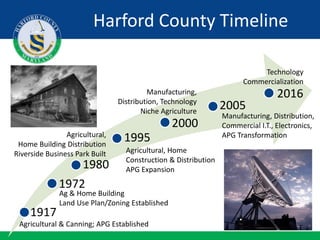

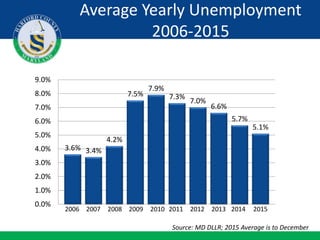

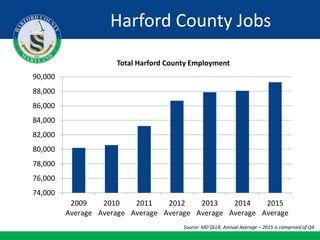

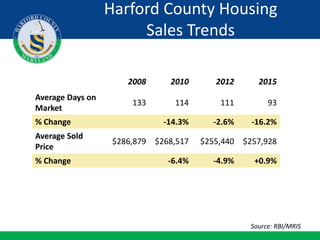

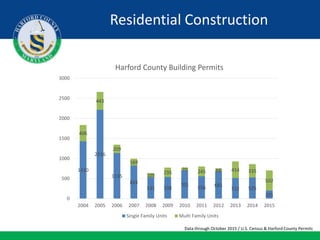

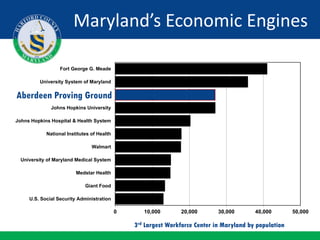

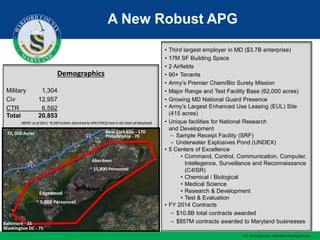

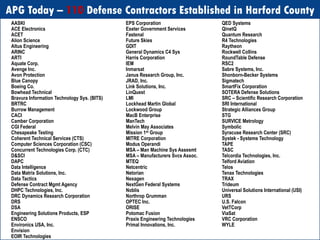

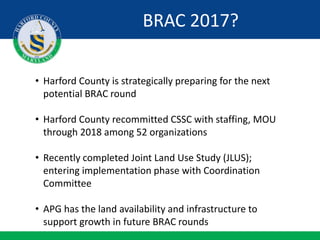

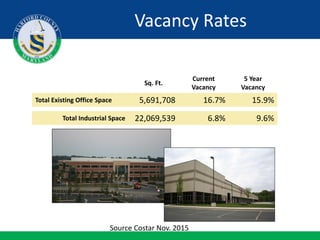

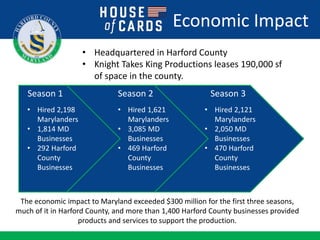

The document summarizes Harford County, Maryland's focus on becoming Maryland's new center of opportunity through facilitating business investment and job creation. It highlights Harford County's transition from an agricultural economy to one focused on manufacturing, distribution, technology and commercialization. Statistics are provided on job growth, housing market trends, major employers, and development opportunities being pursued to continue expanding the local economy.