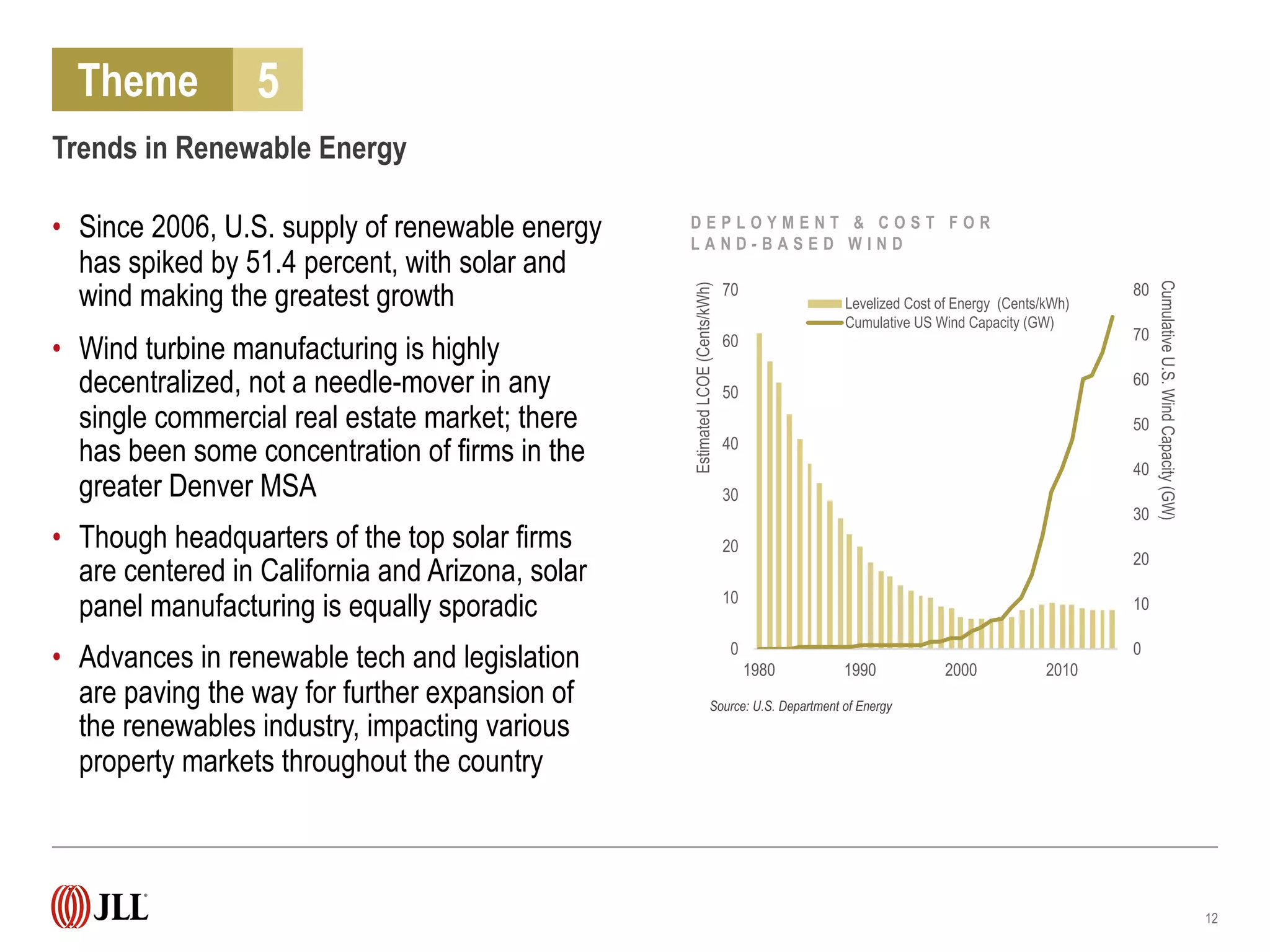

The document summarizes key themes from a 2016 energy outlook report, including: 1) Macroeconomic factors influencing energy markets, such as U.S. oil production growth outpacing Saudi Arabia and Russia; 2) The struggling state of oil and gas companies, with over $67 billion in bankruptcy debt and expected job losses; 3) Impacts on the upstream, midstream, and downstream sectors; 4) Increasing regulations and legislation hindering non-renewable energy expansion; 5) Growth in renewable energy supply and advances in technologies.