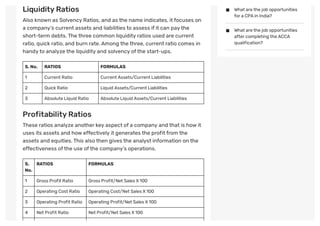

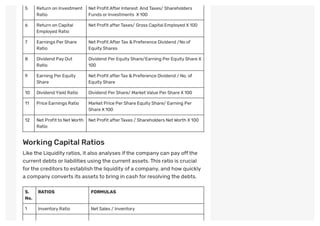

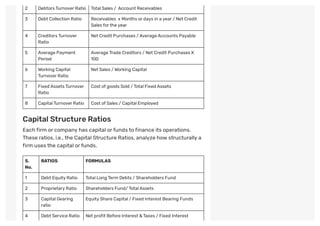

This document provides information about ratio analysis and various ratio formulas. It begins by explaining that ratio analysis is used to gain insight into a company's financial health and performance by comparing quantitative information from financial statements. It then lists and defines various types of ratios including liquidity ratios, profitability ratios, working capital ratios, capital structure ratios, and overall profitability ratios. For each ratio type, formulas to calculate specific ratios like current ratio, return on investment, debt equity ratio, and overall profitability ratio are provided.