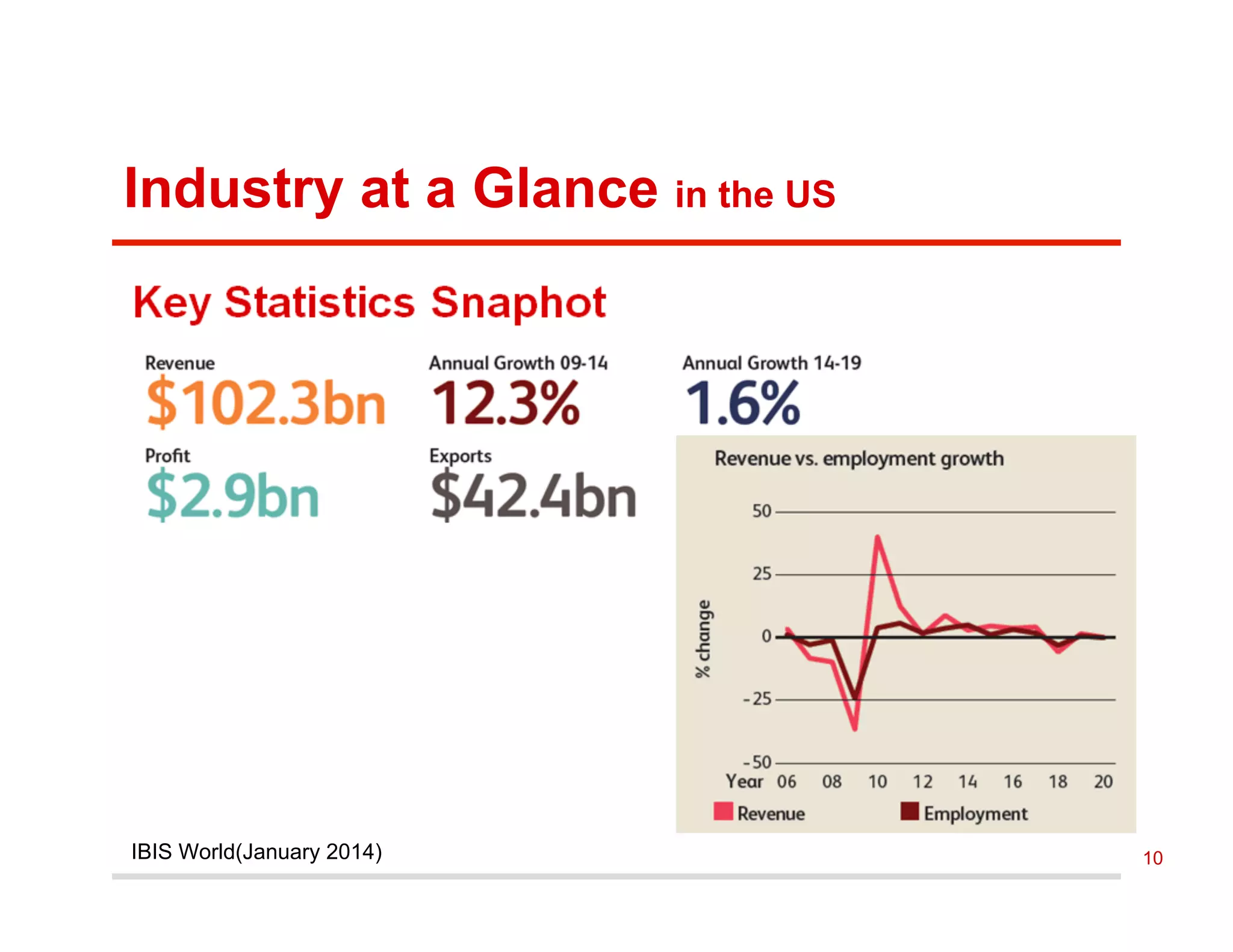

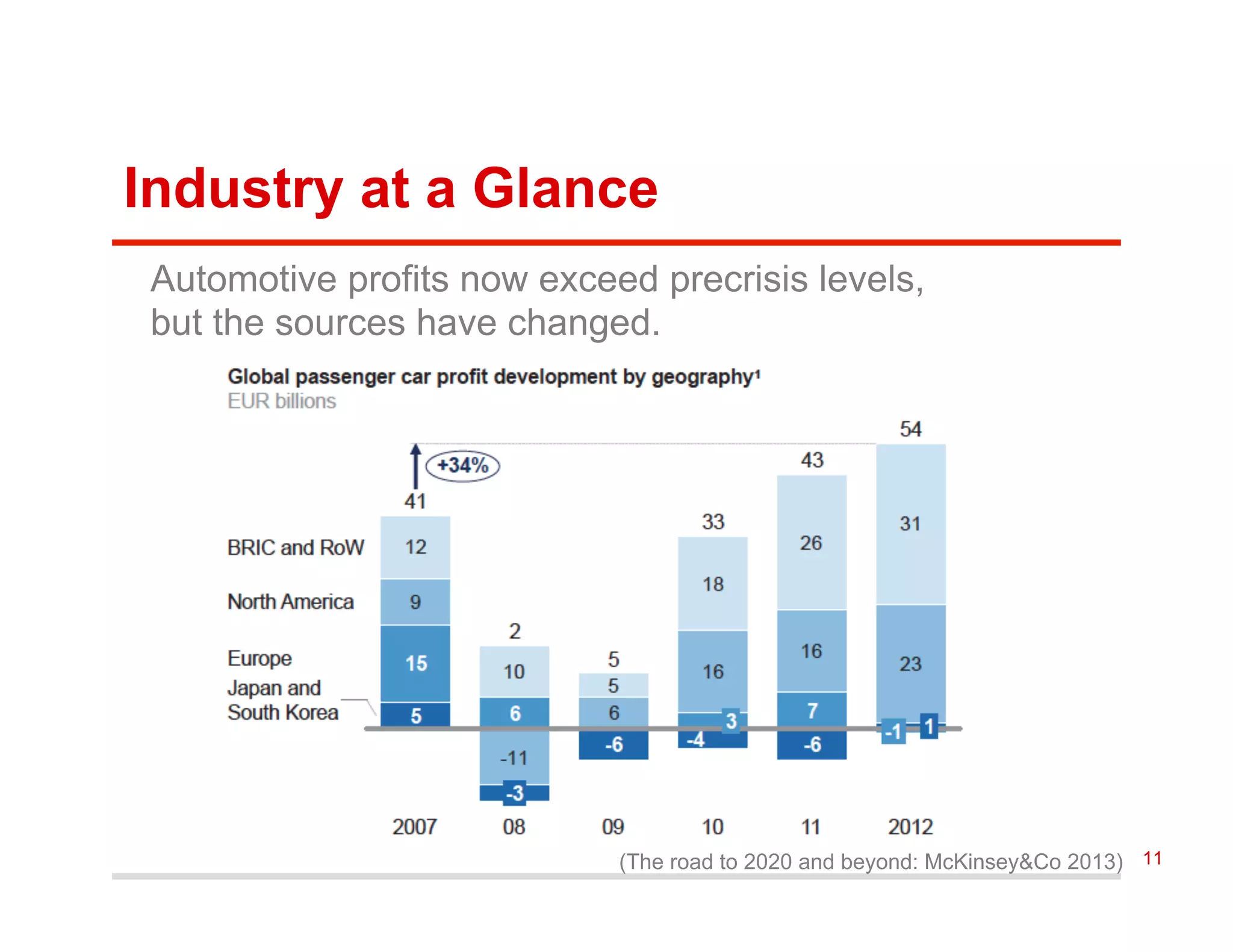

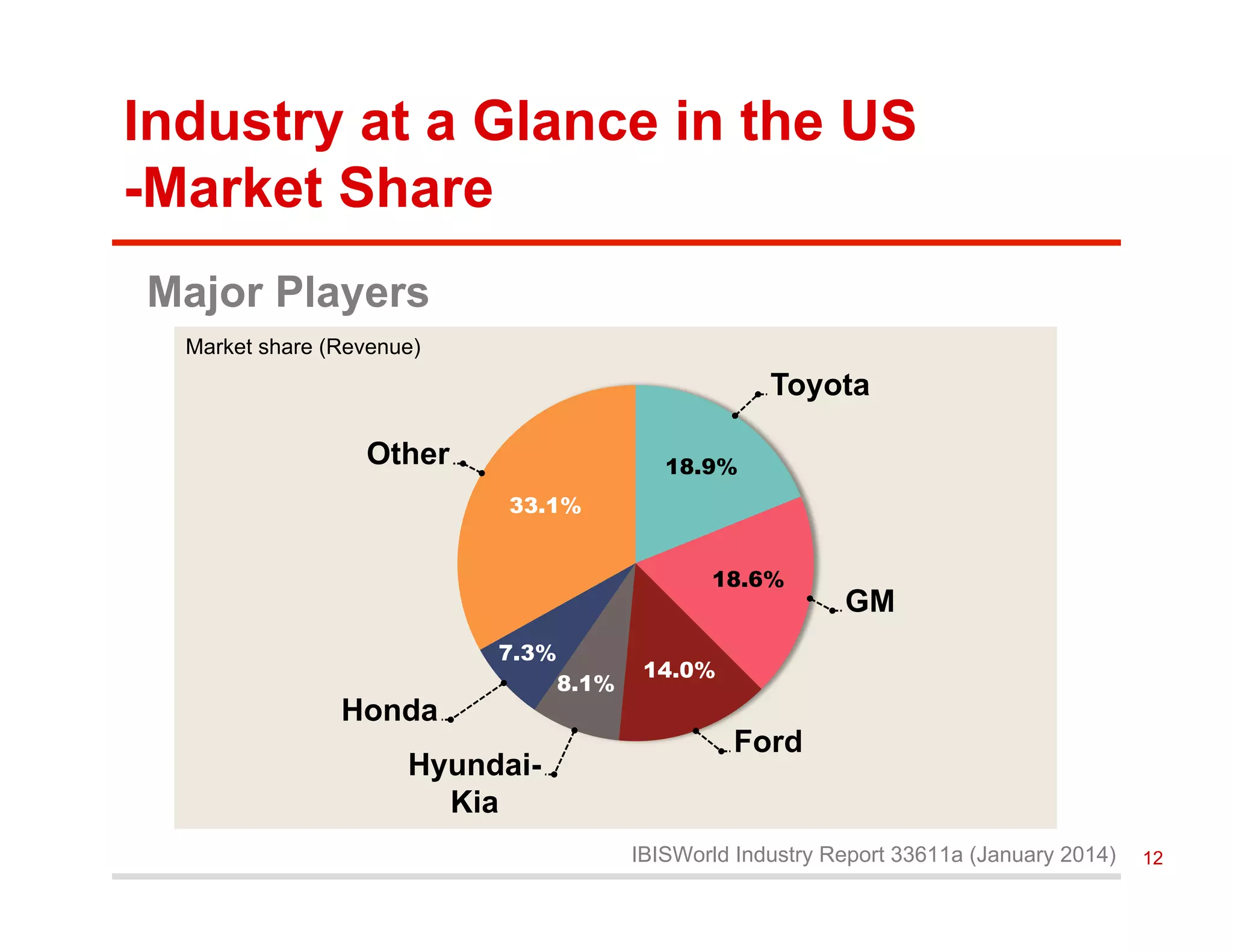

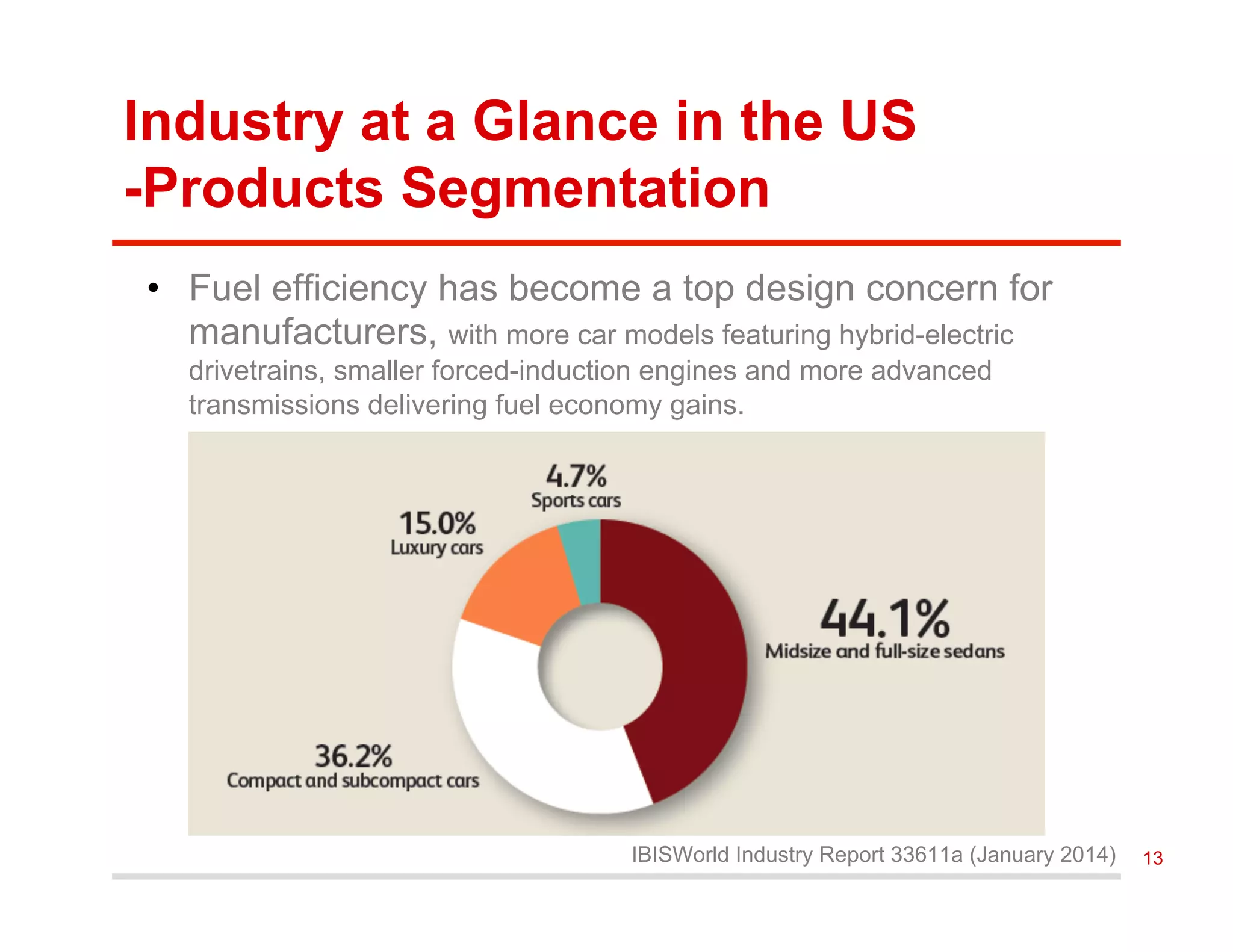

