050511 econ taxes 50m

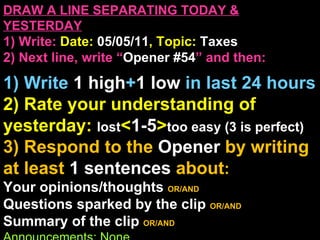

- 1. DRAW A LINE SEPARATING TODAY & YESTERDAY 1) Write: Date: 05/05/11 , Topic: Taxes 2) Next line, write “ Opener #54 ” and then: 1) Write 1 high + 1 low in last 24 hours 2) Rate your understanding of yesterday: lost < 1-5 > too easy (3 is perfect) 3) Respond to the Opener by writing at least 1 sentences about : Your opinions/thoughts OR/AND Questions sparked by the clip OR/AND Summary of the clip OR/AND Announcements: None

- 2. Agenda 1) Tax Introduction 2) Biz Plan 2 due Tues 5/10 End Goal, you will be able to… 1) How should we change our tax policies? Reminder 1) Biz Plan 2 due Tues 5/10

- 5. Journ #54a , Title “ Taxes Debate ” 1) Read the 2 sides, choose 1 side, and write which you choose and explain why . 2) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: Taxes are Patriotic 1) Taxes pay for things that we benefit from, but can’t afford ourselves (schools, security, etc) 2) No person is an island, so taxes allow us to help every American live well PRO: Taxes are Evil 1) Taxes waste your money, you can buy things yourself (schools, security, etc) 2) Taxes make it hard for us to live well, by taking away our money

- 8. US Avg Tax: 35% Denmark Avg Tax: 60%

- 9. Journ #54b , Title “ Denmark Debate ” 1) Read the 2 sides, choose 1 side, and write which you choose and explain why . 2) Then write down what your partner thinks ( include their name at the end ) . 1 2 3 4 5 CON: Denmark’s 59% 1) People in Denmark might not be the richest or most powerful, but they are the happiest 2) Free health care, paid for vacation time, and free education, so less debt. PRO: America’s 35% 1) Already, you work Jan-April for the gov, and just May-Dec for yourself 2) Money = freedom, if I work hard, I can buy the things Denmark provides, and make my own choices on the way.

- 10. Notes #54a , Title: “ Taxes ” 1) Corporate Income Tax : Approx 20% federal tax on profits, CA: 8% tax 2) Personal Income Tax : Approx 0-35% federal tax on income, CA: 0-9% state tax 3) Sales Tax : Tax on final point of sale ( 9.25%) 4) Europe: Valued Added Tax (VAT) : Tax at each stage product is improved, Europe Avg: 20% 5) Payroll Taxes : Approx 15% (12% Social Security-6% by you, 6% by boss, 3% Medicare) tax on workers to pay for current retired, shows up as: FICA, SS, SSWT or OASDI 6) Estate Tax (Death Tax) : Tax on gifts + inheritance, 0% (up to 5 mil) 35% each $ after

- 11. 7) Withholding System : Since 1943, gov ask biz to withhold worker’s income tax & pay for them FED: Fed Income Tax SIT: State Income Tax FICA: Social Security SUI: Unemp Insurance MEDICARE: Old Ppl H.C.

- 13. Notes #54a , Title: “ Do Mr. Chiang’s Taxes ” 8) W-4 : Withholding enrollment form. Exemption # determine how much withheld: “ 0”: Biz withheld a lot, tax refund likely “ 1”: Biz withheld about right, minimal refund/due “ 2”: Biz withheld little, taxes due likely 9) W-2 : Annual report from your boss of how much of your taxes boss paid for you. 10) April15 : Due date to file last year’s taxes ( W2 )

- 17. Do Mr. Chiang’s Taxes ( 10 Points ) Don’t make fun of Mr. Chiang’s pay, the chance to Journ with you each day is… priceless.

