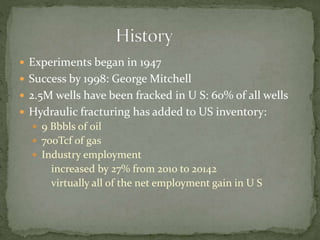

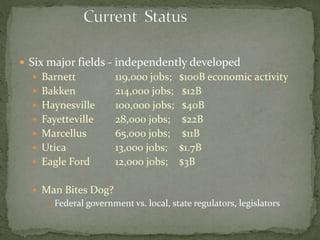

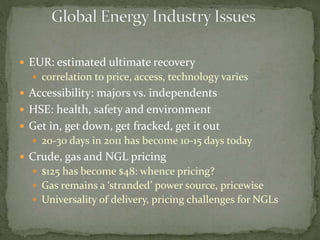

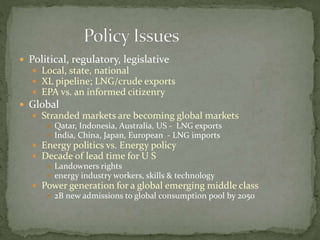

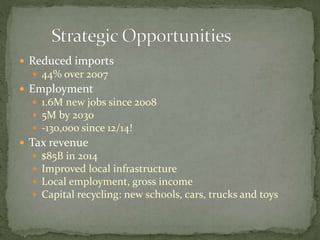

This document provides an overview of fracking in America. It discusses the history of fracking beginning in 1947 and its current widespread use, contributing to significant oil and gas production. Fracking has led to hundreds of thousands of new jobs and major economic benefits across various states. The document outlines the upstream, midstream, and downstream sectors of the fracking industry and options for investing. It also discusses ongoing debates around the environmental and policy issues related to increased use of fracking in the US.