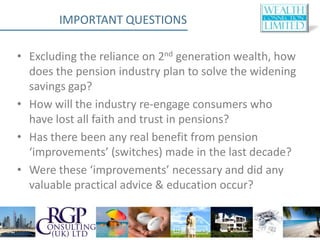

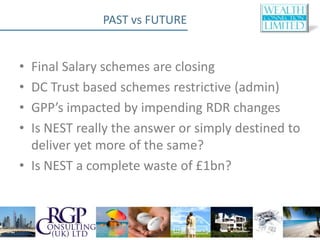

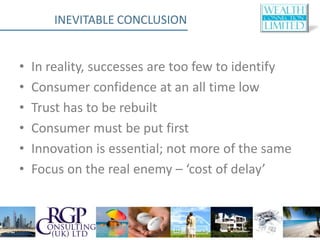

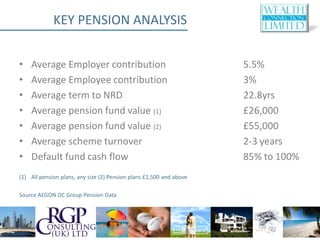

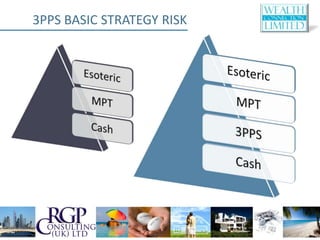

This document introduces the concept of private third party pension sponsorship as a way to address issues in the UK pension industry. It notes that current industry approaches are failing to solve the widening savings gap or rebuild consumer confidence and trust. A new, innovative, consumer-focused approach is needed that provides extra funding, education, and flexibility while reducing risks. Private third party pension sponsorship could potentially improve financial outcomes for savers, tackle consumer negativity, and help address employer budget constraints by shifting some liability to the private sector.