The document discusses recent positive developments for renewable energy in June, including major financial commitments from investors, foundations, and governments. Bill Gates and Softbank committed billions more for clean technology investments. A growing number of large investment firms plan to invest in solar projects due to confidence in returns and a desire to support clean energy. China committed to reduce emissions and increase non-fossil fuel energy use, joining new commitments from other nations ahead of climate talks. Rapidly improving economics and technology are driving momentum for renewables as costs drop and targets increase around the world.

![46 www.power-eng.com

of multiple, parallel flow modules each

containing thousands of spaghetti-like,

hollow-fiber membranes.

The membranes must be regularly

backwashed every 10 to 20 minutes

or thereabouts to remove particulates.

The backwash flow path is the reverse

of the normal flow path. In this par-

ticular case, conversion of the mem-

branes from inside-out to outside-in

normal flow path greatly improved the

backwash efficiency.

Another interesting initial difficul-

ty was noted with the UF backwash

process. Typically with these systems

a small portion of the permeate is col-

lected in a separate tank at the begin-

ning of each process cycle for use in

backwash. So far, so good. But most

modern MF and UF units are now

equipped with automatic chemical-

ly-enhanced backwash (CEB) systems.

After a certain number of cycles, a

CEB backwash kicks in where first the

membranes are cleaned with a dilute

caustic/bleach solution to remove or-

ganics and microbiological organisms,

followed by rinsing and then a dilute

citric acid wash to remove iron partic-

ulates. When this UF was first com-

missioned and CEB backwashes com-

menced, the membranes developed a

layer of calcium silicate during the CEB

caustic stage. The driving force was

the higher pH generated by the caus-

tic, which in turn greatly reduced the

silicate solubility. The solution to this

problem was a switch to softened water

for the backwash supply.

CONCLUSION

This article hopefully illustrated many

of the threads between the water treat-

ment processes at new power plants.

Complex scenarios may arise due to wa-

ter chemistry issues and discharge reg-

ulations. Processes must be viewed and

designed in a holistic manner and not

piecemeal. Accurate and historical water

quality data is an absolute must for de-

signing reliable systems.

feed and a degasifier to lower bi-

carbonate alkalinity.

Under proper conditions, the RO

recovery rate may reach 90 percent.

The RO permeate recycles to the plant

high-purity makeup water system or oth-

er locations. However, while the process

appears straightforward, a number of

lessons-learned have emerged regarding

this technology in actual application.

The following lessons are taken from a

HERO system operating at a power plant

near the Pacific Northwest. One of the

most notable examples for any of these

systems is that some standard water

treatment chemicals may foul the UF

membranes. Operating experience indi-

cates that the membrane manufacturer

and type greatly influence this phenom-

enon. Fouling is induced because mem-

branes typically carry a negative surface

charge while often cationic polymers

are employed for coagulation or floc-

culation. Residual cationic polymer is

strongly attracted to the membranes. A

very similar phenomenon has been ob-

served with MF or UF systems installed

in makeup water systems downstream of

a clarifier. Inexperienced designers and/

or plant personnel have not always rec-

ognized that MF or UF should generally

serve as a replacement for clarification,

not a polishing process for the clarifier.

A straightforward solution that has

significantly improved the reliability of

this particular system is conversion of

the ultrafilter from an inside-out nor-

mal flow path to outside-in. Typical

micro- and ultrafilter systems consist

helps to overcome the boiling point rise

that occurs in conventional units as the

dissolved solids concentration increases.

Considerable energy savings appear pos-

sible with the vacuum systems.

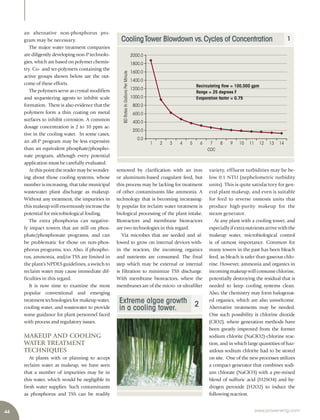

Becoming popular are treatment meth-

ods to reduce the volume of the plant

waste stream before final treatment. Most

notable is high-recovery reverse osmosis.

This schematic outlines the HERO pro-

cess, which is licensed by such firms as

Aquatech, GE, and U.S. Water, while Veo-

lia supplies their Opus technology, which

may also include high-rate softening/clar-

ification as a unit operation. Keys to the

process are:

• Microfiltration (MF) or ultrafiltra-

tion (UF) to remove suspended sol-

ids in the waste stream. This is a

critical process to prevent suspended

solids from fouling reverse osmosis

(RO) membranes.

• Sodium bisulfite (NaHSO3) feed

to remove residual oxidizing bio-

cides. This is also critical to remove

oxidizers that would degrade soft-

ener resin and RO membranes.

• A sodium softener to remove cal-

cium and magnesium. Otherwise

the downstream equipment would

suffer from calcium carbonate and

magnesium silicate scaling.

• Sodium hydroxide injection to ele-

vate the pH above 10. (The combi-

nation of hardness removal and pH

elevation keeps silica in solution.)

• Two-pass reverse osmosis (RO)

treatment.

• Some systems may include acid

Source:

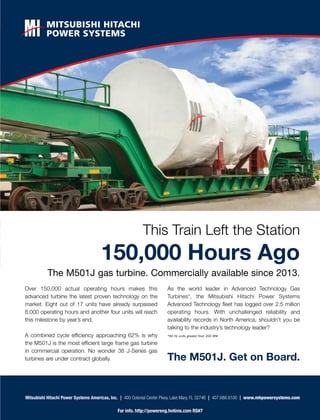

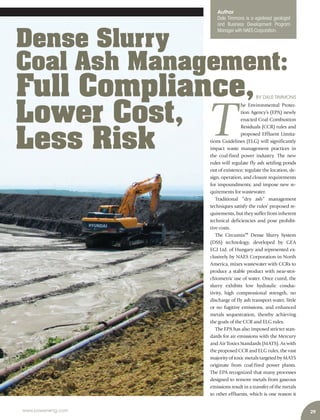

Pollutant Maximum for any 1 day

Average of daily

values for 30 consecutive

days shall not exceed

Arsenic,total (µg/L) 8 6

Mercury,total (ng/L) 242 119

Selenium,total (µg/L) 16 10

Nitrite/nitrate (mg/L) 0.17 0.13

Proposed ELG for FGD Wastewater

Best Technology Available [1] 2](https://image.slidesharecdn.com/201508powereng-160314132843/85/2015-08-Power-Engineering-49-320.jpg)