- 18. Review 1) Corporate Income Tax : Approx 20% federal tax on profits, CA: 8% tax 2) Personal Income Tax : Approx 0-35% federal tax on income, CA: 0-9% state tax 3) Sales Income Tax : Tax on final point of sale 4) Europe: Valued Added Tax (VAT) : Tax at each stage product is improved, Europe Avg: 20% 5) Payroll Taxes : Approx 15% (12% Social Security-6% by you, 6% by boss, 3% Medicare) tax on workers to pay for current retired, shows up as: FICA, SS, SSWT or OASDI 6) Estate Tax (Death Tax) : Tax on gifts + inheritance, 0% (up to 5 mil) 35% each $ after

- 19. Notes #55a , Title: “ Do Mr. Chiang’s Taxes ” 1) Tax Refund : Refund of some withholding 2) Deduction : Lowers your taxable income, the earning level used to measure your tax (donations) 3) Tax Credit : Real money refund or free money, (college spending) 4) Earned Income Tax Credit (EIC) : Tax credit for poor, who pay no taxes, but gov gives money to help them live.

- 20. Notes #55b , Title: “ Taxes, Part 2 ” 5) Federal Revenue : Biz Income + Person Income Tax (+Soc Sec Tax) Capital Gains Tax (Income Tax on Investments) Excise/Customs Tax (Foreign Goods) Estate Tax (Inheritance) 6) CA Revenue : Biz Income + Personal Income Tax + Sales Tax 7) County+City : Property Tax + Sales Tax + Fees 8) Prop 13 : Limit prop tax to 1% of bought price ( reduce gov+school rev )

- 22. Journ #55a , Title “ Tax Debates ” 1) Read the 2 sides, choose 1 side, and write which you choose and explain why . 2) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: Increase Customs Tax Rate 1) Increasing tax on for. goods can help US biz 2) It’s paid by foreigners, so less taxes to be paid by American tax payers PRO: Lower Customs Tax Rate 1) Lowering this tax will encourage for. nations to lower tax on US goods 2) It hurts shoppers, since US biz can charge more, if their for competitors’ prices are higher b/c of tax

- 24. Journ #55b , Title “ Corp Tax Debate ” 3) Read the 2 sides, choose 1 side, and write which you choose and explain why . 4) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: Increase Corp Tax Rate 1) Biz won’t leave, b/c taxes help pay for stable infrastructure and legal sys 2) Biz create negative externalities like pollution which must be cleaned up through tax money PRO: Lower Corp Tax Rate 1) Biz leave US to other countries with lower taxes if we don’t lower 2) Less corp taxes more directly leads to more money to create jobs

- 26. Journ #55b , Title “ Estate Tax Debate ” 5) Read the 2 sides, choose 1 side, and write which you choose and explain why . 6) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: Increase Estate Tax Rate 1) This money is more needed by the gov, than the inheritors, first $3 mil already tax free 2) Every generation should have to make their own start in life PRO: Lower Estate Tax Rate 1) Dead already paid tax on this money when they paid income tax 2) We should have the right to help our children live better lives

- 27. Journ #55c , Title “ Poor v Wealthy ” 1) Copy Source Title: ABC+ CNBC 2…) Discuss questions on the board with a partner. Summarize your discussion ( include their name at the end ). Remember participation points are deducted if off task. 5 Reading/Film Qs Come From These Journ Sections

- 29. $20 Billion Dollar Annual Deficit

- 30. Red: No personal income tax Yellow: No income tax, but there is capital gains tax State Income Tax Map

- 33. Journ #56a , Title “ Sales Tax Debate ” 7) Read the 2 sides, choose 1 side, and write which you choose and explain why . 8) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: Increase Sales Tax Rate 1) Lead to less wasteful consumption, more saving 2) High sales tax will help raise money for CA’s budget crisis (schools) PRO: Lower Sales Tax Rate 1) Lower sales tax increases spending, stimulate the economy 2) Sales tax hurts poor more, since the flat rate of 8% is harder when you make less money.

