer confidence in Ireland is showing signs of improvement according to the latest survey by Behaviour & Attitudes. While still negative, perceptions of the economy and personal finances over the next year have risen to their highest levels since before the financial crisis.

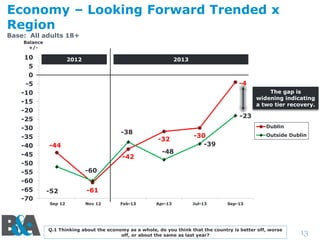

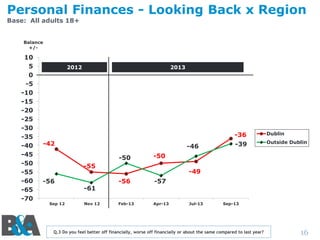

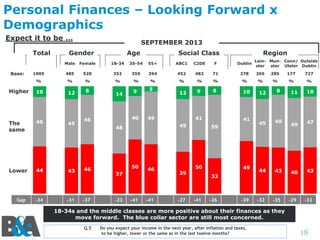

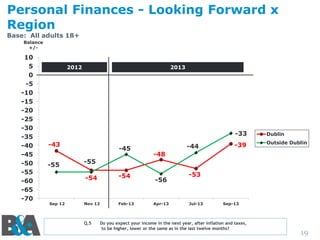

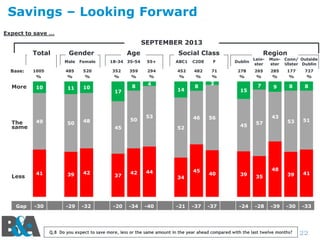

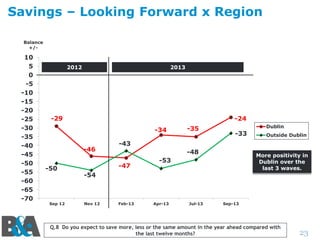

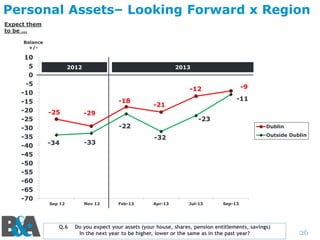

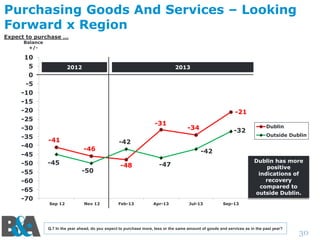

- The recovery appears to be stronger in Dublin compared to the rest of Ireland. Dublin residents are significantly more positive about the economy and their financial prospects than those outside Dublin, and this gap is widening.

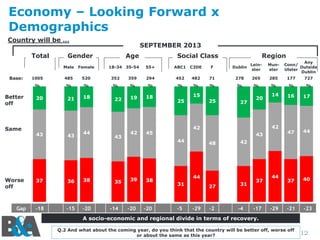

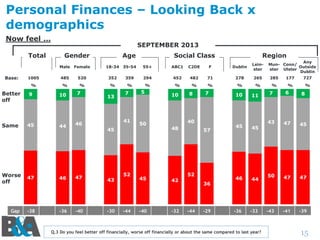

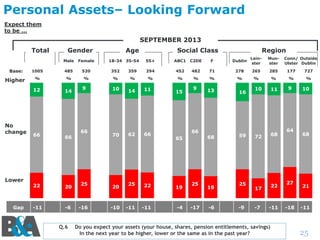

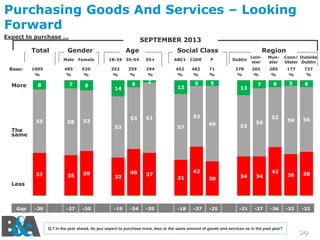

- There are also divisions according to socioeconomic class, with middle and upper class citizens expressing more optimism than blue-collar workers. Younger people also view the future more positively than older respondents.