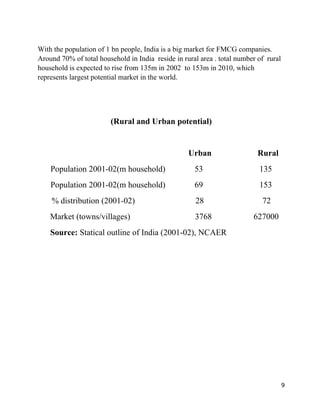

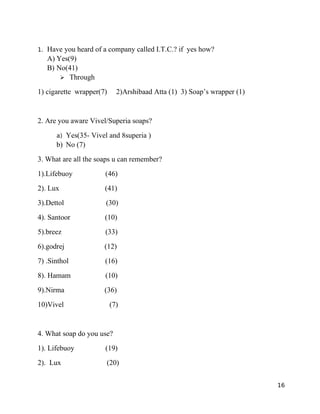

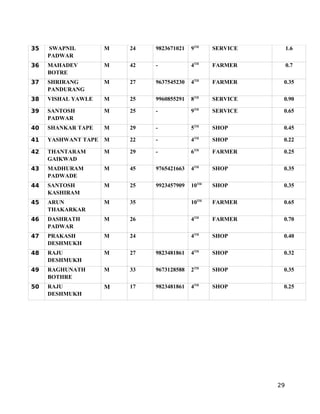

This document provides a project report on a study of soap buying behavior among rural consumers in India. The report was completed by Akhilesh Kumar under the guidance of Prof. G.M. Jayasheenan. The report includes an introduction on the history of soap companies targeting rural markets in India. It describes the objectives and scope of the study, which was to understand rural consumer choices, usage habits, and buying behaviors related to soap products. The report also includes a literature review, SWOT analysis, research methodology, data collection details from a village, data analysis, conclusions, and recommendations.