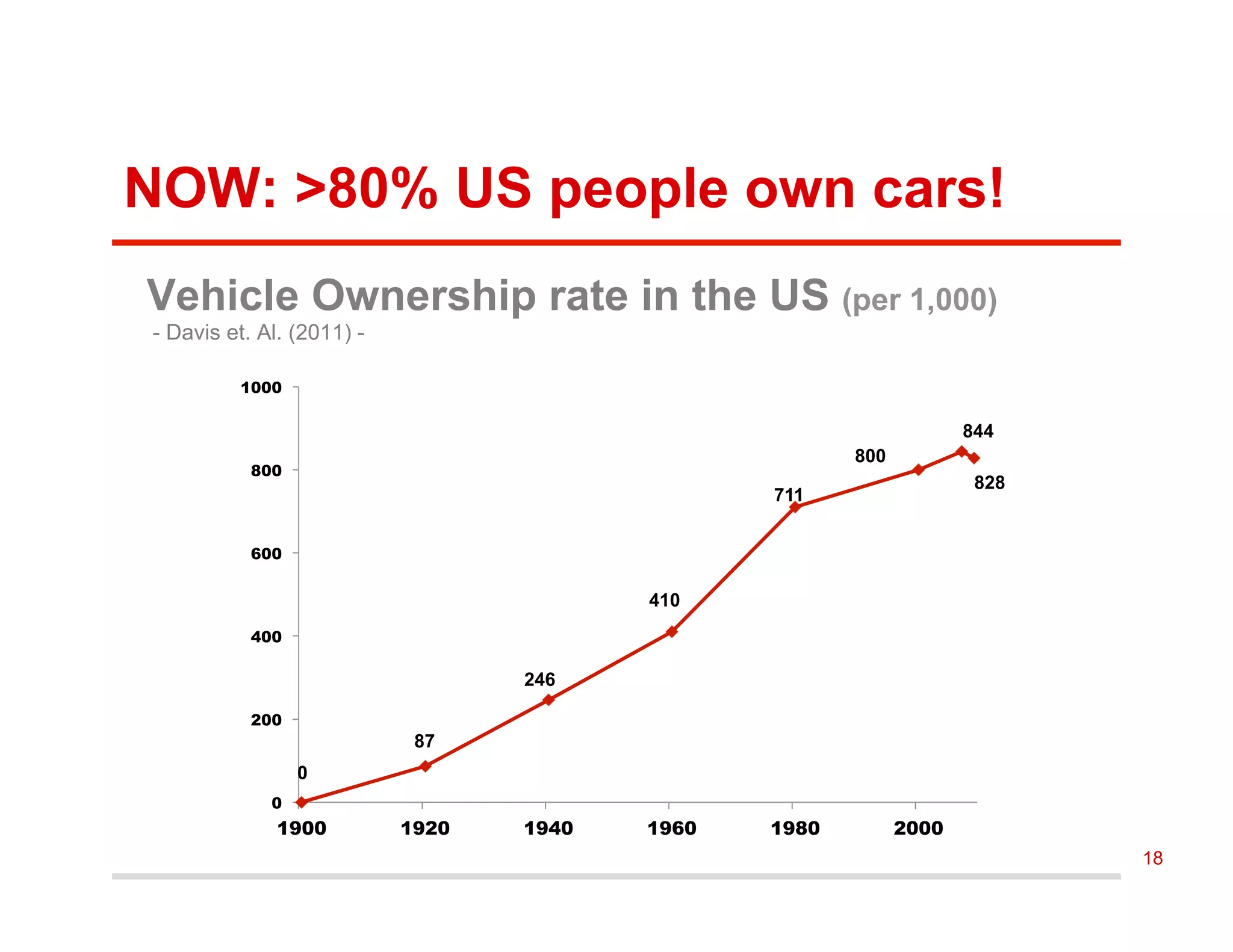

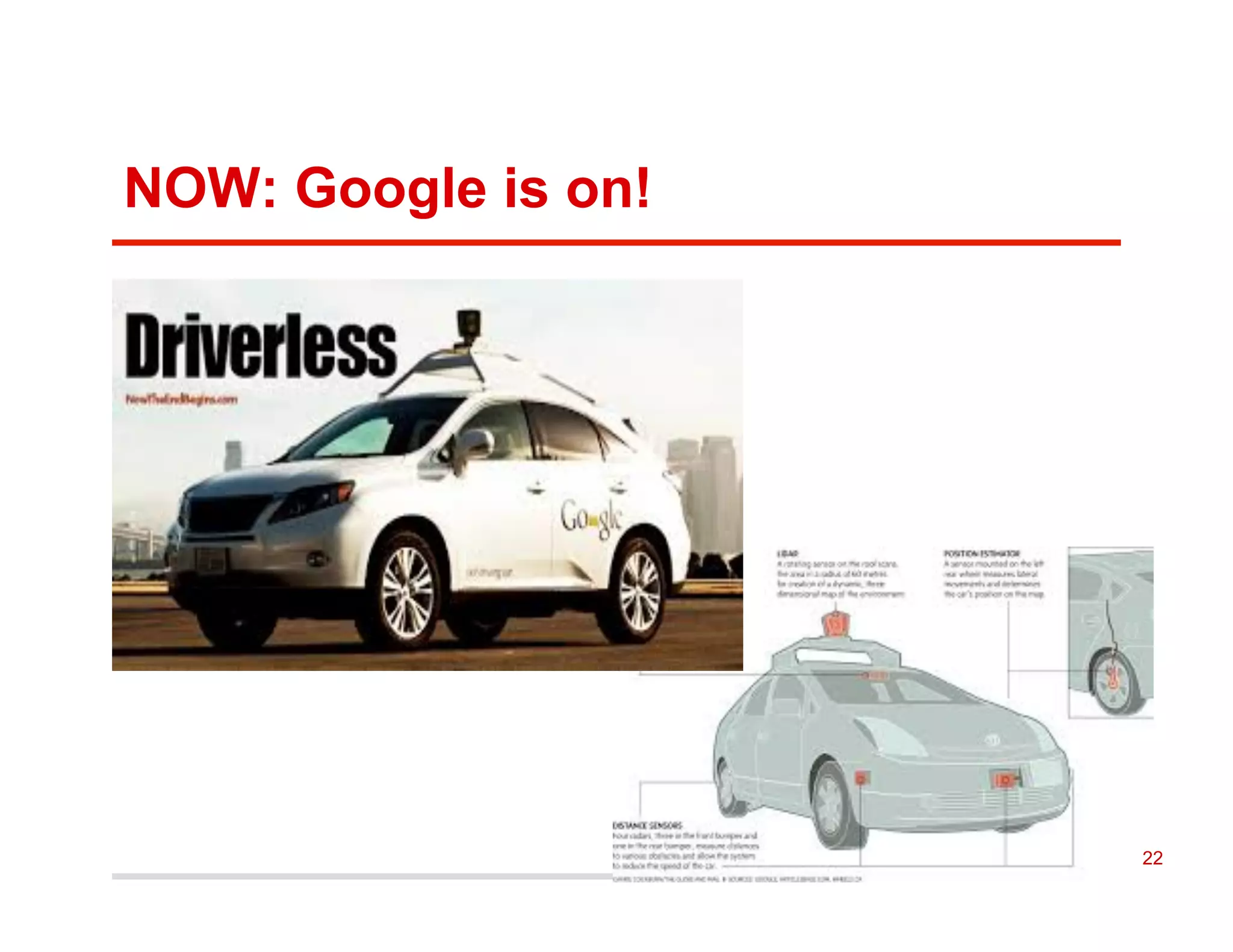

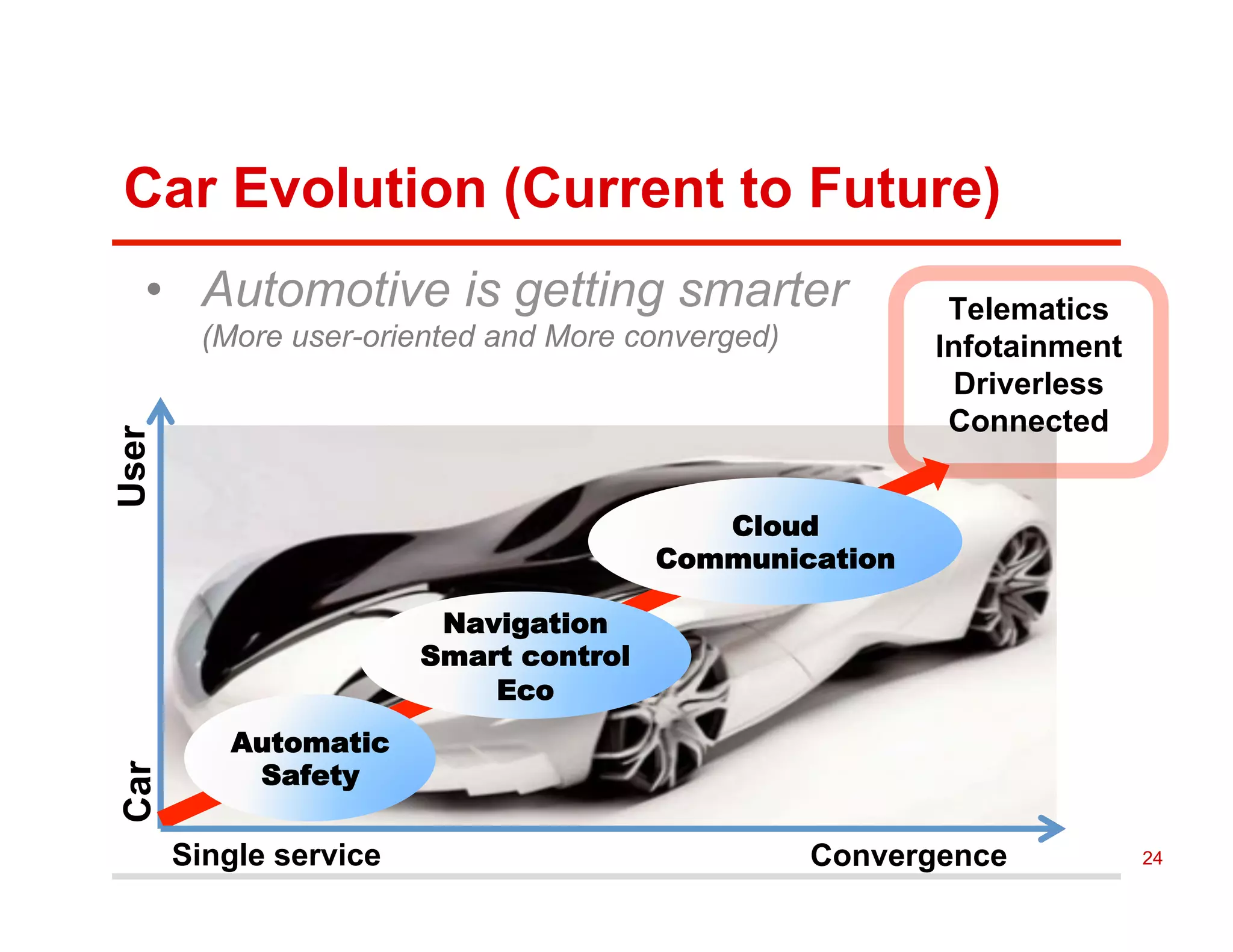

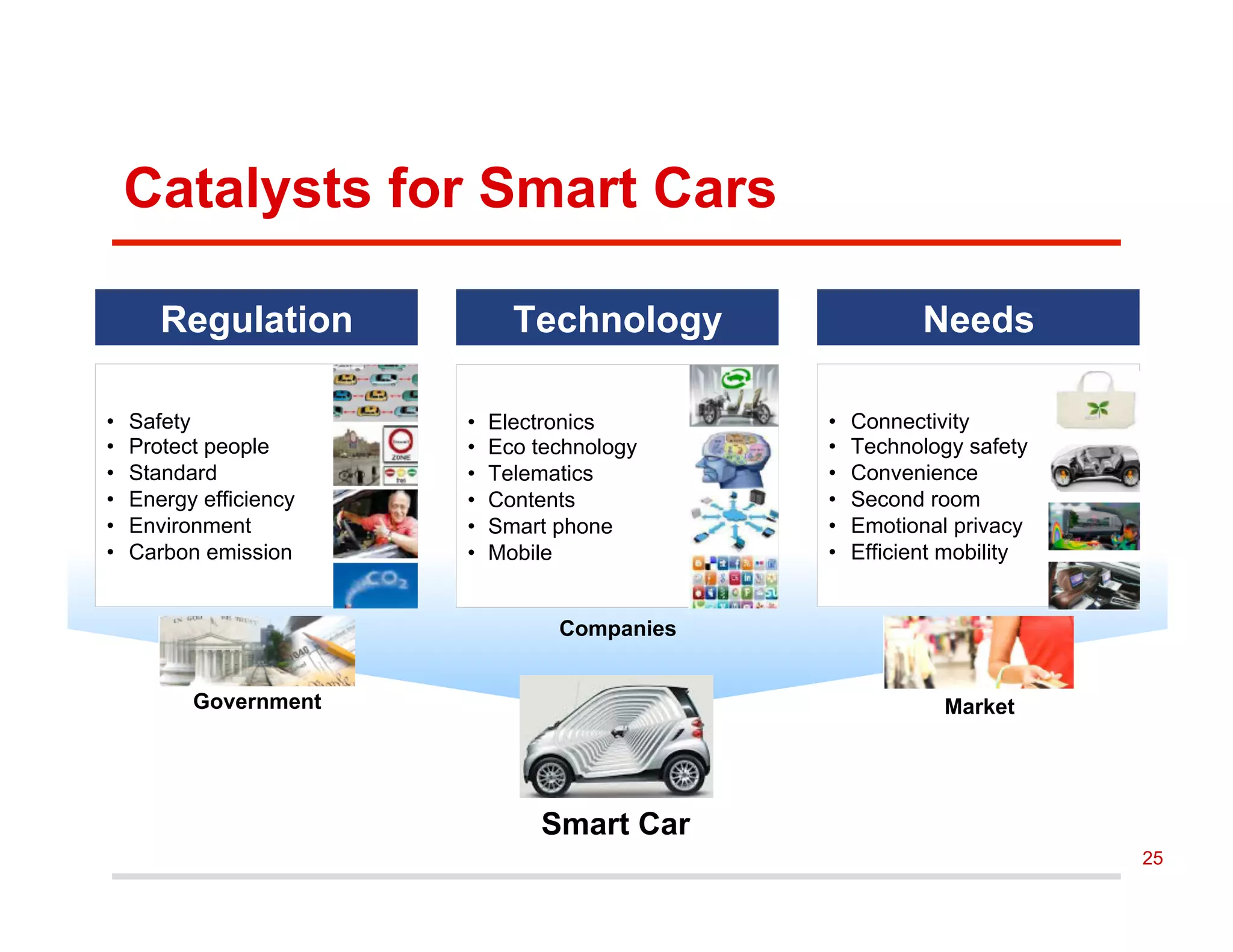

