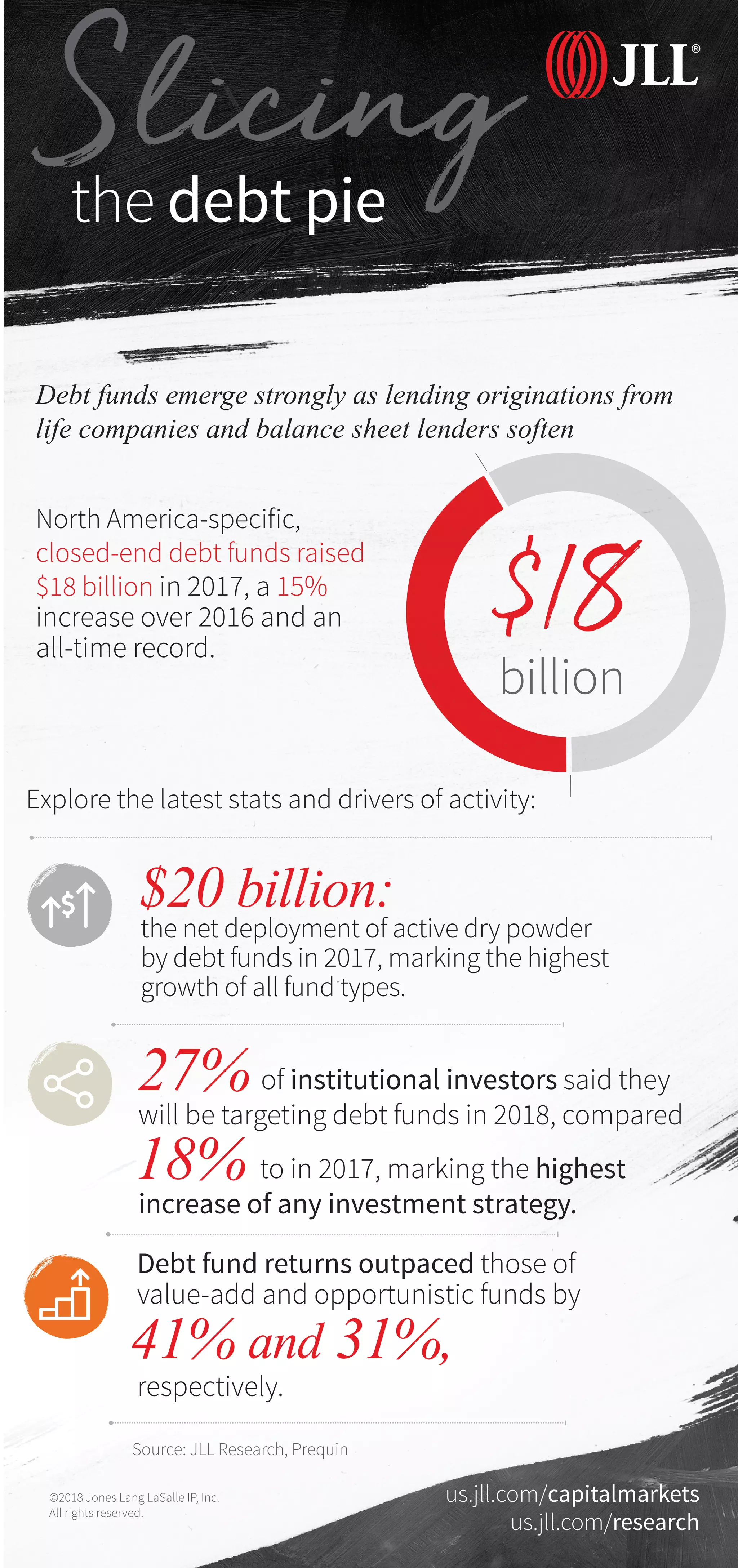

In 2017, North America-specific closed-end debt funds raised a record $18 billion, marking a 15% increase from 2016. Debt fund returns surpassed those of value-add and opportunistic funds, with a significant portion of institutional investors planning to target debt funds in 2018. The net deployment of active dry powder by debt funds also saw the highest growth compared to other fund types as lending from life companies and balance sheet lenders declined.