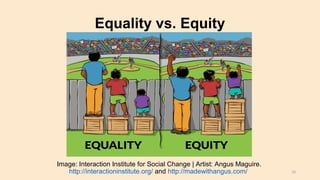

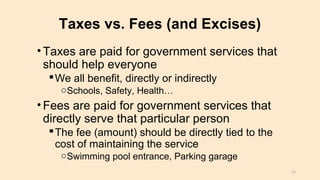

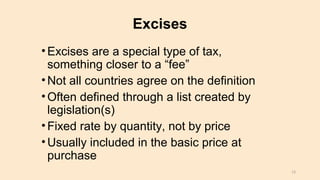

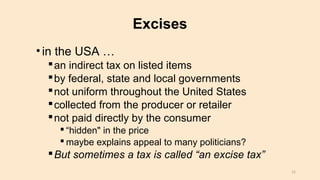

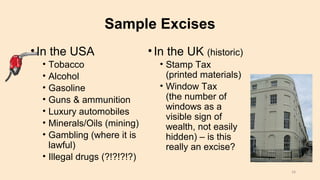

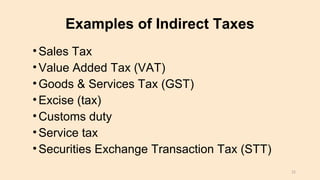

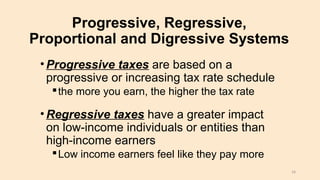

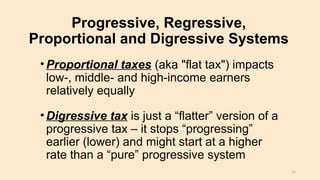

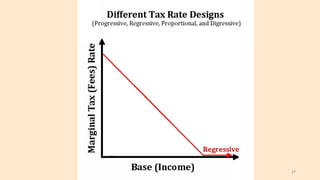

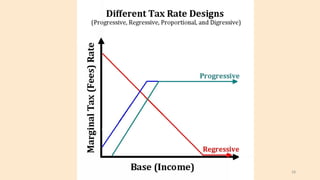

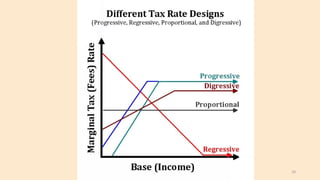

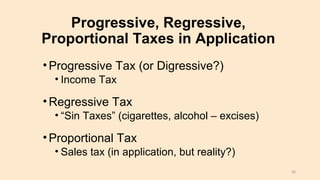

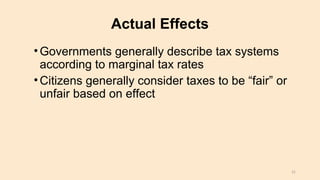

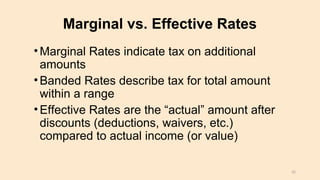

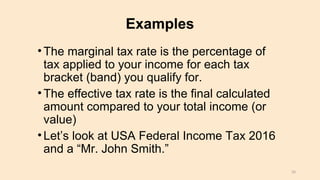

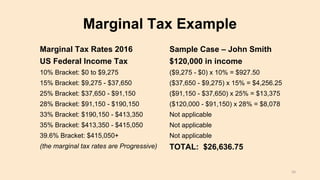

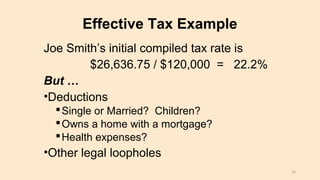

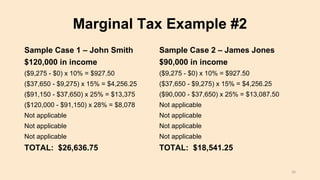

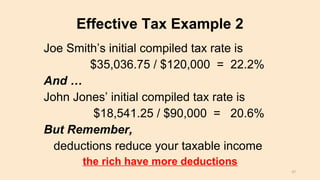

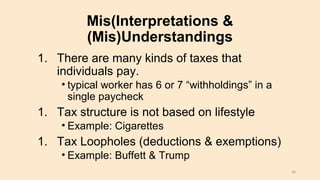

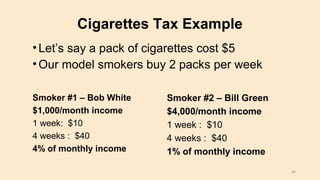

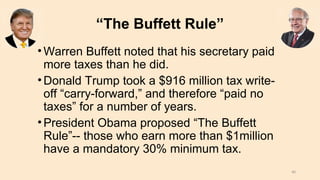

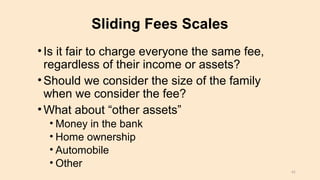

This document provides an overview of a lecture on taxes and fees. It discusses the aims of taxes and fees, including generating revenue, encouraging or discouraging behavior, and promoting equity. It defines different types of taxes such as direct vs indirect taxes, progressive vs regressive vs proportional systems, and excise taxes. It discusses key concepts like marginal tax rates versus effective tax rates and how deductions impact taxes paid. The document aims to clarify interpretations and misunderstandings around the complex tax system.