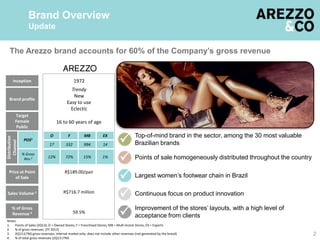

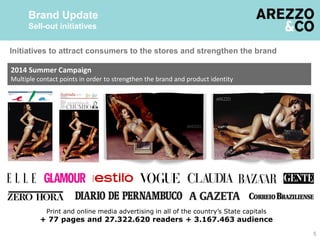

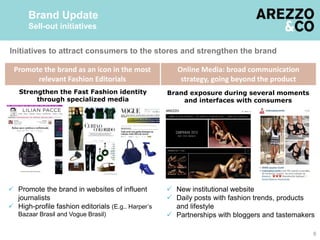

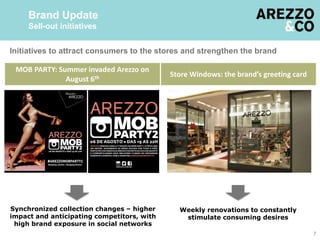

The Arezzo brand accounts for 60% of the Company’s gross revenue. It has developed since 1972 by making the right changes at the right time such as focusing on product innovation, improving store layouts, and expanding distribution channels. Recent initiatives to strengthen the brand include summer advertising campaigns, promoting the brand through fashion editorials, and loyalty programs to promote unique purchasing experiences.