The document discusses various aspects of job work under GST including:

- The definition of job work as any treatment or process undertaken on goods belonging to another registered person.

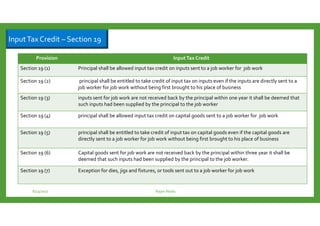

- Input tax credit provisions for inputs and capital goods sent for job work.

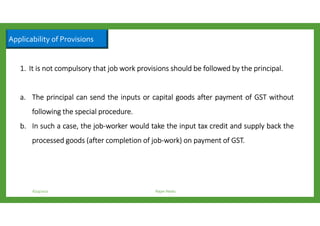

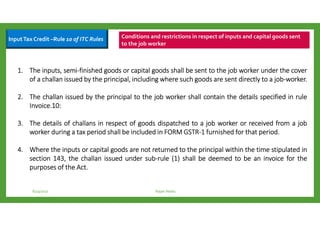

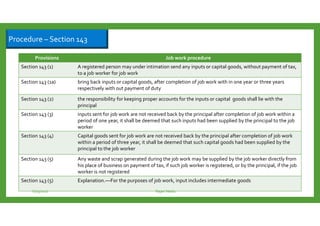

- The procedure for sending inputs/capital goods to a job worker without payment of tax and bringing them back after job work.

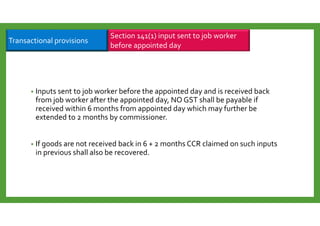

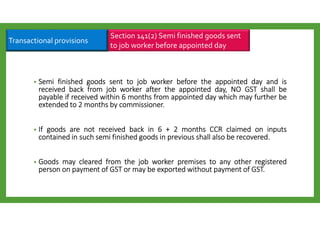

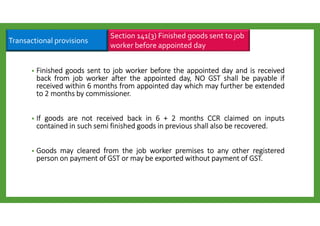

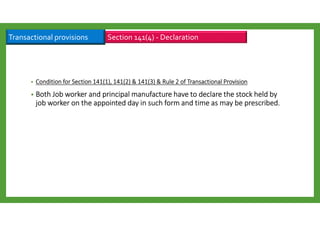

- Transactional provisions for inputs/goods sent to a job worker before the GST appointed date.

- Requirements for maintaining proper accounts and reconciling supplies between the principal and job worker.