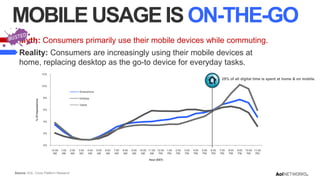

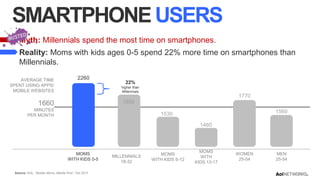

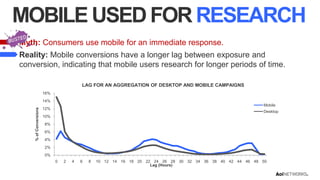

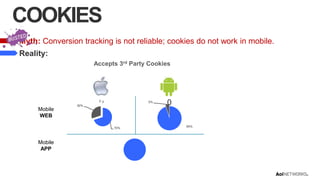

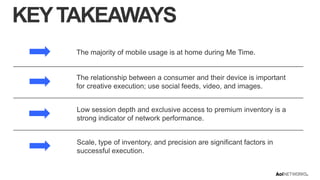

The document discusses common myths and realities surrounding mobile device usage and advertising strategies. Key points highlight that consumers primarily use mobile devices at home for personal activities rather than just commuting, and they are increasingly making purchases through mobile. Additionally, it emphasizes the importance of creative execution in mobile advertising, suggesting strategies for improved engagement and performance.