This document provides an overview of mutual funds, including:

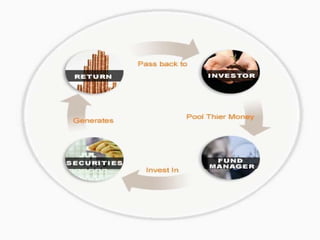

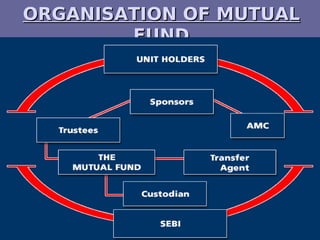

- Mutual funds pool money from investors and invest it in stocks, bonds, etc. on their behalf.

- Investors prefer mutual funds over directly investing in stocks because it reduces the time spent researching companies and allows for a more diversified, lower risk portfolio.

- Asset management companies (AMCs) professionally manage the investors' money in mutual funds and charge fees for their services.

- Mutual funds can be invested in either through a lump sum payment or systematic investment plan (SIP) which invests a fixed amount each month.

- The main types of mutual funds are open-ended and closed-ended funds, which differ based on whether