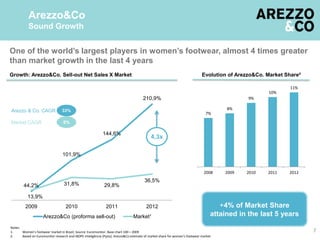

Arezzo&Co is a leading Brazilian retail company with unique positioning that aligns growth with high cash generation. It has grown sales 4 times faster than the market average over the last 5 years through a sound growth strategy. The company has a flexible, asset-light business model with 87% of stores franchised and 90% of production outsourced. It also has a platform of benchmark brands that are top-of-mind for Brazilian women. Going forward, it is well positioned to continue consistent growth by focusing on the right products, a multichannel strategy, strengthening sourcing, consolidating the Anacapri brand, and improving corporate governance.