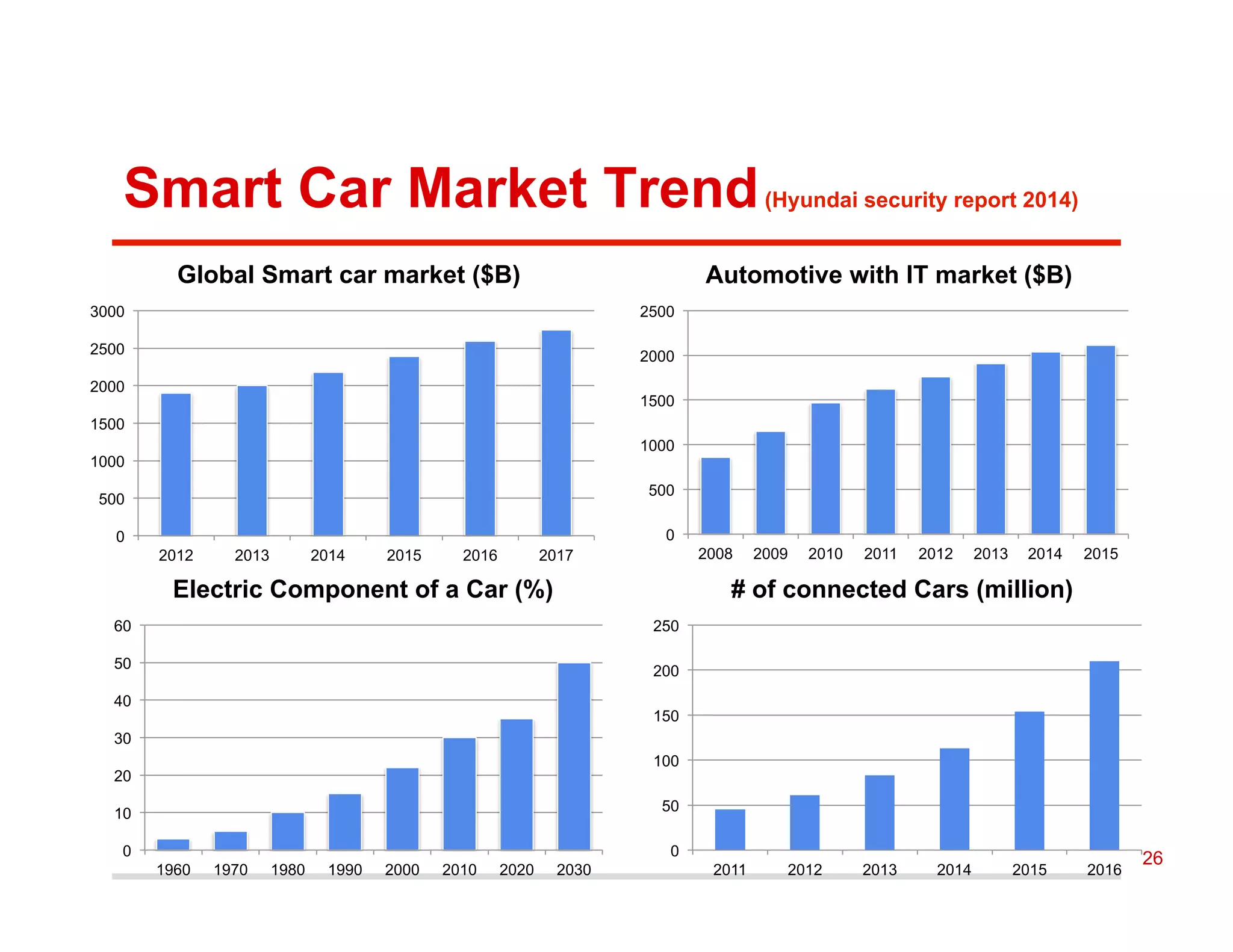

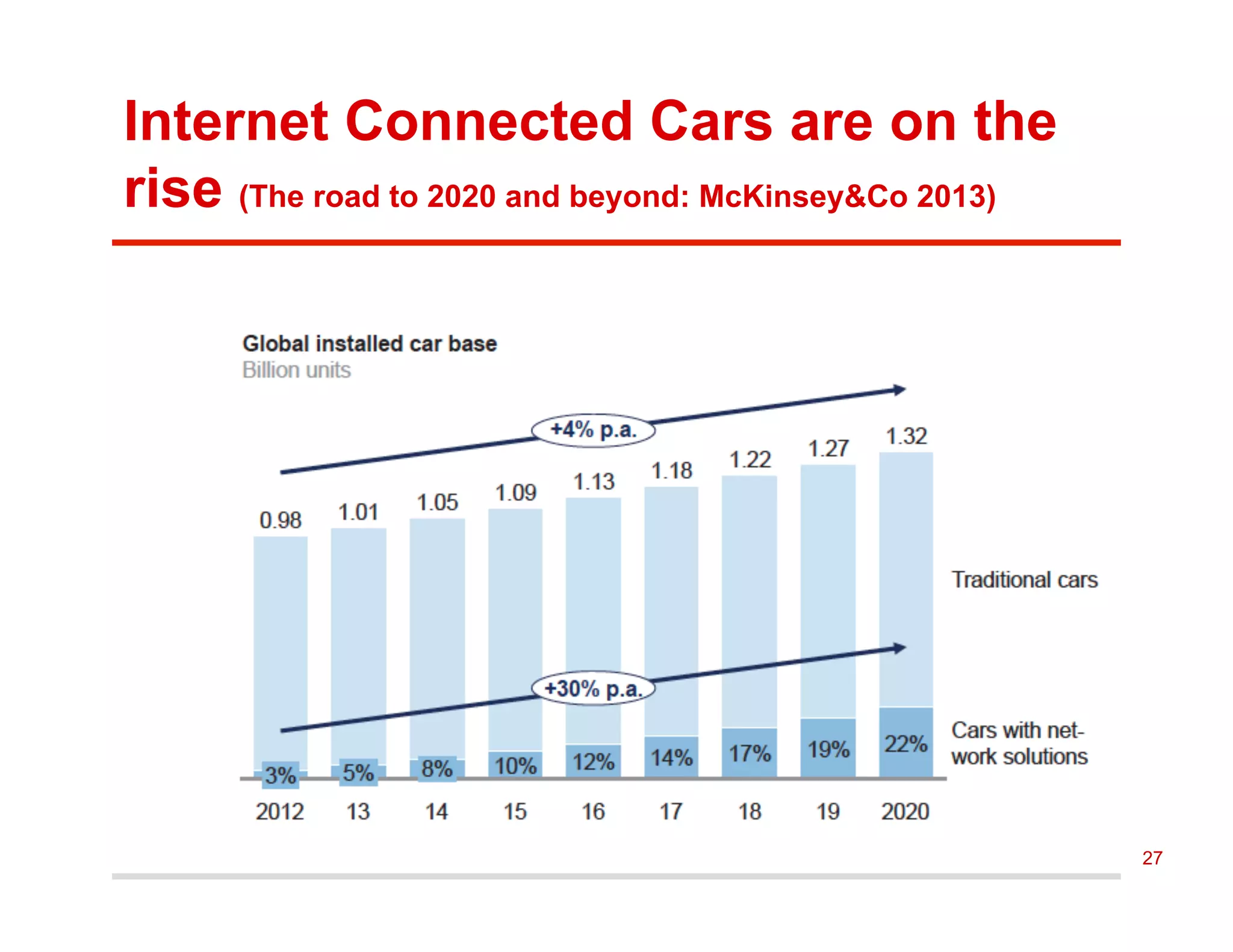

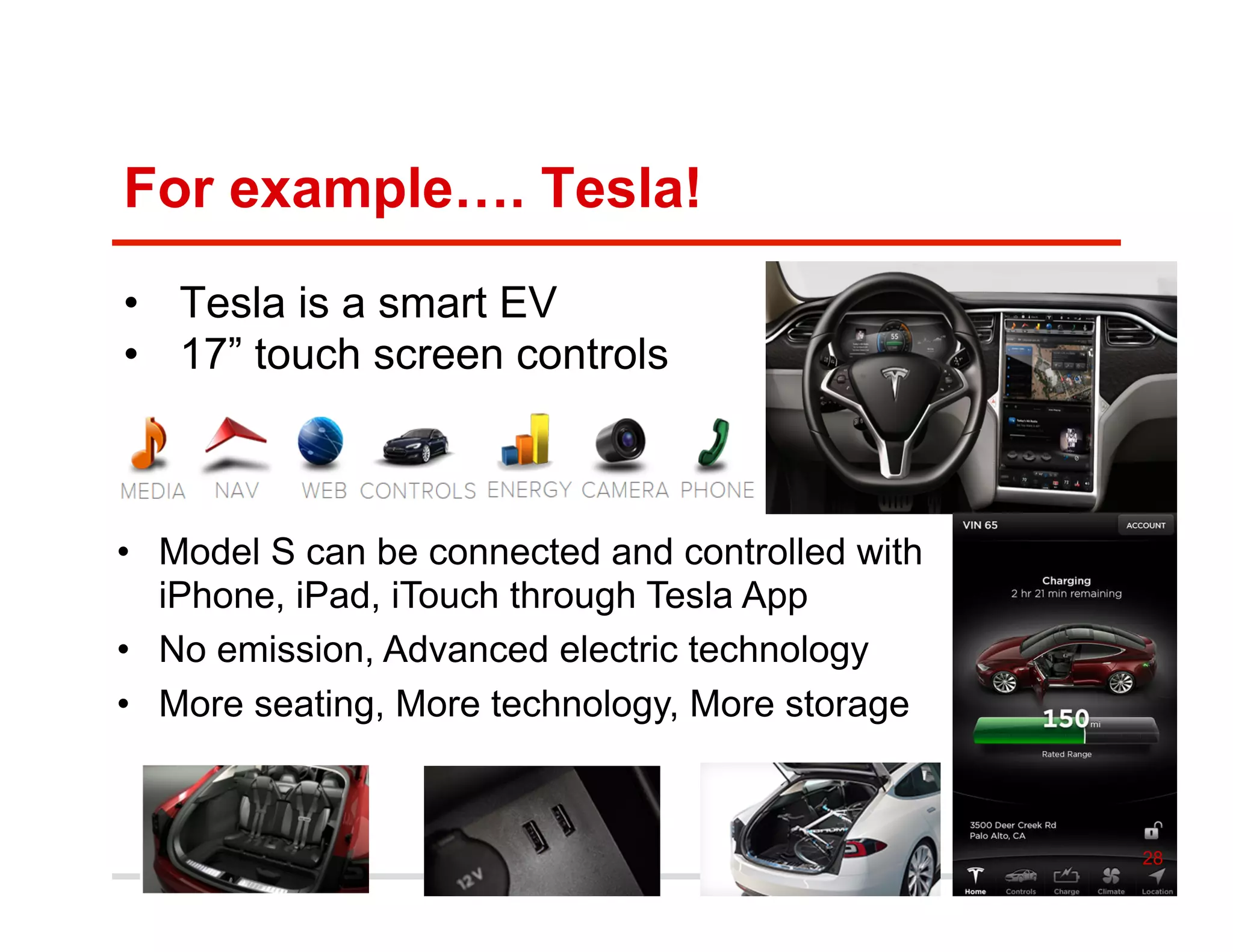

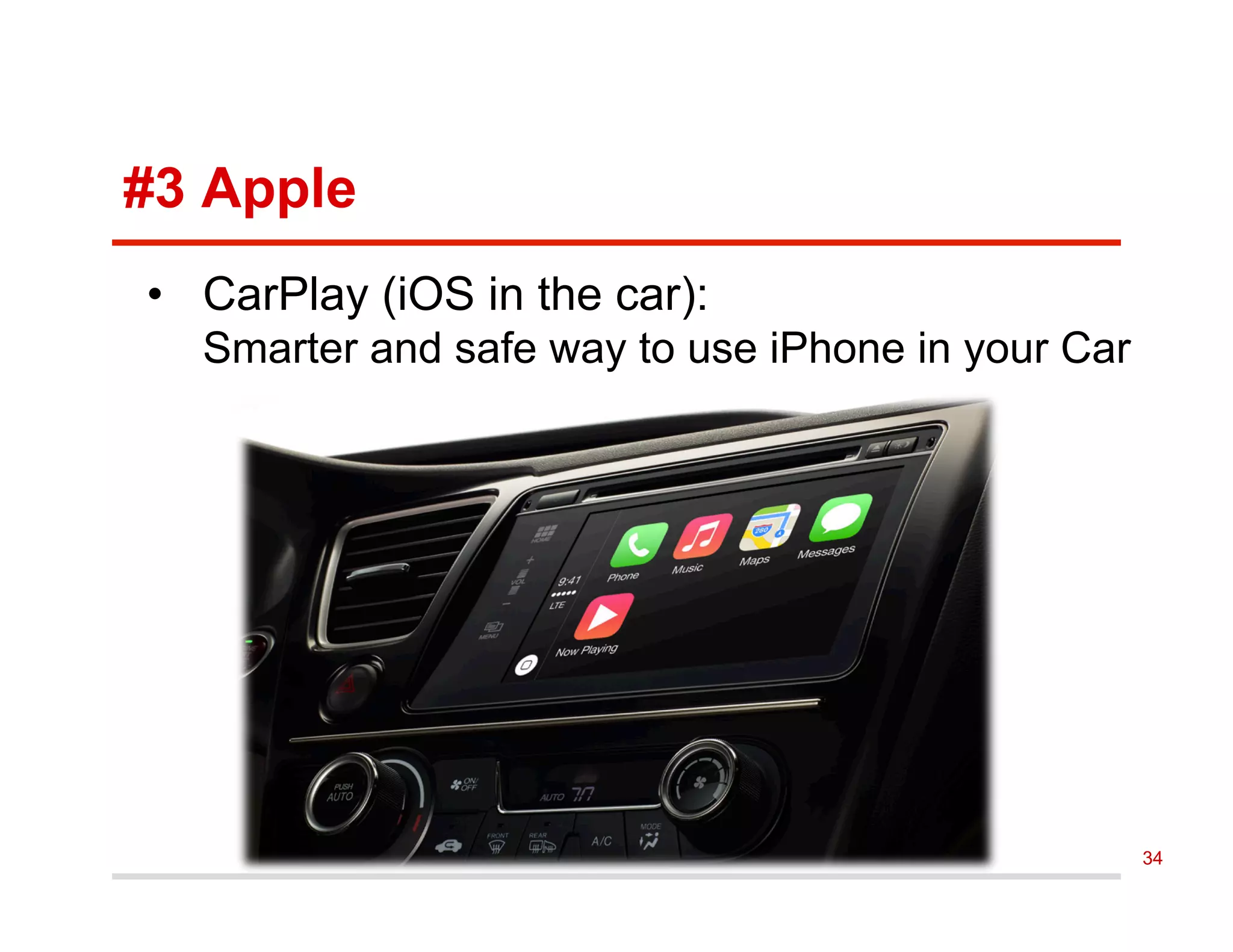

