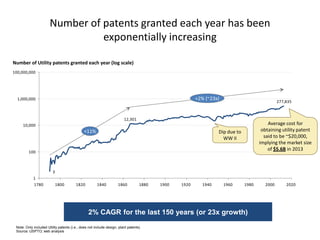

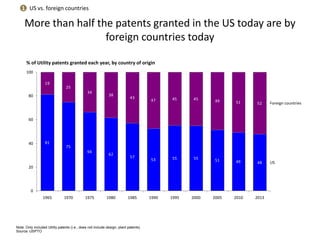

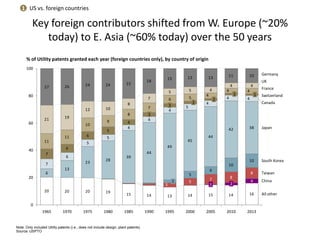

1) The number of patents granted each year in the US has been exponentially increasing over the past 150 years, with foreign applicants now receiving over half of US patents, led by companies from East Asia.

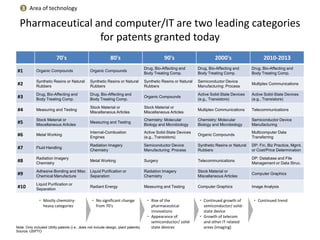

2) Top patent-receiving industries have shifted from chemicals and machinery in the 1970s to pharmaceuticals and computer/IT technologies today.

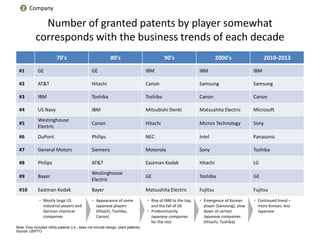

3) While many areas of innovation were dominated by large US and European companies in the past, the rankings are now led by international technology companies like IBM, Samsung, and Canon.