Hering reported its 3Q17 results with the following highlights:

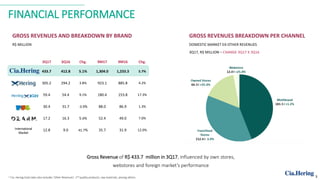

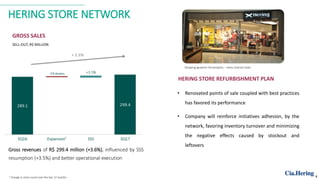

- Gross revenues increased 5.1% to R$433.7 million, influenced by own stores, webstores, and foreign market performance.

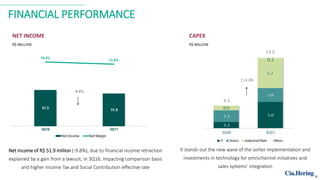

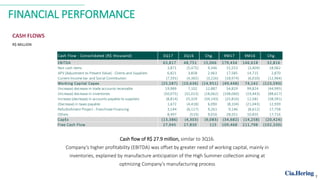

- EBITDA was R$63.8 million with 310 basis point margin expansion due to sales growth and gross margin increase.

- Net income decreased 9.8% to R$51.9 million due to a financial income gain in 3Q16 impacting comparisons.

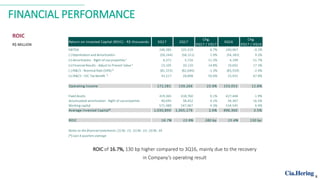

- ROIC increased 130 basis points to 16.7% mainly due to recovery in operating results.