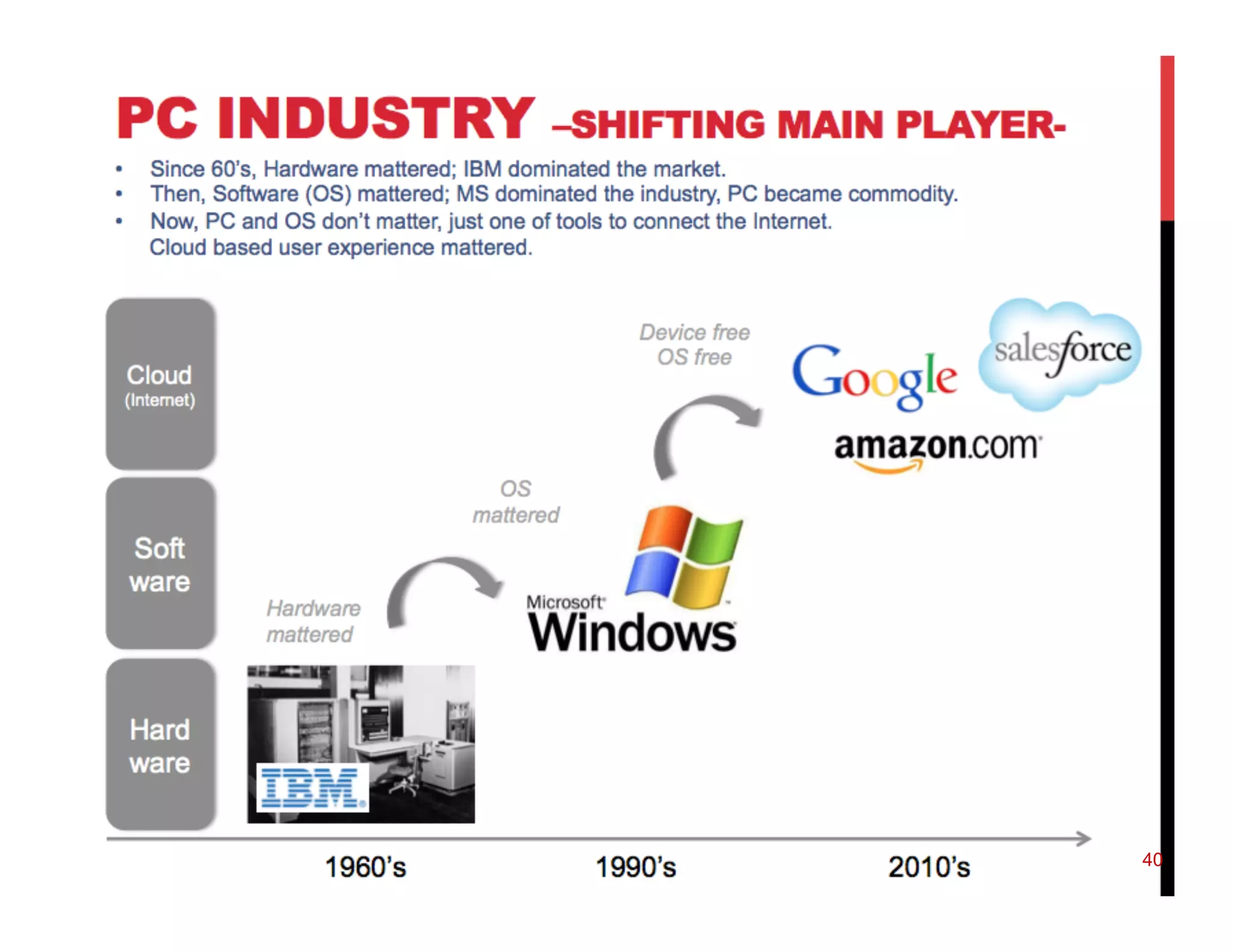

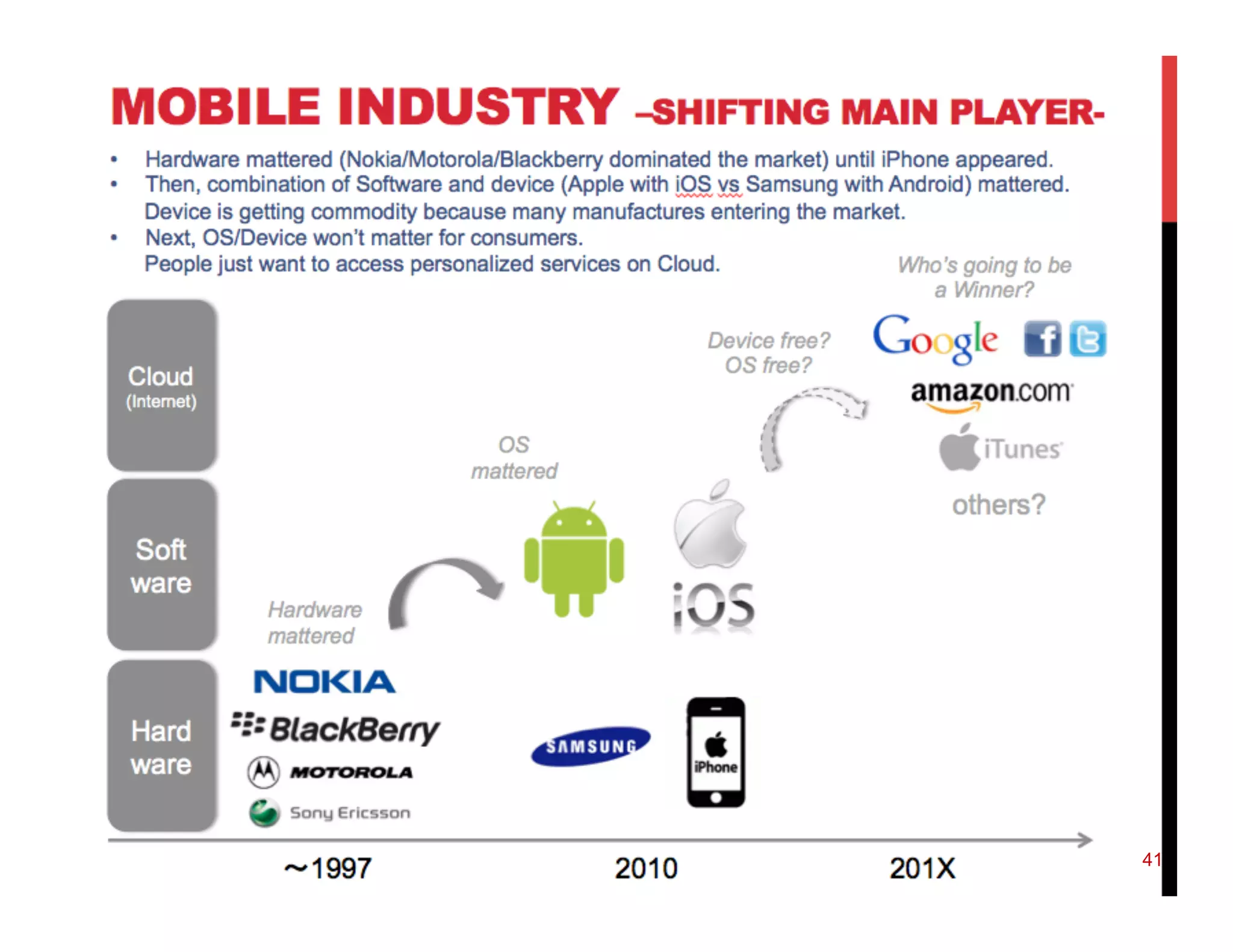

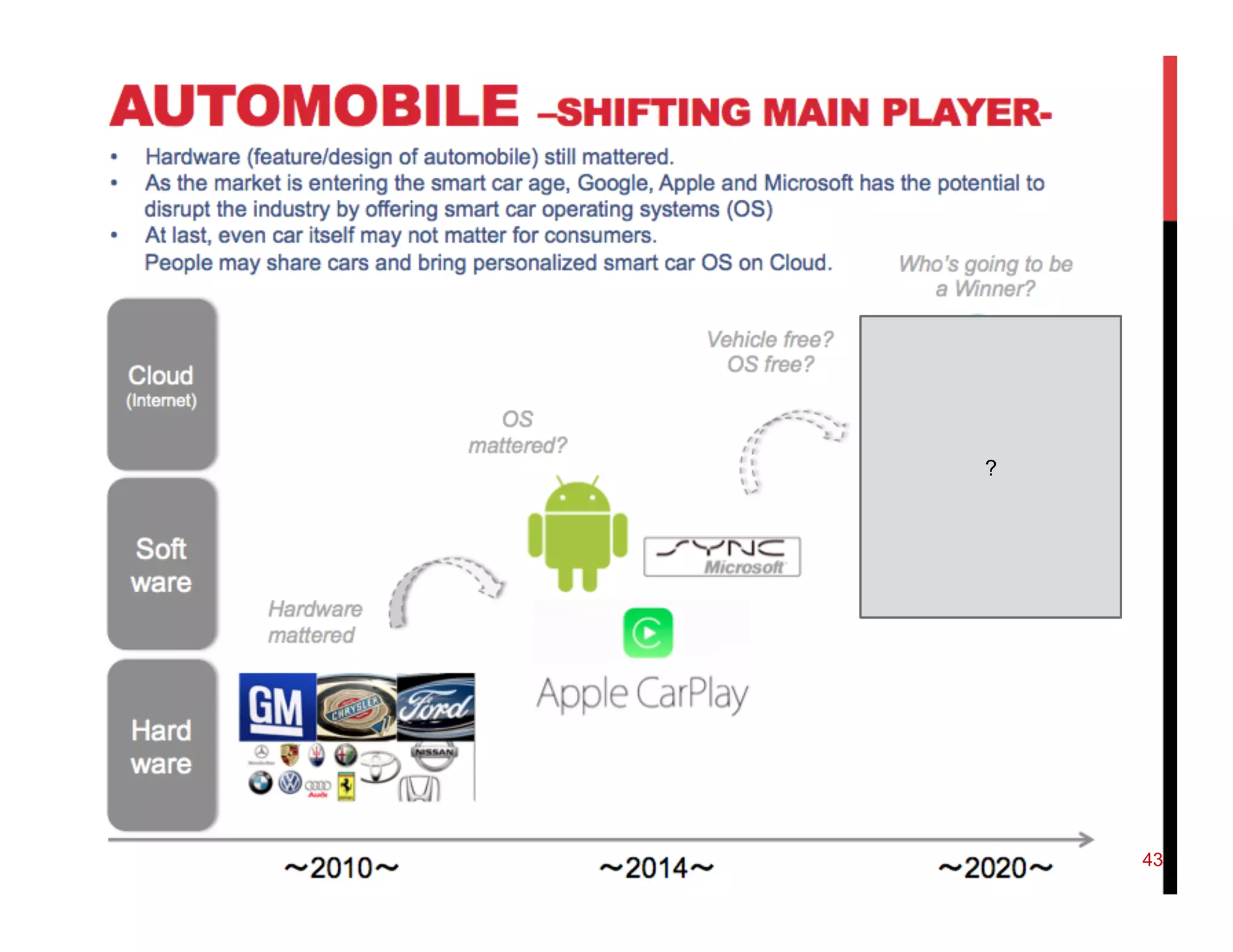

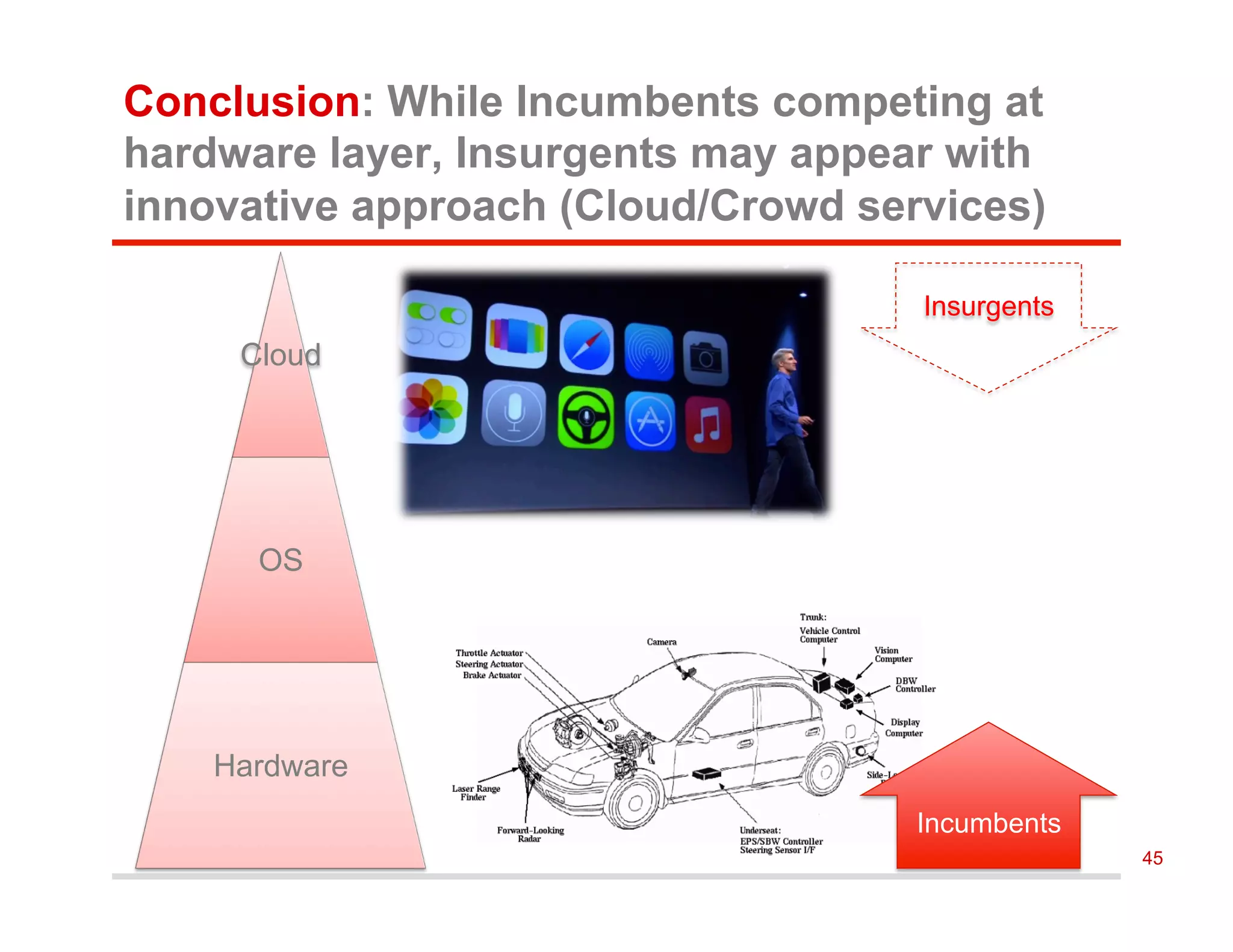

The document discusses the current state and future trends of the automobile industry. It analyzes major players like Toyota, GM, Ford, and newcomers in the space like Tesla. Emerging technologies around connectivity, autonomous driving, and electric vehicles are shifting the industry. The document recommends that incumbents develop their own operating systems and acquire software talent to control the software stack, while insurgents should leverage existing internet-based models and connectivity to transfer platforms to cars. It remains unclear whether incumbents or insurgents like Google and Apple will become the ultimate winners in this changing industry.