- 34. Journ #56b , Title “ CA Tax Debate ” 9) Read the 2 sides, choose 1 side, and write which you choose and explain why . 10) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: CA Needs More Taxes 1) High taxes help pay for services CA life, and who would leave beautiful CA 2) CA budget crisis can only be solved with higher taxes PRO: CA Needs Less 1) Biz and ppl are leaving CA b/c of high taxes 2) Lower taxes would actually bring more tax revenue to the gov (Laffer)

- 35. Journ #56c , Title “ Prop 13 Debate ” 11) Read the 2 sides, choose 1 side, and write which you choose and explain why . 12) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: Get Rid of Prop 13 1) If we can charge more than 1%, we can help our schools 2) At the very least, we should allow the 1% to be charged of the current value, not the value at the past point of sale. PRO: Keep Prop 13 1) 1% tax is already really high for many home owners ($1mil house, means $10k a year) 2) Many seniors on fixed incomes can’t afford any higher taxes if you re-value their house

- 36. Notes #56a , Title: “ Taxes Reform ” 1) Progressive Tax : Tax that rate goes up with earnings: Income Tax 2) Marginal Tax Scale : Multi-level, rate goes up after certain amount, prevents cheating 3) Flat Tax : Simple same tax rate for everyone ( Considered regressive b/c hurts poor more)

- 40. 4) U.S. Class Levels: Top 1/3: $65k Top 1/4: $80k Top 1/5: $90k Top 15%: $100k Top 10%: $120k Top 5%: $160k Top 1%: $400k Top 0.1%: $1.6m Avg US: $54k

- 49. Journ #56d , Title “ Rich v Poor Debate ” 1) Read the 2 sides, choose 1 side, and write which you choose and explain why . 2) Then write down what your partner thinks ( include their name at the end ). 1 2 3 4 5 CON: 60% on Over $1mil 1) Those who make 80,000 a mo/2,700 a day can afford to pay 60% on every dollar over $1mil 2) These people benefited most from America, so they should give back to the poor who need help PRO: Keep or Lower Highest Tax Brack. of 35% 1) Rich already pay the majority of the nation’s (1% paying 40% of bills) 2) High taxes will discourage success and productivity, thus lower gov tax revenue (Laffer)

- 52. Journ #56e , Title “ Flat Tax Debate ” 1) Read the 2 sides, choose 1 side, and write which you choose and explain why . 2) Then write down what your partner thinks ( include their name at the end ) . 1 2 3 4 5 CON: Keep our current progressive tax 1) Rich can afford to pay more 2) This hurt poor more since 20% of poor is more painful than 20% of a millionaire’s income PRO: Create a 20% flat tax 1) This is the most fair 2) This would make taxes far easier to collect, we could do away with deductions, and have a tax form that takes no lawyers, and is doable in 10 minutes

- 53. Review 1) Corporate Income Tax : Approx 20% federal tax on profits, CA: 8% tax PROGRESSIVE 2) Personal Income Tax : Approx 0-35% federal tax on income, CA: 0-9% state tax PROGRESSIVE 3) Sales Income Tax : Tax on final point of sale FLAT 4) Europe: Valued Added Tax (VAT) : Tax at each stage product is improved, Europe Avg: 20%

- 55. Journ #56f , Title “ Nat Sales Tax Debate ” 1) Read the 2 sides, choose 1 side, and write which you choose and explain why . 2) Then write down what your partner thinks ( include their name at the end ) . 1 2 3 4 5 CON: No federal sales tax 1) People would shop less, this would hurt jobs 2) This would hurt poor people since they don’t pay income tax, but would have to pay the sales tax PRO: Create a 23% sales tax 1) Encourages earning more money + savings 2) Easier to enforce, this would be better for the environment, since it reduces consumption

- 56. Journ # , Title “ Video: Tax Reform ” 1) Copy Source Title: A 2…) Discuss questions on the board with a partner. Summarize your discussion ( include their name at the end ). Remember participation points are deducted if off task. 5 Reading/Film Qs Come From These Work Sections Time Bookmark: 00:00

- 57. Homework: 1) Biz Plan due Tues 5/10